This is about depth, not breadth

'It will be terrific if the major economies have consistent capital rules'

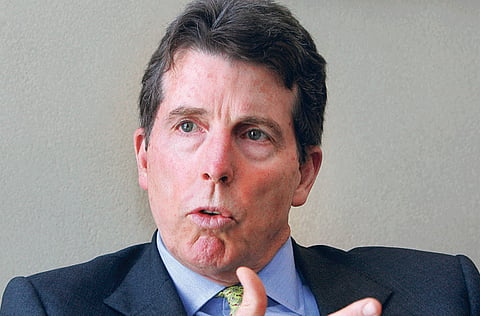

Dubai: He is the man whom erstwhile UK Business Secretary Lord Mandelson called the "unacceptable face of banking". Unfazed, Robert E. Diamond Jr., the American president of 320-year-old British bank Barclays, simply smiles.

Diamond has plenty to be happy about. At a time when most bankers were tearing their hair out trying to deal with the economic effects of the credit crisis, Diamond was out shopping.

He bought Lehman Brothers after it defaulted in September 2008 to become the biggest bankruptcy in American history. He sold his bank's investment unit, Barclays Global Investors, or BGI, to BlackRock, and ended up with Barclays holding 19.9 per cent of the combined company. The icing on that particular cake was: the new company, BlackRock Global Investors, has the same initials as the unit that Barclays' clients already knew well — BGI.

Diamond has been described by Esquire magazine as "the man who stayed calm in a time of chaos, who stayed ambitious when dreams were dying, who thought big when others thought only of survival."

One of the highest-paid bankers in the world, Diamond is proud of being one, in spite of living in a moment in history when bankers are mistrusted. He ought to be. Under his and Group Chief Executive John Varley's stewardship, Barclays posted profits for every single quarter, even during the height of the crisis, and did not need to resort to government bailout cash like most other lenders in the US and the UK.

Gulf News caught up with Diamond on one of his infrequent visits to Barclays' Dubai offices, with a view to figuring out his secret for turning dross into gold. Excerpts from an interview:

Gulf News: You bought the best bits of Lehman Brothers, you sold off BGI and in the process got a 20 per cent stake in BlackRock. All this deal making - where is it going in terms of a long-term strategy?

Robert E. Diamond Jr: I think our long-term strategy is very clear, and it hasn't changed one iota. It is at the core of everything we do. It is to be an integrated universal bank, diversified by product and by geography, with the best talent and the best risk management. This enables us to contribute to our clients' success on a global basis and to provide integrated services in response to their needs.

We believe that we are today one of the premier universal banks. Nowhere is this more important than here in the Middle East, where there is less of a distinction between a private client and a public client, a corporate and an individual.

So we drive our businesses in an integrated fashion — our wealth business, our private client businesses, our investment bank, and our corporate and our retail businesses. We benefit from the strength of our global businesses.

Barclays is one of the few global banks that came through the economic crisis without missing a step. You were profitable in every single quarter. What makes you so strong?

We think the fact that we came through this crisis without any government money is a real advantage. It's also a powerful cultural advantage. I think we feel confident and strong.

Every one of us made mistakes. And every one of us had to manage through a very difficult period. But I think the integrated universal banking model combined with good risk management and firm management underpinned our success. When we were going through periods of turmoil in the investment bank, the retail bank was strong. When we saw provisioning rise on the retail banking side of the business last year, investment banking and wealth management were strong. So our balance and diversification of earnings have been critical ingredients of success.

What steps did you take when you first understood the magnitude of the crisis?

Our risk management clearly stood out as one of the strategic advantages. We were able to manage our risks and our capital without having to take government money, which is very important. The moment we knew the crisis was real was in the summer of 2007. We didn't know how deep or how broad, but we knew it was real. We set some specific criteria.

We talked about it and saw it is an opportunity. One, we needed to manage through proactively. We had to have our focus on the bottom line and risk management. We have been profitable in every single reporting quarter. Two, we had to be close to our clients. We saw many of our competitors turn inward. We looked outward.

We immediately separated our legacy assets, the assets that we knew would create a problem, into a separate book away from our client businesses and I think that really stood out for us. This allowed us to stay close to the client and our market share in virtually every business we were in went up during the crisis. Three, we focused on managing our costs. And four, we sought to maintain our strategic momentum; we saw an opportunity to take advantage of the dislocation to emerge from the crisis stronger than at the start.

How did you deal with the assets that you put aside? Did you deal with them any differently from the way other banks dealt with their toxic assets?

I think the key was the separation. We created a separate business to manage our legacy positions. That was the first step, keeping in mind that there are implications on capital, in markets that aren't particularly liquid. Second, we didn't allow them to deflect our ongoing business.

There was a dramatic but methodical decrease in these positions, we marked them down and we liquidated when we found the right opportunity to sell. We restructured them when they needed to be restructured.

At the same time we achieved consistent quarter by quarter growth of market share; we couldn't have hoped for anything better. It was a really difficult period and we took some significant losses. I don't mean to say it was easy. But we had a good plan, which allowed us to manage those positions without losing focus on what is most important - our clients, risk, costs, and our strategic position.

We wanted to come out of the turmoil in a stronger competitive position, and I think we have been able to do that.

Now you've got one of the strongest capital ratios in the world, and economic recovery has begun, well, mostly everywhere. It may not be even, but it has begun. So, what do you see happening from your firm's perspective? Is the structure of the firm where you want it to be, or is there something you'd like to do with that?

In many ways, it is. As I said earlier, we've re-affirmed our commitment to the integrated universal banking model. But there are areas where we need to invest and grow and become deeper. I think the key is that we recognise that this is not about breadth, it's about depth.

Probably the best example is our investment bank Barclays Capital. This period gave us an opportunity to change our relative positioning significantly, by giving us scale in the US, which is the biggest, most important and profitable market. And we're now one of the two or three top players there.

I don't mean to say for a second that we're done, but our ambition is to build up an equities and M&A business in Europe and Asia. In Europe we're completely up and running, in Asia we're pretty close. We also want to move into the top tier in emerging markets, where we're increasingly strong but not yet in the top tier.

In which emerging markets do you think you need to strengthen Barclays' presence?

It depends on the business. Wealth management is an example. The board just approved a five-year plan with a £375 million investment. So we can move from our current position, which is somewhere around nine, 10 or 11 on a global basis, into the top five. And we're going to do that organically — it's an investment in technology and people.

Probably here in the Middle East more than anywhere else in the world, our integration of our wealth business and our investment banking business is important. We call it private investment banking. The serious clients in this region are in private banking or in wealth. We have the institutional services, and institutional advice, that are provided to corporates and pension funds. Here the individuals demand it, and we're able to deliver that by bringing those businesses so close together.

This is an area that will continue to grow significantly. Not by bringing in new businesses but by continuing to get better at what we do and by broadening our client footprint.

There seems to be an effort to increase regulation and oversight of markets. This is happening in the US, in Germany; but there doesn't seem to be a concerted effort. It seems to be happening disjointedly. What's the impact going to be?

We are strongly in favour and strongly supportive of reform and strong regulation. There's no-one more disappointed with the failure of some of the banks than the strong banks. The failure of a number of large institutions casts a pall — and a question — over all of us.

So we're working closely — personally, I am working very closely — with the key regulators and politicians in the UK, in Europe and in the US. It seems disjointed because there are some aspects that are national and there are some that are international...

But I'm optimistic. I think we're going to get regulatory reform that will address some of the issues around risk and derivatives. The derivative markets will move in a significant way towards centralised clearing and trading on exchanges with a specific carve-out for end-users and structured transactions.

We are probably the first big firm that supported electronic trading in derivatives as well as centralised clearing of derivatives. We think it is the right direction for the market to go, because it provides more transparency, more security.

I don't think we'll go to the extreme of separating the derivatives business from the banks. Once financial regulation in the US is concluded, and my sense is that the President of the United States will have signed a financial regulation bill by the Fourth of July, on Independence Day, which I think is a great opportunity to achieve a bi-partisan, coordinated success.

Then the Treasury, under Secretary Geithner, will turn its attention to international capital. It will be terrific if the major economies — the G20 — have a consistency in capital rules. Using capital rules as a consistent basis for banks around the world to measure and quantify risk, and to measure and quantify the amount of capital and the quality of capital needed in the banks, is absolutely the right way to go.

These rules have always been there, like the Basle II regulations. How will the new rules be different?

Well, I think you hit a good point there. Even in those nations that implemented Basle II, it wasn't as standardised as we would have liked, in hindsight. It was tailored a bit, nation by nation. I think a lot of the new regulation will be national but with global coordination and global integration. If we get down to minor differences in interpretation, I'm not too worried.

What I am worried about is that Basle II was never implemented in the US banks, while it was in the UK and in Europe. So, we have banks playing with different rules around capital, which drives tremendous opportunities for regulatory arbitrage. In our view, that opportunity for regulatory arbitrage is one on the principal weaknesses of the current system.

What is the outlook for investment banking? When do you think capital-raising is going to begin again?

It's a tough market right now. We have been, like a number of other institutions, mandated by clients to execute transactions when the markets are ready. When will the markets be ready? I think some resolution of US reform has to happen.

In the UK, most outsiders are looking at the smooth transition from the Labour Party to the coalition between the Conservatives and the Liberal Democrats as a positive development. The statesmanship with which Prime Minister Cameron has operated has been a strong benefit for the UK.

I think markets are still digesting some of the issues around what the agendas are going to be. It's increasingly clear that it's about cutting spending and about boosting jobs and strengthening economic growth. There is also a recognition that those objectives will not be met without strong banks.

OK, so if the markets have discounted the UK election in terms of no strong winner, if the markets are about to discount financial regulation, what remains as a hump to get over?

I don't think we've discounted financial regulation. But I do think over the next month or so, by July 4, we'll be there in the US, which will be a significant step forward.

What else gives me a cause for optimism? The US economy is very strong. Coming out of the crisis, the US economy has once again demonstrated its phenomenal resilience. The currency weakened. Jobs were cut. Cyclical industries cut back — the car manufacturers being the best example. There's a real bounce to that economy right now. I am incredibly impressed by how efficient US companies have become.

What's your view on the credit markets? Are they still frozen?

Not frozen. Although in some ways let's hope they never become as liquid as they were in 2005, 2006 and 2007.

That's not what bankers were saying at that time…

No, and I think we've all learned our lesson. I'll be the first to put my hand up: I made mistakes. Our bank made mistakes. We never put our organisation at risk, but all of us have learned lessons.

I think we've learned lessons on corporate policy. I think we've learned lessons on central banking. I think we've learned lessons on regulation. I think we've learned lessons on leverage at the individual level, at the corporate level, at the government level and at the banking level. So I think we're better prepared.

Some of the things happening in Europe, some of the things that happened right here in Dubai, are good lessons. And I think investors have become more discriminating, less reliant on rating agencies and more reliant on good, old-fashioned credit work.

It is good for financial markets that investors increasingly recognise that there is a difference between a sovereign bond from one European country and one from another European country. That is great for Barclays too. It's great for our business model. We're the number one institution in the world in issuing sovereign and supranational debt.

How do you think the whole concept of capitalism has morphed as a result of this crisis? What's the road ahead for the free market model?

Again, accepting that there are lessons learned all over, the thing that is the most remarkable to me is the incredible resilience of the US economy. Private companies have stayed focused. We're seeing a stronger bounce in that economy than in some of the other economies which, when the crisis hit, resorted to protection of their national industries.

I think the strength of the free enterprise system will be very clear as we emerge from the economic downturn.

How did you respond when Lord Mandelson called you the "unacceptable face of banking"?

I smiled, just as I am doing right now. I think if any of us worry about what politicians say in the middle of a political race, I'm being way too sensitive.

Everyone is now saying bankers are greedy and rapacious… How does that sit with you?

I think there have been cases of greedy people in our industry and greedy people in other industries. I'm very proud to call myself a banker. And I'm extremely proud of what Barclays has done to strengthen its franchise - the clients, the employees, the shareholders - during a very difficult time in the financial markets. There are 144,000 of us in over 50 countries servicing more than 48 million customers around the world and I'm very, very proud of this organisation.

Resume

Consummate banker

Robert E. Diamond Jr. is President of Barclays and Chief Executive of Corporate and Investment Banking and Wealth Management, comprising Barclays Capital, Barclays Corporate and Barclays Wealth. He is an Executive Director of the Boards of Barclays and Barclays Bank and has been a member of the Barclays Group Executive Committee since September 1997. He joined the firm in 1996.

Diamond is also a board member of BlackRock following the integration of Barclays Global Investors.

He was formerly vice-chairman and head of global fixed income and foreign exchange at CS First Boston, which he joined in 1992. Based in Tokyo, he was chairman, president and chief executive officer of CS First Boston Pacific.

Previously, Diamond was managing director and head of fixed income trading at Morgan Stanley International, spending 13 years with the firm.

A native of Concord, Massachusetts, Diamond received a Bachelor of Arts degree in Economics from Colby College in Maine (1974) and an MBA from the University of Connecticut, where he ranked first in his class (1977). He was awarded Doctor of Humane Letters from the University of Connecticut in 2006 and Doctor of Laws from Colby College in 2008. He is married with three children.

— Y.D.