GCC nations, Mena oil exporters face growth decline

Their average GDP to fall from 5.7% in 2012 to 3.2% in 2013

Dubai: Gulf countries and other oil exporters from the Middle East and Africa are expected to face a deceleration in economic growth this year, according to the latest update of the regional economic outlook from the International Monetary Fund (IMF).

The region’s oil-exporting countries achieved robust growth of 5.7 per cent in 2012 on account of the almost complete restoration of Libya’s oil production and strong expansion in GCC countries.

“For the region as whole economic growth is projected to fall to 3.2 per cent in 2013, as oil production growth pauses in the context of subdued global oil demand. However, non-oil growth continues at healthy rates of about 4.5 percent on average,” said Masood Ahmad, director of the IMF’s Middle East Department.

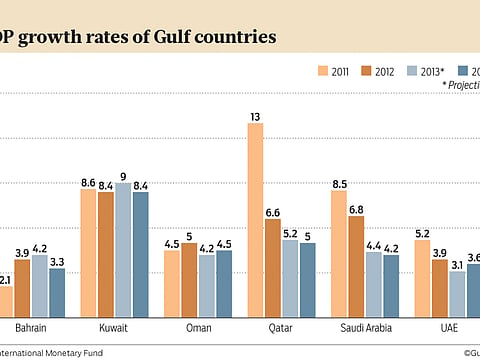

For Gulf oil exporters, GDP growth is projected to moderate from 5.8 per cent last year to 5 per cent this year.

Despite the decline in growth rates, the fiscal health of Gulf oil exporters is expected to remain stable in the short to medium term.

However, the IMF warned that the region’s economies should be mindful of the ever rising break-even oil prices and the looming fiscal deficits that could limit the growth of these economies in the medium term.

“Sharp increases in fiscal expenditure resulting from the prevailing socio-political compulsions could eventually lead to [the] depletion of reserves and prolonged periods of fiscal deficits,” Ahmad said.

Elevated oil and gas export volumes and prices allowed oil exporters to accumulate current account surpluses of about $440 billion (Dh1.6 trillion) in 2012. A small decline in projected global oil prices (based on futures markets) and an expected rise in imports will lead to a somewhat smaller — but still sizeable — current account surplus of about $370 billion this year.

Fiscal break-even oil prices — the price levels that would ensure that fiscal accounts are in balance at a given level of spending — have been trending upward in most countries.

In several countries, some degree of fiscal consolidation to rein in spending and bring down the government deficit will need to be considered to bring fiscal balances down to more sustainable levels, the IMF said.

The IMF expects a decline in oil prices due to slower economic growth across the world, new supplies from Iraq, Libya and new shale oil supplies coming onto the market.

“To build resilience to a possible sustained decrease in the oil price, oil exporters should contain increases in hard-to-reverse current government expenditures, like wage [bills] and subsidies,” Ahmad said.

Effective social and capital expenditure can decrease dependence on oil revenues in the long term by promoting future growth in non-energy sectors, the IMF said, adding that high-quality education can support job creation for nationals.

Tim Fox, chief economist at Emirates NBD, said while the growth supported by the oil sector is declining in the GCC, growth rates in the region are still much better compared to many parts of the world.

“We expect the non-oil sector growth to compensate for the decline in oil sector growth over time with Saudi Arabia and the UAE topping performance in the non-oil sector,” Fox said.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox