Abu Dhabi: The Abu Dhabi Investment Authority (ADIA), widely believed to be the world's largest sovereign wealth fund by assets under management, said in its annual review yesterday that at the end of last year, in US dollar terms, the 20-year and 30-year annualised rates of return for the Adia portfolio were 7.6 per cent and and 8.1 per cent, respectively.

This compares to 20-year and 30-year annual returns of 6.5 per cent and eight per cent respectively, at the end of 2009, said Adia.

"2010 was a year of great change. Externally, it will be remembered as a year when financial markets proved their resilience and generated positive returns against a backdrop of considerable uncertainty," Shaikh Hamed Bin Zayed Al Nahyan, Adia's managing director, said in the annual review.

He said 2010 was also a year of considerable volatility, "but one that ultimately delivered favourable economic and market outcomes."

"Global economic growth proved impressively resilient in the face of considerable uncertainty, and the recovery that had begun a year earlier broadened and gained momentum. This provided investors with solid returns across most asset classes," said Shaikh Hamed.

He also said on the economic front, outcomes were shaped by the residual effects of the financial crisis. "Where balance sheets had not been burdened by excessive debt — primarily among the emerging market countries, but also within non-financial corporate sectors in the major developed economies — recovery proceeded briskly, helped by ample liquidity and reflationary economic policies. The opposite was true in markets that remained burdened by a legacy of excess leverage and depressed asset prices. These included consumer sectors in many developed economies as well as construction and large financial institutions, where economic policies were able to achieve less traction."

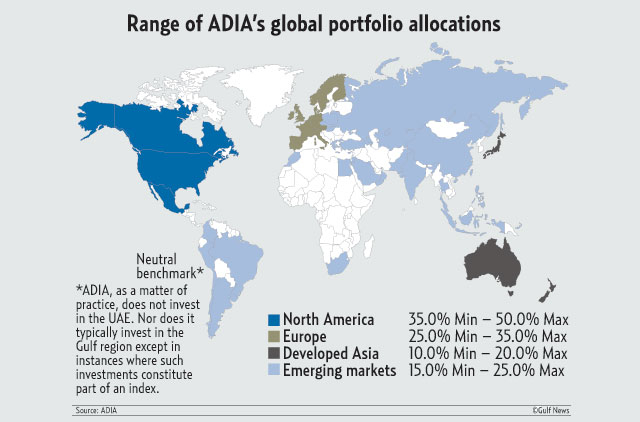

Shaikh Hamed said Adia, while remaining diversified across all major global markets, continued to benefit during 2010 from its decision a year earlier to tilt exposures in the portfolio towards asset classes and regions able to benefit from better growth prospects. "This is an approach that remains in place as we enter 2011," he added.

Shaikh Hamed, however, said the global economy remained subject to large current account imbalances, to which have been added historic divergences in monetary and fiscal policies. "Two years ago, the G20 took on the necessary task of global policy coordination and we continue to believe it remains the best forum to ensure that policy conflict does not escalate further and hamper what remains a relatively fragile expansion."

He said two years after the financial crisis, the investment climate was set to undergo considerable change as economic policies evolve from measures focused on stimulus to steps to ensure the sustainability of growth.

"Large increases in government debt to fight recession have drawn the most attention, but governments face another significant challenge in meeting long-term costs associated with ageing populations. They now have the sensitive task of maintaining and increasing growth, while cutting debt levels quickly enough to prevent an unwelcome rise in bond yields," said Shaikh Hamed.

He added: "In a number of economies, inflationary pressures also are a threat to growth, whether driven by strong demand from emerging markets, or concerns about supply. While efforts to control inflation through tighter macroeconomic policies should be welcomed in fast-growing emerging markets, central bankers in many developed economies may face difficult choices in terms of timing and the extent of any tightening moves."

Alongside these concerns, though, are grounds for long-term optimism about the global landscape, said Shaikh Hamed.

"While developed economies continue to demonstrate their ability to innovate and grow, the secular shift in global economic weight from developed to fast-growth emerging economies has accelerated as a result of the financial crisis. Greater demand from this expanded global marketplace will provide a positive investment climate as it drives new discoveries in life sciences, alternative energy, and other emerging technologies," he said.

"There will always be risks and less positive outcomes at times. These can be managed, however, and should not stand in the way of our objective to seek out promising long-term opportunities, while being mindful of the role that we, as a responsible investor, can play in promoting stability in global financial markets," Shaikh Hamed added.

"However, as we enter the post-recovery phase, we remain confident that returns from equities will gradually revert close to their long-term historical average between six per cent and eight per cent.," it added.

Adia's investment objective is to invest funds on behalf of the government of Abu Dhabi and make available the financial resources to secure and maintain the future welfare of the emirate. Its investment strategy involves looking beyond individual economic cycles and focusing on strategies aimed at capturing secular trends to generate long-term, sustainable returns.