Abu Dhabi: Stock markets from Europe to the US and Asia plunged yesterday on increasing tensions between North and South Korea and concerns that Spain's ailing banks are a signal to a widening debt crisis in the euro zone.

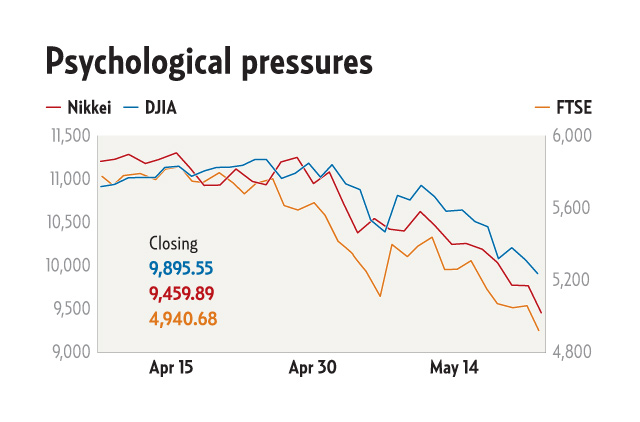

The Dow Jones index in the US fell below the psychological 10,000 points for the second time this year. The UK's FTSE 100 dropped below 5,000 and Japan's Nikkei broke below the 10,000-level.

Risk-averse investors are now increasingly turning to relatively safer havens like treasuries, gold and the US dollar amid rising market uncertainty.

Region's shares slump

Within the region, shares in Saudi Arabia fell the most in 18 months, leading a drop on regional markets as crude prices slumped on fears the euro zone debt crisis will spread in the coming days. The Tadawul All Share Index plunged 6.8 per cent, the biggest drop since November 2008, to 5,760.33.

In Dubai, the Dubai Financial Market (DFM) index fell a further 4.64 per cent yesterday to 1,570.34 after falling 2.01 per cent on Monday, led by a sell off in Emaar and Arabtec's shares.

In Abu Dhabi, the Abu Dhabi Securities Exchange (ADX) general index fell 3.13 per cent to 2,650.32.

Elsewhere in the region, Qatar's QE Index fell 4.2 per cent, the Kuwait Stock Exchange Index slid 2.7 per cent, Bahrain's measure lost 1.9 per cent and Oman's MSM30 Index declined 3.2 per cent.

"Stocks in Dubai fell today due to fears on the international market. Investors are now risk averse and are pulling out their money from the Dubai market," said a Dubai-based market analyst.

Analysts say that until Dubai's market breaks the 1,750 level on high volume, it will remain a downtrend market.

The DFM index's decline yesterday was accentuated by falls in other heavily-traded stocks like DFM, Air Arabia and ARMX. DFM investors are now pinning their hopes on having access to Nasdaq Dubai's shares.

This would not only boost the volume on DFM, but also help the overall market. About 79.40 million shares of Emaar worth Dh267.79 million were traded on the DFM yesterday. Market participants say any major market rebound in Dubai will only be led by a recovery in the local real estate sector.

In Abu Dhabi, "investors dumped stocks as they feared they were trapped in illiquid stocks. Liquidity is a concern on the Abu Dhabi market," said a market analyst.

Analysts say the the absence of domestic catalysts in recent months also has contributed to the downtrend in the Abu Dhabi market.

The ADX general index yesterday was dragged down mainly by the decline in real estate, energy, construction and banking stocks.

Its support level of 2,700 was broken, which means the market could go down still lower in the days ahead.