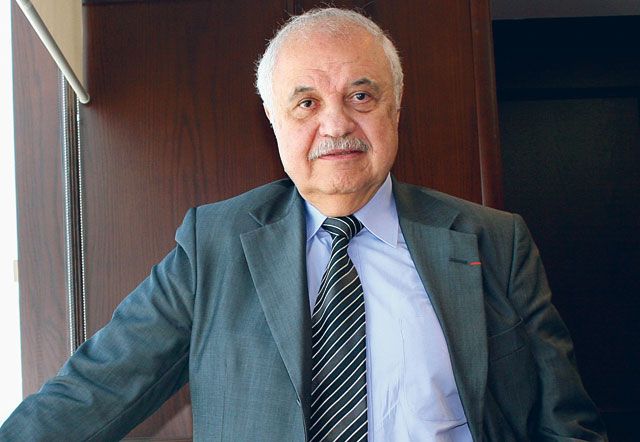

Dubai: Talal Abu Ghazaleh, chairman and CEO of Talal Abu Ghazaleh Organisation, one of the largest Arab groups in the field of accounting, financial consulting, economic and strategic studies about Middle East economic issues, shares his views with Gulf News in an exclusive interview.

Gulf News: What is your general view about the economic crisis and would you support the perception that the worst is over?

Talal Abu Ghazaleh: I don't think the crisis is over. I think it is just starting. There are no real signs of recovery, and we won't see them until there is a real restructuring of the financial system in the US. For me, the world we knew ended in 2008 — we are now living in a completely new world, and the crisis will impose and dictate changes. The US has to reform its system on control, so that regulatory agencies can really function. The Fed has very limited influence on policies and rules of the US financial system, it's a very laissez-faire attitude.

But the US government helped banks through their darkest hours by bailing them out.

Yes, but the bailouts were done to secure the liquidity of the banks, not to cover their losses. We are going to see more bank failures. Some 120 have failed already, it will be at least 1,000 at the end of this process. And there is a need at the level of G20 countries to revise accounting standards.

To what extent has the financial meltdown affected Gulf countries and what are the most viable measures to return to growth?

The Gulf countries show the other side of the picture because of their oil reserves. Oil is a major driving force in the region, and the recovery will be based on oil revenue. I predict that the oil price will reach $100 (Dh367) by the end of the year and stay above this level. Oil as an engine of development in the region will continue to strengthen development. According to our analysis, the fair value of oil would be $150 per barrel.

Isn't there a need for diversification in the region in the long run?

There is, but you cannot separate this from oil revenue. Oil is a source of income for the regional governments. Saudi Arabia, for example, is currently allocating 25 per cent of its budget for education and capacity building. They are able to invest in the human being. I am really not worried about the Gulf economy.

Besides oil, what is your outlook for the region's property sector?

Speaking of Dubai, property became much of a stock market kind of business. Property here has no structural problem, I see a trading problem. And everybody who buys on expectations of high profit takes high risk — and should be aware of it. But all this has already stopped. What we need are regulations for the market, like speculation period laws like in Europe which make the immediate sale of a freshly acquired property unattractive over a certain period due to heavy profit taxation. I don't oppose the free market, but there should be rules and regulations. A free market does not mean chaos. Look at my office here in Dubai: I bought it several years ago off-plan for about Dh2 million, later I was offered Dh24 million for it, and I don't know the value right now.

Do you think the Gulf currency union is a necessary step to consolidate and strengthen the region's monetary policy?

The unit of measurement in the region is still the dollar. It is inevitable that we will have a new currency, but globally, like Maynard Keynes proposed decades ago. A new global currency is in the interest of the US because devaluing its currency to boost exports like now is not a solution. Regarding the GCC, an economic unity like the European Union should be sought. Even as the dollar peg remains, as it represents the valuation for oil, a currency basket would be the best basis for a monetary union.

Do you think that changes in the labour law are necessary in the region to attract more talent?

Changes are necessary all over the world including the Arab countries. There is indeed a need for change. There should be free labour movement within the countries for exchange of talent. The European standard in terms of social security should be imposed.

As far as labour unions are concerned, they should come after the right environment is created.

Your growth predictions for the region?

By 2010 we will see 5 per cent growth on average, and by 2011 it should reach 8 per cent.

Godfather of Arab accounting

Dubbed the Godfather of Arab accounting, Talal Abu Gazaleh founded two firms — Talal Abu Ghazaleh Company (TAGCO) and Abu Ghazaleh Intellectual Property (AGIP) — in 1972.

Since then, Abu Ghazaleh founded 14 professional service firms specialised in various sectors such as management, consulting, legal services, IT and much more.

He established close partnerships with global organisations such as the UN and the WTO.

He is holds a variety of posts in international organisations and companies.

They include Vice-Chairman, Board of Directors, UN Global Compact; Chairman, Vice-Chair, Global Alliance for ICT and Development; Executive Board, International Chamber of Commerce; Board of Trustees, Arab Anti-Corruption Organisation.