IPO revival needs realistic valuations

Investors seek healthier equity markets with low volatility levels and increased risk appetite

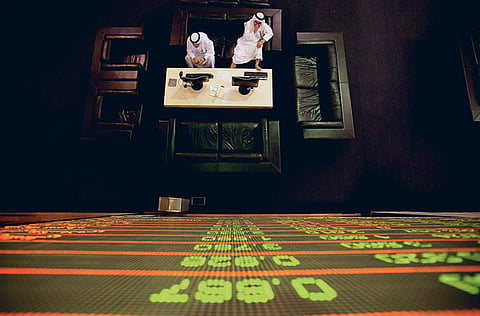

Dubai: Potential issuers need to get real about prices they can fetch if the telecoms, retail and energy sectors, as well as prized government assets, are to lead a revival in Gulf initial public offerings (IPOs).

Thin volumes and high trading volatility — sparked mainly by regional retail investors — have sunk valuations on the region's exchanges and kept international institutions on the sidelines, awaiting clarity on companies' debt challenges.

"If companies are to sell assets or equity voluntarily, we need more realism around valuations and current market conditions," said Paul Reynolds, head of equity and debt advisory at Rothschild in the Middle East.

"The lack of interest in regional equity markets is far more to do with developing investor appetite and market conditions than structural issues."

After a sharp slump in IPOs out of the Gulf in the last two years, Omani telecoms operator Nawras' IPO opened for subscriptions on September 15 and will test whether deal pricing meshes with current market sentiment. It also spearheads efforts in the region to broaden opportunities for investors looking beyond the property and banking sectors.

Dubai's index, heavily reliant on real estate and financial services, has declined nearly 7 per cent this year as investors seek to limit further losses on these sectors and seek exposure to others.

"There is a genuine desire by investors to diversify their sector exposure in the region," said George Pavey, Credit Suisse's co-head of EMEA Equity Capital Markets.

"We need to see equity markets in a healthier state including a lower level of volatility and improved risk appetite [and a] broader re-opening in developing markets and other emerging markets. This will be a phased process."

Bankers expect future IPO activity to centre on the energy, telecoms, consumer, retail and services sectors. Family businesses active in manufacturing and trading could also bring deals to the market.

The region's first IPO of significance for international investors this year could be Nawras, a unit of Qatar Telecommunications, which is expected in October.