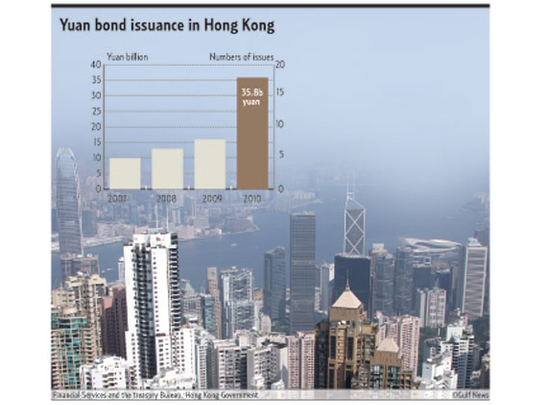

Hong Kong: China's recent moves to internationalise the yuan are expected to result in a huge demand for fund-raising through yuan denominated debts or the so called ‘dim sum bonds'.

Analysts say the rising yuan liquidity through Hong Kong will see yuan emerging as the currency of choice for fund-raising for both Chinese and International firms that have business interests in China.

Following China's announcement earlier this month that the country's qualified enterprises could conduct direct investment overseas using yuan, bankers said it will open flood gates of yuan liquidity making it an important currency as the dollar in the international trade and investment.

Until now, companies have had to exchange the yuan into foreign currencies in China before undertaking such transactions.

Speaking at the Asian Financial Forum (AFF) last week, Standard Chartered Chairman John Peace said "last decade was characterised by made in China; this one by owned in China; the next one: paid by China."

As important as dollar

Peace said it will become more "attractive for businessmen to use yuan for payments and investments" as trade between emerging markets in the Asia Pacific region continues to grow in the next five to 10 years.

"I don't see it [the yuan] replacing the US dollar... What I see is it will be as important as the US dollar," he said, adding that "I expect it to happen quite quickly."

Officials in Hong Kong said the process of fund-raising and investing through yuan is fast picking pace and they expect more than one third of China's total trade to be settled in yuan in next five years making that much yuan available in the international market.

"Currently there are about 110,000 corporate yuan accounts operated through Hong Kong.

"The recent decision to allow international trade settlements through yuan will increase [yuan] liquidity in Hong Kong.

"Additionally cross border acquisitions by Chinese firms and portfolio investments by the Chinese are expected to surge in the coming months," Julia Leung, under secretary for financial services and the treasury of Hong Kong told Gulf News.

Just about 25 days into 2011 and there were already 15.8 billion yuan (Dh8.8 billion) of synthetic bonds issued and 4.5 billion yuan denominated debt.

Hong Kong's secretary for financial services and the treasury, K. C. Chan, believes that the region would take step-by-step moves to develop other yuan denominated investment options aside from fixed-income products.

Final countdown

"In the final stage, we are willing to see investors with options of [yuan denominated] IPOs [initial public offerings] products," he told a discussion panel at the Asian Financial Forum.

Most of the yuan outside of China is collecting in Hong Kong, which has become the laboratory for Beijing's attempts to spread the use of its currency abroad. At its current rate of growth the yuan deposit base in Hong Kong could hit 2 trillion yuan this year from 280 billion yuan as of November 2010.

While companies of all types are queuing up to issue yuan-denominated debt in Hong Kong, investors are equally enthusiastic to accept these at lower yields thanks to the direct exposure these instruments give them to an appreciating currency.

The yuan appreciated about 3 per cent last year and is expected to do so by about 5 per cent this year.

The biggest challenge in the medium term for issuers and investors in the yuan denominated debt will be moving the yuan in and out of China. Bankers say currently for borrowers getting the yuan back into China can be a lengthy, complicated process, especially with Beijing getting more hawkish against hot money.

But bankers are concerned the detailed regulations of the Peoples bank of China's (PBOC) pilot programme may make it cumbersome for companies to move funds overseas, as the size of the investments by domestic companies must first be approved by the Chinese authorities. The restrictions would need to be lifted at a later stage for the benefits of the program to be fully felt, the bankers said.

Last year multinational companies such as McDonald's and Caterpillar tapped Hong Kong's yuan market. Bankers say until now the yuan raised in Hong Kong is treated like a foreign currency by China's foreign exchange regulator. The speed that it takes to get the "foreign yuan" into China depends on the location of the borrowing company's mainland operations, because provincial governments ultimately handle the process.

Some bankers also question the viability of investing yuan abroad. "Why would an overseas company accept yuan from a Chinese company seeking to buy a stake?" asked Ha Jiming, Goldman Sachs managing director.

"There's a lack of available investment assets denominated in yuan."

Hong Kong officials expect the current mechanism will be eased further as the yuan liquidity builds in the territory. The PBOC has allowed the interbank bond market to borrow and lend in offshore yuan raised through bonds in Hong Kong. While this will ease the process of moving back funds in to China, officials say there are plans to introduce Qualified Foreign Institutional Schemes which would allow select foreign institutions raise funds in offshore yuan and invest that money in the domestic shares and bonds in China.

Hong Kong Hong Kong officials insist that despite the surging yuan liquity in the territory it will continue to anchor its currency against the US dollar.

"The dollar pegged exchange rate system has served Hong Kong well since it was set up in 1983. The currency could face large fluctuations in value if it were to float freely given the small size of the city's economy," Julia Leung, under secretary for financial services and the treasury of Hong Kong.

She said it is not feasible to peg the Hong Kong dollar against the yuan as it is not a freely traded currency.

Although there is public resentment against the dollar peg for contributing to rising inflation in the territory, as Chinese food imports — which account for the bulk of Hong Kong's food supplies — have become much more expensive amid an appreciating yuan and a weaker US dollar.

"Peg has its long term objective of keeping financial stability. Ours is a financial centre that attracts huge fund flows..." she said.