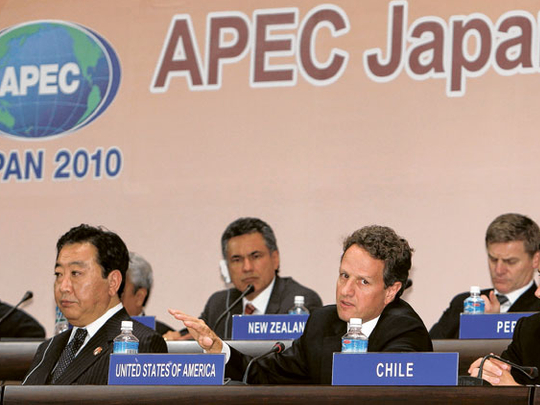

Kyoto: Asia Pacific finance ministers, including from the world's three biggest economies, met Saturday amid mounting criticism of US monetary policy and its plans to solve so-called economic imbalances.

The Japanese hosts said the Asia-Pacific Economic Cooperation (APEC) meeting would issue a statement that was expected to reaffirm commitments to fiscal discipline, free trade and infrastructure investment.

But the gathering in the ancient capital Kyoto was unlikely to quiet growing discord ahead of this week's summit of Group of 20 leaders, with several countries, including China, heavily critical of US policy.

The meeting of officials from 21 economies in the fast-growing region follows hot on the heels of last month's G20 agreement to avoid competitive currency devaluation and disorderly movements in reserve currencies, to protect the broad-based decline in the dollar.

China on Friday said a US proposal for numerical targets for current account surpluses and deficits smacked of outmoded central planning.

Chinese officials and state media have also weighed in against the latest US quantitative easing steps, warning that they could trigger an influx of "hot money" into China.

The official Xinhua news agency quoted analysts as saying: "China should raise a dyke to block an influx of hot money by strengthening capital account management, raising the costs of entry of hot money, and creating barriers to its entry".

There was a question mark over how hard Washington would push on its proposal for numerical targets. It also argued that efforts to lift the US economy were fundamental for global recovery.

A number of other leading economies have warned against the latest US moves.

Brazil's central bank head Henrique Meirelles said on Friday that the US Federal Reserve's decision to increase Treasury purchases to boost the economy risked creating asset bubbles elsewhere.

The Brazilian finance minister's warning of a "currency war" in September captured the frustration many policymakers have over the dollar's steady decline and the appreciation in their own currencies due to ultra-easy US monetary policy.

German Finance Minister Wolfgang Schaeuble went further by saying US monetary policy was "clueless".

German Chancellor Angela Merkel will address US money supply policy at the G20 summit on November 11 and 12 in Seoul.