Dubai: The private equity industry in the Middle East and North Africa (Mena) region is seeing the light at the end of the tunnel. The industry is witnessing improved deal flows and investors are seeing scope for higher valuations, higher regional fund raising and improved allocations by limited partners (LPs) to the region.

According to statistics compiled by Al Masah Capital, a regional private equity firm, the Mena region witnessed increased deal activity in the private equity space this year to date as economic recovery has started gaining pace.

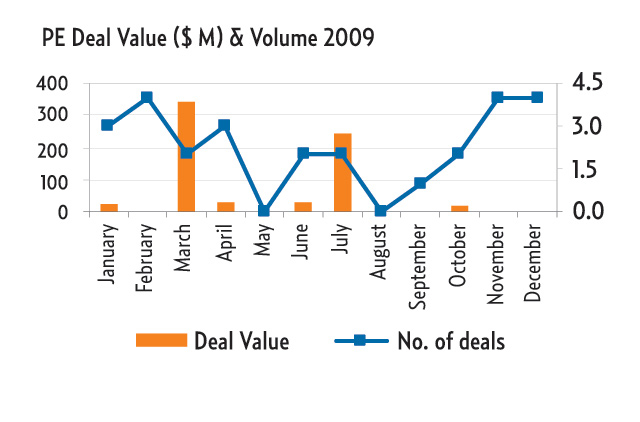

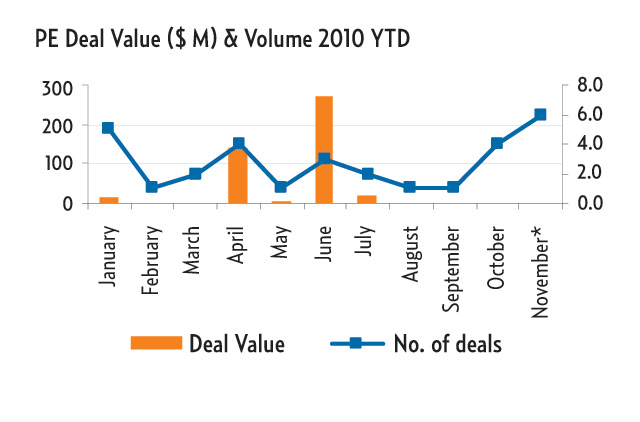

Based on the number of PE deals in November, 30 PE deals have been executed this year to date with an estimated value of $449.2 million (Dh1.65 billion) compared to 27 deals in the whole of 2009.

Mark Mobius, Executive Chairman of Templeton Emerging Markets Group, a leading global asset/fund manager, told a recent regional private equity conclave in Beirut that the Mena region offers great value to investors, even when compared to economic powerhouses India and China. According to Mobius, the Mena region remains bullish on valuations as the market is still in the process of a correction and is under-allocated from the perspective of global investors.

Investment schemes

For instance, the Mena region collectively represents 13.1 per cent of the global nominal while representing only 7 per cent of the global market capitalisation. According to him, consumers and commodities remain some of the most important investment themes for 2010-11.

The PE industry in the Mena region witnessed a sharp decline in 2009, with fund managers raising only $1.06 billion compared to a near-record $5.4 billion in 2008. Investments also declined from $2.72 billion in 2008 to $561 million in 2009, according to statistics from the Gulf Venture Capital Association (GVCA).

According to the Zephyr M&A Report for the first half of this year, the value of private equity investment in the Middle East plunged to a low not seen since the financial crisis. Just $135 million in private equity transactions was recorded in the first half of this year — a decline of 78 per cent from $617 million in the second half of 2009 and 62 per cent from $355 million in the first half of 2009.

According to GVCA's estimates, the regional private equity industry is sitting on $10 billion worth of dry powder (uncalled capital).

With the tight liquidity situation in the market and many funds nearing the end of their terms, fund managers are unable to utilise these funds for fresh investments.

Despite the long dry spell in deal flows and the tight liquidity situation, observers say optimism is returning to the industry. According to a recent survey of the PE industry by Arbor Square Associates conducted for Deloitte, optimism in the industry has improved substantially over the past 12 months.

"The perception of the market on fundraising remains tough. However, the overall negative perception has subsided substantially compared to last year. Many general partners [GPs] are left with funds raised in the past. These firms have an opportunity to invest at attractive valuations," Richard Clarke, Managing Director of Transaction and Recognition Services Middle East Region of Deloitte, told Gulf News in a recent interview.

Recent studies show that confidence among GPs is rising as a majority of them believe that the global LP appetite for the Mena region will increase over the period, fuelled by market recovery and, in particular, interest in new and specialist sectors. However, many in the industry admit that LPs have become extremely cautious on fund allocation.

Largest number

The rise in deal flows indicates that confidence is returning to the industry. Last month recorded the largest number of PE deals compared to the rest of this year; PE deals were higher even compared to the same period last year.

Six deals were executed last month compared to four deals in November last year. However, the value of the deals was not disclosed.

Analysts say family-owned businesses, which play an extremely important role in the Middle East's economies, offer sizable opportunities for PE firms. Entrepreneurs who have run many of these family-owned businesses for the past few decades are giving way to a rising second or third generation of family members who see the need to develop more focused strategies and more professional management approaches.

"In the years ahead, these businesses are expected to divest some of their scattered holdings, scale up the businesses they retain, and seek to improve their overall performance. To do so, they need to acquire good management capabilities with a breadth of strategic, financial, and operational knowledge.

"We expect the private equity industry to play a big role in preparing these companies for public markets," Luca Peyrano, Head of Continental Europe, Primary Markets of the London Stock Exchange Group, told Gulf News in an interview.