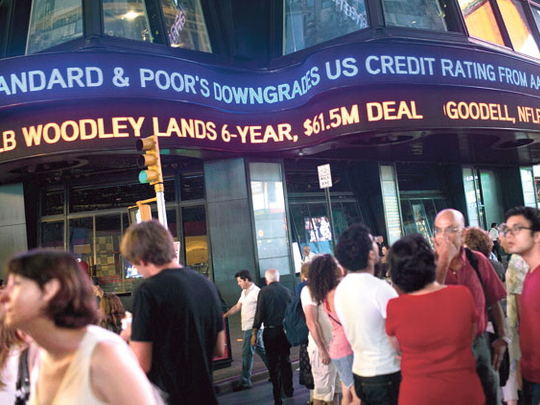

Dubai: The United States lost its top-tier AAA credit rating from Standard & Poor's on Friday.

The downgrade to AA+, S&P's second-highest rating, was not unexpected. The agency has previous threatened to lower the rating unless the US government trimmed in excess of $4 trillion (Dh14.7 trillion) from its budget over the next 10 years.

A deal reached last week in Washington by congressional leaders and President Barack Obama only cut $2.4 trillion in spending.

China, the largest foreign holder of US government debt, made clear that Washington only had itself to blame and called for a new stable global reserve currency.

"The US government has to come to terms with the painful fact that the good old days when it could just borrow its way out of messes of its own making are finally gone," China's official Xinhua news agency said in a commentary.

The ratings downgrade could raise borrowing costs for the American government, companies and consumers. In addition, the credit rating agencies have said that a downgrade of government debt would probably be followed by downgrades of other entities, such as Fannie Mae and Freddie Mac, backed by the government.

By calling the outlook "negative," S&P signalled another downgrade is possible in the next 12 to 18 months.

The Obama administration attacked the credibility of the analysis underlying Standard & Poor's decision, saying it had found a $2 trillion error.

S&P declined to hold off on its downgrade even after the error was found, sources said.

There is also a financial cost. The federal government makes about $250 billion in interest payments a year.

So even a small increase in the rates demanded by investors in US debt could add tens of billions of dollars to those payments.

While the impact of the rating cut on financial markets when they reopen tomorrow may be modest because the decision was expected, the shift may have a major long-term impact for the US standing in the world, the dollar's status, and the global financial system.

"The global system must now adjust to the many implications and uncertainties of the once-unthinkable loss of America's AAA," Mohammad Al Erian, co-chief investment officer at Pacific Investment Management Co, which oversees $1.2 trillion in assets, told Reuters.

Implications of S&P move

Credit ratings reflect the overall ability of a country to service its debt, based on factors such as financial and political stability. Lower ratings indicate a higher probability of default (non-payment).

Although there are others, the three primary agencies that issue sovereign credit ratings are Moody's, Standard and Poor's (S&P) and Fitch. With a AAA rating from all three agencies, US debt — also known treasuries — was considered the safest investment in the world. Now, the US may have to pay higher interest rates to retain investors who may now seek safer havens.

The wider implications of the S&P decision to downgrade the credit rating of the US is not immediately clear.

The current rating according to S&P, AA+, is still the second highest rating given by the agency. Both Moody's and Fitch have indicated that they will keep the US rating at Aaa and AAA, respectively, although they have said they will continue to monitor the US economy.