Washington: Racheting pressure on Goldman Sachs two days after its executives were grilled and rebuked in the public glare, the Justice Department has opened a criminal investigation of the Wall Street powerhouse over mortgage securities deals it arranged.

The new criminal inquiry follows civil fraud charges filed by the government against Goldman two weeks ago and as Congress pushes toward enacting sweeping legislation aimed at preventing another near-meltdown of the financial system.

The investigation by the US attorney's office in Manhattan stems from a criminal referral by the Securities and Exchange Commission, a knowledgeable person said Thursday. The person spoke on condition of anonymity because the inquiry is in a preliminary phase.

The SEC brought civil fraud charges against Goldman and a trader in connection with the transactions in 2006 and 2007. The agency alleged the firm misled investors by failing to tell them the subprime mortgage securities had been chosen with help from a Goldman hedge fund client, Paulson & Co., that was betting the investments would fail. Goldman and the trader, Fabrice Tourre, have denied the charges and said they will contest them in court.

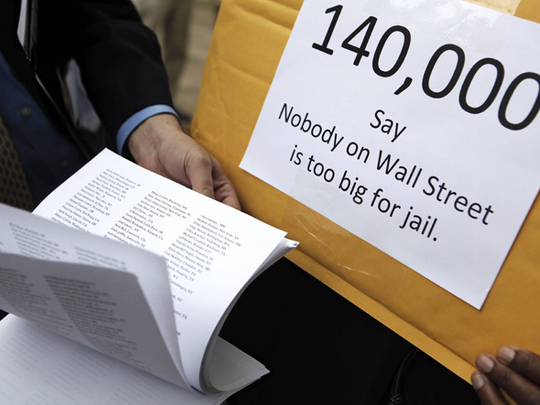

Word of the Justice Department action came a day after a group of 62 House of Representatives lawmakers, including Democratic Judiciary Committee Chairman John Conyers, asked Justice to conduct a criminal probe of Goldman. "On the face of the SEC filing, criminal fraud on a historic scale seems to have occurred in this instance," the lawmakers, mostly Democrats, said in a letter to Attorney General Eric Holder.

SEC spokesman John Nester declined any comment on the matter, as did Yusill Scribner, a spokeswoman for the US attorney's office in Manhattan.

Goldman spokesman Lucas van Praag said, "Given the recent focus on the firm, we're not surprised by the report of an inquiry. We would cooperate fully with any request for information."

The Justice Department move was the latest in a dramatic series of turns in the Goldman saga, which has pitted the culture of Wall Street against angry lawmakers in an election year, in the wake of the financial crisis that plunged the country into the most severe recession since the Great Depression of the 1930s.

At Congress Thursday, following days of failed test votes, the Senate lurched into action on sweeping legislation backed by the Obama administration that would clamp down on Wall Street and the sort of high-risk investments that nearly brought down the economy in 2008.

And two days earlier, a daylong showdown before a Senate investigative panel put Goldman's defense of its conduct in the run-up to the financial crisis on display before indignant lawmakers and a national audience. The panel, which investigated Goldman's activities for 18 months, alleges that the Wall Street powerhouse bet against its clients - and the housing market - by taking short positions on mortgage securities and failed to tell them that the securities it was selling were at very high risk of default.

Goldman CEO Lloyd Blankfein testily told the investigative subcommittee that clients who bought the subprime mortgage securities from the firm in 2006 and 2007 came looking for risk "and that's what they got." Blankfein said the company didn't bet against its clients - and can't survive without their trust. He repeated the company's assertion that it lost $1.2 billion in the residential mortgage meltdown in 2007 and 2008. He also argued that Goldman wasn't making an aggressive negative bet - or short - on the mortgage market's slide.

In addition to the $2 billion so-called collateralized debt obligation that is the focus of the SEC's charges against Goldman, the subcommittee analyzed five other such transactions, totaling around $4.5 billion. All told, they formed a "Goldman Sachs conveyor belt," the panel said, that dumped toxic mortgage securities into the bloodstream of the financial system.