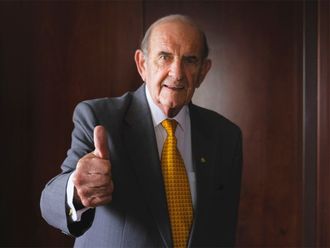

Dubai: As a professional services firm that provides tax, accountancy and advisory to some of the world's biggest companies, KPMG International is well placed as an observer as the global economy struggles forward after four years of uncertainty. But chairman Michael Andrew told Gulf News that he is upbeat about the second half of 2012. In Europe, he believes that German Chancellor Angela Merkel is doing the right thing as one of the leaders tasked with solving the eurozone crisis, while in the Middle East he sees a continuing prominence for supply chain and logistics services.

GULF NEWS: What is the outlook for the global economy ?

Michael Andrew: The world economy does not look good for at least the first six months of 2012, as the Eurozone crisis is going to cause loss of confidence in the banking system, and in its capacity to let people access funds. But I am more hopeful abut the second half for two reasons.

First, the US economy is proving to be more resilient than people expected. We were seeing corrections in housing valuations six months ago, and investors coming back into the marketplace. US companies are benefiting from the low US dollar and are starting to re-employ in some of the more depressed zones of the US. What we have not yet seen is an upturn in investment on capital equipment and a growth in productive capacity.

Second, people have underestimated China, where growth is slowing, but this is a function of two temporary effects. The first is that the 2008 fiscal stimulus package caused them to lend money to a lot of speculative ventures, which resulted in a lot of problems, including inflation, although that is now under control.

But the big thing in China is that right now we are seeing the transition to a new leadership. Everyone's position is being rotated, so no one is prepared to make long-term decisions, as we will have an interregnum for the next six months. Until the picture becomes clearer, we will see little action. But in the second half of 2012, China will start to execute the 13th Five Year Plan, and we will see significant spending on infrastructure and new technologies.

Will Europe get through its crisis?

Because Europe is so large, it is a structural problem for the whole world, which the world needs to address. Europe has a banking and currency problem, but underlying those issues is very low economic growth. Although some say that what has happened is a banking problem manifesting itself in the economy, you could say that the economic problems have manifested themselves in the banking system.

Europe is cost-uncompetitive, and it is difficult to restructure in Europe because of the social restrictions on businesses. This compares badly to the United States, where companies are allowed to downsize, become more flexible, and can operate more easily.

Chancellor Merkel is on the right track, and has a good plan. She has been very good at fending off short-term solutions which might have rescued a particular bond issue for a short period of time, but did not address the structural problems. Germany is the only European country which has had productivity and growth for a long period of time, and Merkel is insisting that Europe must have a sustainable growth plan. She is saying that Europe has to address these issues in a much more serious fashion, and then Germany can find the money. She has played a very clever game.

Companies see a European problem that has to be worked out by the bankers, politicians and the governments, but they need to get on and run their business. So they do not see Europe as an investment destination at the moment, and prefer to focus on the emerging markets of Africa, Asia, South America, or Russia.

Is the world on track to achieve effective global financial supervision?

A lot more thinking has to be done around the Basel requirements. Simply focusing on risk-weighted asset publication is not the complete answer. We want really strong prudential supervision which puts a few more restraints, such as some activities being based on a certain capacity. This would mean that some banks would not being able to go into certain kinds of businesses, and risk their capital in areas where they clearly they do not have the capability to meet the impact of a downturn, or unusual black swan event.

This is a global issue, and affects large global banks. There is a gap in the global prudential system, which is a lack of coordination between the prudential authorities. Some banks say that there is too much action, and they are being restrained to set an example to meet the problems that happened in the second and third tier of European banks

In the UK, the Vickers proposals will bring more stability to the system, with increased transparency. It will help to segregate what kind of businesses banks can do and what the capital is required for each kind of business. Investors can then make a choice about which banks they want to invest in, and look for a higher return. With the increasing complexity of financial products, it is very difficult for external stakeholders and prudential regulators to truly get a clear opinion on the risks they are taking.

How can auditors do their job better?

There is a lot of criticism as to who caused the financial crisis of 2008. I do not think auditors were to blame in any way. In fact, I think we did a pretty good job and blew the whistle early on some of the fair value accounting of some of those financial instruments.

But the real question to ask is: if you did such a great job, did you do the right job? How did this happen? Are there things that you should be doing to prevent this happening again?

What do the capital markets need from their auditors that will give them greater comfort, going forward.

First, we should talk more to the prudential regulators about how we can help them do their job. At the moment there is not a lot of conversation between regulators and auditors, but in Germany, for example, it is compulsory for auditors to meet the regulators every three months and exchange information and exchange views around the risks you are seeing in the business model. That is a very good model to pick up.

Second, auditors should look at the critical things that investors need to make their investments safer. For example, investor presentations by companies are not audited. Once the accounts themselves are signed off, then the CEO and the CFO go around the world, making all these presentations to investors which are not audited.

So they can claim a particular return from this or that merger, or they might say that their cost-to-income ratio is something, and they can claim a particular return on investment. But this is not audited and investors should be able to trust this critical information. This is the stuff that we should be auditing, and giving the markets more assurance.

Why is the Middle East important to KPMG ?

The Middle East is extremely important for three reasons. First, It is the place where sovereign wealth funds have liquid and available investments. They are cornerstone investors, and are going to be major investors overseas, and major investors in new technologies. The Middle East is at the heart of where those investment decisions are being made, and that will lead you into a lot of really good quality transaction work.

Second, the Middle East is a supply-chain and logistics hub. The world is changing, and the trade patterns are emerging between developing nations. The Middle East is well placed to pick up a very large share of the increase in the new Silk Road. We see Africa opening up dramatically, and the Middle East has a tremendous understanding of how to do business there, as it has with India and South Asia.

This shift to regional trade is a major trend in today's world. Investors want regional investments, in a hub where they can build their network. This is happening in the Middle East, Africa, Asean and Central America. Dubai may have been doing this for some time, but now the world is catching up.

What has really driven this regional approach is the collapse of the Doha Round or trade talks. People who were looking for the a global trade solution now know that it will not occur. Therefore, countries that want free trade are now finding like-minded countries in the same geographic area and going ahead.

There are 54 countries in Africa and it hard to do business if you have trade barriers in every single one, so the Africans are saying that if they are going to attract investment, they need to build a series of sub-regions in West Africa, East Africa, South Africa. The politicians no longer refer to Angola, Zimbabwe, or South Africa. They all talk of the southern Africa region that they are trying to create.

Third, investors are interested in the Tier One, low-cost, long-life assets that these Middle Eastern countries have and are hard to find in other regions. There is increasingly a more sophisticated services and technology market in the Middle East, which is attractive to a number of investors who want to diversify their portfolio.

There is going to be a lot of reconstruction and redevelopment work in the region that has to occur, and the region will need a lot of infrastructure. The Arab Spring has not put off investors, and we are seeing interest in countries like Iraq and Libya, looking at sectors like energy, infrastructure, social housing, and services.

Do companies care about reducing carbon emissions?

Around the world, we see huge corporate interest in dealing with global carbon emission and global warming; and companies want some degree of independent assurance that they are meeting their targets on carbon reduction, so we have a good business in auditing carbon reduction.

Companies are moving well ahead of government regulators, but they are finding that the NGOs they deal with are much more aggressive in terms of meeting their requirements on carbon emissions than any corporate regulators to whom they have to answer,.

Then you have companies like Walmart and Siemens which are now saying that if a company wants to be a supplier, they have to demonstrate that they are reducing their own carbon emissions. So governments are doing the same as part of their procurement function.

Large network

Michael Andrew is Chairman of KPMG International, the global audit, tax and advisory firm. KPMG has offices in 144 countries and recorded global revenues of $22.7 billion (Dh83.36 billion) in 2011. It has 138,000 professionals and 7,900 partners across the KPMG network. Based in Hong Kong, Michael Andrew is the first global chairman of a Big Four accounting firm to be based in the Asia Pacific region.