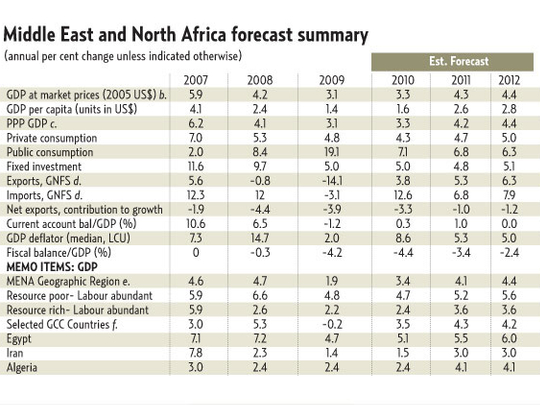

Dubai: Developing economies in the Middle East and North Africa (Mena) region are expected to grow at 4.3 per cent this year, after witnessing a modest upturn in growth of around 3.3 per cent in 2010, a latest World Bank report said.

"Higher oil prices in the year benefited oil exporters, while rebound in parts of the euro area — and growth in high-income Gulf Cooperation Council (GCC) countries helped to support a revival in exports, remittances and tourism," according to the World Bank's half-yearly Global Economic Prospects 2011, released yesterday, a copy of which was obtained by Gulf News.

"After an advance of 3.3 per cent in 2010, the region is expected to enjoy stronger gains of 4.3 per cent and 4.4 per cent in 2011 and 2012 respectively, as domestic demand growth continues, export markets firm, and oil prices remain at high levels," it said.

The UAE economy is expected to grow at a rate between 3.2 per cent to 4 per cent, according to various estimates.

A recent Standard Chartered Bank report had said that "growth should accelerate further across the region in 2011, but Mena economies are unlikely to boom".

"Growth in the GCC in 2011 will be driven by hydrocarbons, infrastructure investment and private sector activity. The outlook for oil prices and production will be key. Oil production in most of the GCC is unlikely to increase, as the region has to comply with Opec quotas. We do not expect significant changes to these quotas in 2011, so the direct impact of the oil sector on real growth should be moderate."

Developing world leads

The world economy is moving from a post-crisis bounce-back phase of the recovery to slower but still solid growth this year and next, with developing countries contributing almost half of global growth.

"More than two years after the crisis triggered by the collapse of the Lehman Brothers, now the world economy has entered into the new phase of recovery," Justin Yifu Lin, the World Bank's chief economist and senior vice-president for development economics, said in a briefing in Washington, the transcript of which was obtained by Gulf News.

"We know that most developing countries have recovered to the pre-crisis level activity, or close to the pre-crisis level of activity. That means that we have went through this bounce-back phase to a more mature growth phase, and by that we expect the growth rate this year in the developing countries will moderate somewhat.

"And according to our forecast, the growth rate for the developing countries in 2011 will decline from 7 per cent of growth rate in 2010 down to 6 per cent, and next year, 2012, it's likely to recover a little bit to 6.1 per cent," he said.

India could be one of the growth engines in 2011 for both Asia and the world according to the latest Strategic Focus study published by Bank Sarasin's Research team.

Philipp Baertschi, Chief Strategist, Bank Sarasin & Co, said, "Although India's potential is not in dispute, how it faces the two main challenges — education and infrastructure — in the medium term will be crucial."

The World Bank estimates that global GDP, which expanded by 3.9 per cent in 2010, will slow to 3.3 per cent in 2011, before it reaches 3.6 per cent in 2012. Developing countries are expected to grow 7 per cent in 2010, 6 per cent in 2011 and 6.1 per cent in 2012. They will continue to outstrip growth in high-income countries, which is projected at 2.8 per cent in 2010, 2.4 per cent in 2011 and 2.7 per cent in 2012.

"In most developing countries, GDP has regained levels that would have prevailed had there been no boom-bust cycle. While steady growth is projected through 2012, the recovery in several economies in emerging Europe and Central Asia and in some high-income countries is tentative," the report said.

Without corrective domestic policies, high household debt and unemployment, and weak housing and banking sectors are likely to mute the recovery.

"On the upside, strong developing-country domestic demand growth is leading the world economy, yet persistent financial sector problems in some high-income countries are still a threat to growth and require urgent policy actions," said Lin.

Net international equity and bond flows to developing countries rose sharply in 2010, rising by 42 per cent and 30 per cent respectively, with nine countries receiving the bulk of the increase in inflows.

Foreign direct investment to developing countries rose a more modest 16 per cent in 2010, reaching $410 billion after falling 40 per cent in 2009. An important part of the rebound is due to rising South-South investments, particularly originating in Asia.

Capital flows

"The pickup in international capital flows reinforced the recovery in most developing countries," said Hans Timmer, director of development prospects at the World Bank. "However, heavy inflows to certain big middle-income economies may carry risks and threaten medium-term recovery, especially if currency values rise suddenly or if asset bubbles emerge."

Most low-income countries saw trade gains in 2010 and, overall, their GDP rose 5.3 per cent in 2010. This was supported by a pick-up in commodity prices, and to a lesser extent in remittances and tourism. Their prospects are projected to strengthen even more, with growth of 6.5 per cent in both 2011 and 2012, respectively.

According to the report, in many economies, dollar depreciation, improved local conditions, and rising prices for goods and services means that the real price of food has not risen as much as the dollar price of internationally traded food commodities.

Dubai The developing countries of the Middle East and North Africa (Mena) region were less affected by the global downturn because of their limited financial integration, but also due to their export mix, which is concentrated in products (oil, materials and light manufactures).

These exports were not as sharply affected by the crisis as capital goods, and in turn, the economies that produce them were safe.

The upturn in 2010 reflected both an improved external environment, the effect of earlier stimulus measures, higher oil prices, and a rebound in remittances and exports in the region, particularly among the diversified economies.

Gross domestic product (GDP) gains for the developing Mena region picked up modestly from 3.1 per cent in 2009 to 3.3 per cent in 2010.

East Asia and the Pacific, with GDP growth estimated at 9.3 per cent for 2010, led the global recovery. This was on the back of an estimated 10 per cent increase in Chinese GDP and a 35 per cent increase in its imports. Output growth in the rest of the region was also strong at 6.8 per cent.

Loose monetary policy in high-income countries boosted capital inflows, with the Thai and Indonesian equity markets up more than 40 per cent since January 2010.

Following a 6.6 per cent decline in GDP in 2009, output is expected to expand by 4.7 per cent in the Europe and Central Asia region in 2010, as several countries underwent intense restructuring.

Europe debt concerns

Excluding Bulgaria, the Kyrgyz Republic, Lithuania and Romania, growth in the rest of the region is forecast to ease to 4.2 per cent in both 2011 and 2012. The recovery in the region remains sensitive to the situation in high-income Europe where the sustainability of sovereign debt remains a concern.

After contracting by 2.2 per cent in 2009, GDP in the Latin America and Caribbean region is estimated to have expanded 5.7 per cent in 2010, similar to the average growth recorded during the 2004-07 boom years. Growth is forecast to slow somewhat to around 4 per cent in 2011 and 2012.

The South Asia region is projected to post GDP growth of 7.9 per cent on average over the 2011-12 fiscal years, buoyed by vibrant growth in India. This compares with estimated growth of 8.7 per cent in 2010.

The region benefited from aggressive demand stimulus measures, a revival in investor and consumer sentiment, and a resumption of capital inflows. A recent move toward tighter policy will likely need to be pursued further, given the region's high fiscal deficits, high inflation and deteriorating current accounts.

Output in Sub-Saharan Africa expanded by an estimated 4.7 per cent in 2010, a strong rebound following a 1.7 per cent growth rate in 2009. In South Africa, the region's largest economy, growth is projected to pick up to 3.5 per cent and 4.1 per cent in 2011 and 2012 respectively.