Dubai private sector output and employment surged in July

Wholesale and retail sector emerges the best performing area of economic activity

Dubai: The Emirates NBD Dubai Economy Tracker Index (DET) rose further in July to reach 55.9, the highest reading since March 2015 signalling a positive start to the third quarter of 2016.

The rise in the DET in July was largely driven by faster growth in output and new work, with both these indices posting readings above 60 last month. Employment increased in July but at a relatively modest pace.

“The improvement in the Dubai Economy Tracker Index in July is consistent with the rise in the whole UAE Purchasing Managers Index last month, and is underpinned by stronger new work and output growth. The wholesale & retail sector in particular probably benefitted from holiday spending over Eid,” said Khatija Haque, head of MENA Research at Emirates NBD.

Firms surveyed cited favourable business conditions, resilient client demand and competitive pricing strategies as contributing to the overall improvement in business conditions last month. Higher levels of business activity have now been recorded for five consecutive months, following the moderate decline seen in February.

“Overall, the Emirates NBD Dubai Economy Tracker survey shows growth in Dubai gaining momentum from the second quarter after a soft start to the year. However, the pace of growth year-to-date, as indicated by the DET index, is slower than for the whole of 2015, which is in line with our expectations,” said Haque.

Steeper growth of incoming new business was the key factor behind the positive performance recorded in July. The latest expansion of new orders was the fastest since March 2015. Survey respondents cited generally favourable business conditions, resilient client demand and competitive pricing strategies. Meanwhile, private sector companies remain confident about the year-ahead business outlook, although the degree of optimism eased since June in all three key sub-sectors.

The wholesale & retail sector index eased slightly to 57.3 in July from 58.2 in June, but remained the highest of the three sector indices last month. Output and new work sub-indices remained above 60 for the second month in a row, as demand remained robust.

Firms continued to reduce selling prices on average, but the extent of price discounting was the weakest year-to-date. However, input cost growth was the highest since April, suggesting that margins remain under pressure. Employment in the wholesale & retail sector increased modestly in July, following a slight decline in June. Suppliers’ lead times shortened in July, while firms added to their inventories at a faster pace than in Q1 2016. However, business expectations for the coming year were more modest, with this subindex falling to its lowest level since February.

The overall travel & tourism sector index rose to 55.1 last month, after a relatively soft January-May. Employment also recovered in July, with the index rising to 51.9 from 49.5 in June.

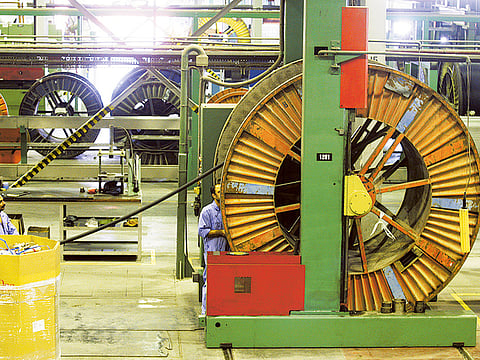

The construction sector index increased to 53.5 in July from 51.5 in June, with output growth accelerating sharply. New work also increased at a faster rate last month, as firms cut output prices to secure new orders.

Employment increased modestly in July, after declining in June. Suppliers’ delivery times shortened considerably, contributing to the overall improvement in business conditions in the sector last month. However, inventory accumulation remained relatively soft, and the business expectations index eased to 57.2, its lowest reading since January.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox