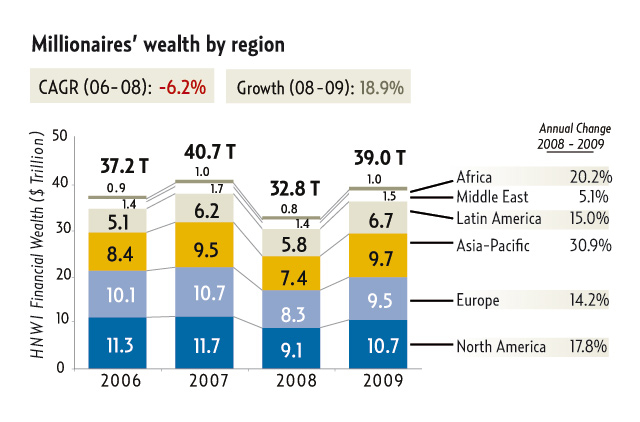

Dubai: The world's rich and ultra rich individuals shook off the effects of the global economic crisis to increase their personal wealth by 19 per cent to $39 trillion, returning to 2007's pre-crisis levels.

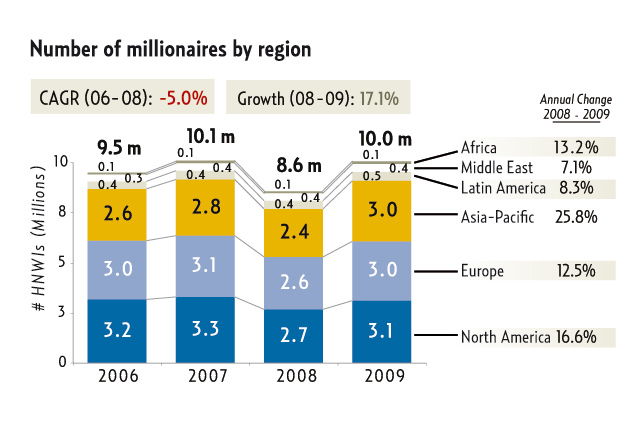

According to the 14th annual World Wealth Report compiled by Capgemini and Merrill Lynch, the population of millionaires in the world returned to 10 million in 2009. Asia led the rebound, with total wealth in the Asia-Pacific region surpassing Europe for the first time.

In the Middle East, the total population of high net worth individuals (HNWIs), or those with investable assets of more than $1 million, rose 7.1 per cent to 400,000, returning to 2007 levels, and their combined wealth increased by 5.1 per cent to $1.5 trillion.

"The last few years have been significant for wealthy investors. While in 2008 global HNWI wealth showed an unprecedented decline, a year later we are already seeing distinct signs of recovery, and in some areas a complete return to 2007 levels of wealth and growth," said Amir Sadr, Head of Middle East, Merrill Lynch Wealth Management.

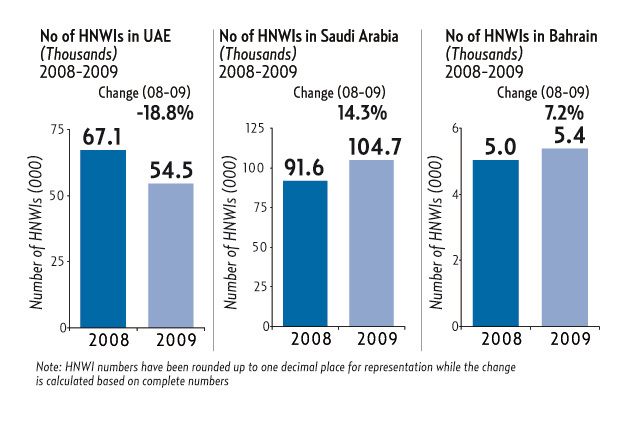

In 2009, the number of HNWIs grew in Saudi Arabia and Bahrain but declined in the UAE. Saudi Arabia had 104,700 HNWIs at the end of 2009, an increase of 14.3 per cent from the previous year. The number of HNWIs in Bahrain stood at 5,400, up 7.2 per cent from 2008.

In contrast, the HNWI population in the UAE declined by 18.8 per cent to 54,500 due to unprecedented market conditions.

"The rebound has been, and will continue to be, driven by emerging markets – especially India and China, as well as Brazil," said Yasar Yilmaz, Regional Head of Sales, Middle East, Global Financial Services, Capgemini.

"In fact, Asia-Pacific was the only region in which both macroeconomic and market drivers of wealth expanded significantly in 2009."

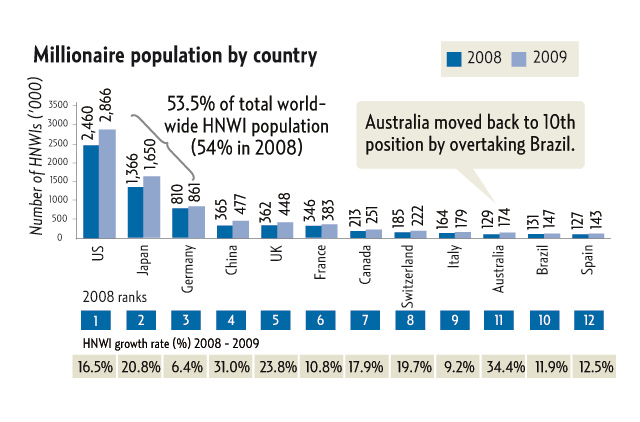

While the global HNWI recovery was generally stronger in developing nations, most of the world's HNWI population and wealth remained highly concentrated in the US, Japan and Germany, which together accounted for 53.5 per cent of the world's HNWI population in 2009, down slightly from 54 per cent in 2008.

North America remains the single largest home to HNWIs, with its 3.1 million HNWIs accounting for 31 per cent of the global HNWI population.

While the wealth report does not give details of millionaire densities, Sadr said the total number of the rich is equivalent to about one per cent of the world population.

In a separate report earlier this month, Boston Consulting Group echoed that finding and added that three Gulf nations were among the top 10 worldwide by millionaire density. Kuwait, Qatar and the UAE were at the fourth, fifth and sixth positions, repectively, with densities of 8.2, 7.4 and 6.2 per cent of their populations being HNWI households.

The Asia story is prominent in the Merrill Lynch Capgemini report. After falling 14.2 per cent in 2008 to 2.4 million, Asia-Pacific's HNWI population rebounded in 2009 to reach 3 million, matching that of Europe's HNWI population for the first time.

Asia-Pacific wealth also surged 30.9 per cent to $9.7 trillion, more than erasing 2008 losses and surpassing the $9.5 trillion in wealth held by Europe's HNWIs.

"This shift in rankings occurred because HNWI gains in Europe, while sizeable, were far less than those in Asia-Pacific, which saw continued robust growth in both economic and market drivers of wealth," the report said.

Hong Kong and India led growth in Asia-Pacific, after experiencing massive declines in their HNWI bases and wealth in 2008.

The report has forecast that the BRIC nations (Brazil, Russia, India and China) are expected to again be the drivers of HNWI growth for their respective regions in coming years.

In Asia-Pacific, China and India will continue to lead the way, with economic expansion and HNWI growth likely to keep outpacing more developed economies. Asia-Pacific HNWI growth is likely to be the fastest in the world as a result.

In Latin America, Brazil is similarly expected to remain an engine of growth. Russia is expected to display strength due to its commodity-rich resource base.

However, global economic recovery, especially in Europe, "is still fragile", Sadr said. "Deficits in most economies are still a cause for concern."

Easing property values

One of the main inhibitors of wealth in the UAE in 2009 was an easing of real estate values by more than 40 per cent, the World Wealth Report says. In the same year, real GDP contracted by 2.7 per cent and oil production dropped by 12.4 per cent.

"Compared to many of the global economies, the UAE saw a larger pullback due to debt concerns," said Sadr.

"We did not see a sovereign-level crisis of this magnitude in any of our global markets."

Imports of goods and services into the UAE contracted by 18 per cent in 2009, but are expected to increase by six per cent this year. GDP is forecast to accelerate by 2.5 per cent this year.

Saudi Arabia: The number of millionaires increased due to three key wealth accelerators - market capitalisation increased by 29.2 per cent in 2009, GDP grew by 0.2 per cent, and the short-term deposit rate was slashed from 2.9 per cent in 2008 to 1.3 per cent in 2009.

Bahrain: The kingdom witnessed a 2.9 per cent GDP growth in 2009 and the money market rate dropped from 2.4 to 0.6 per cent.

When do you expect to make your first million? Are conditions in the region conducive enough for you to reach this goal?