Settling hotel bills, buying a meal or purchasing a souvenir overseas — credit cards or ‘plastic money' is usually the answer to your payment woes. However, most people may not be aware of the fee banks charge every time an individual swipes his or her credit card when travelling abroad.

The ‘foreign currency transaction fee' entitles banks to charge up to three per cent extra charges on every transaction made overseas. One per cent of that charge is decided by the credit card company and the rest is at the bank's discretion.

According to bankrate.com, once a card is swiped, the exchange rate on that particular day is applied to the foreign currency, in order to convert the amount to US dollars. The credit card company adds a one per cent fee to process this conversion. However, the bank then adds up to a maximum of two per cent charge to it.

Some banks inform customers of the transaction fee on their credit card bills. However, they usually fail to mention what is the exact percentage being charged, which leaves most customers unaware.

In the UAE, most leading banks are implementing these charges, but they vary from bank to bank. For example, HSBC Bank charges up to 2.8 per cent foreign currency transaction fee, First Gulf Bank charges 1.65 per cent whereas Emirates NBD and Barclays charge 2.75 per cent, each. This includes the charges levied by credit card companies.

Abdul Fattah Sharaf, CEO of personal financial services, Middle East and North Africa (Mena), HSBC Bank Middle East said: "When a transaction is conducted by the cardholder in a foreign currency, the bank charges a foreign currency transaction processing fee. HSBC Premier and Platinum credit cards attract a fee of 2.6 per cent, while Gold and Classic credit cards attract a fee of 2.8 per cent."

This extra charge means if you paid $200 (Dh734) for a night at a five-star hotel in the US, you would be charged $205.6 (Dh754.5) instead.

When asked about the reason for this extra charge, Sharaf said: "The foreign currency transaction fee is an industry norm and the same is applied by various card issuers in the UAE and abroad. The purpose of this charge is to cover the additional cost of servicing a transaction conducted overseas."

Several times, banks fail to inform customers of this fee, when they apply for a card. Many cardholders are not aware that they are being charged extra.

This was evident when a credit cardholder lodged a consumer complaint with Gulf News against one of the leading banks in the UAE. A 2.75 per cent fee had been added to the customer's transactions made in the US. No prior information was provided by the bank and the customer had to pay more than Dh700 in extra charges.

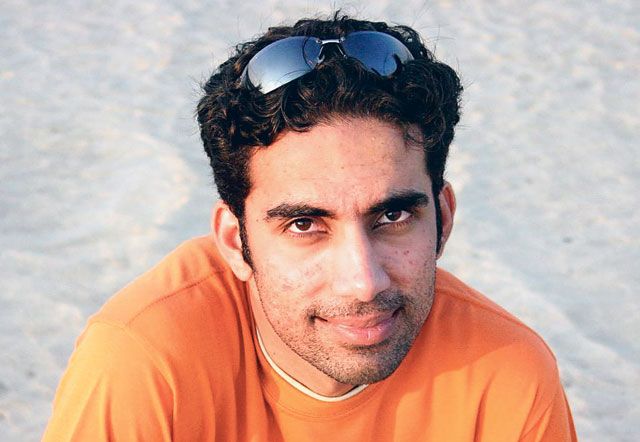

Gulf News readers were equally surprised to hear of the foreign currency transaction fee. Aju Sharf Al Deen, an Indian expatriate, is one of them.

He said: "I always thought that the conversion would be based on the exchange rate. I never realised that the bank would charge an additional fee for the process."

Sharf Al Deen expects banks to be more transparent and inform customers of all charges applied. "There should be no hidden charges, regardless of where I use my credit card," he said.

Mirza Imran Hanif, a Pakistani expatriate, decided to cancel his credit card due to the unknown charges.

He said: "I recently got rid of my credit card and I was not aware of the foreign transaction fee. It seems like a loophole to trap customers."

Hanif is not happy about his interaction with banks. "There are several other hidden charges, when it comes to banks, which customers are not informed of and end up paying a lot more money than they should," he said.

However, Suvo Sarkar, general manager of retail banking, Emirates NBD disagrees.

He said: "Customers are informed of all the charges when applying for a card through the service and price guide, which is an integral part of the welcome pack sent to a customer. The applicable charges and fees are also continuously reiterated in the monthly statement sent to the cardholder."

On the foreign currency transaction fee, Sarkar said: "This charge is for the service of providing the convenience [to customers] to be able to use the card anywhere in the world without the hassle and fear of carrying cash or converting traveller's cheques at multiple points."

Experts approve the transaction fee

Benjamin Artz, assistant professor of economics at the American University of Sharjah, thinks it is a common practice for credit cards to charge a fee for international transactions.

He said: "While it seems this is unfair because of the dirham-dollar peg, it does cost banks some resources to exchange dollars for dirhams and vice versa. Banks must still maintain some overhead costs in order to trade money internationally."

Artz, however, argues that credit cards could charge a fixed fee rather than a proportion.

He said: "For instance, international ATM transactions are generally charged a fixed fee, regardless of the size of the withdrawal. To some extent, credit card companies could do this as well."

When asked about the ideal transaction fee, Artz could not decide on an acceptable percentage.

He said: "I would imagine the three per cent rate is a bit high, but I cannot imagine what a fair rate would be. However, when travelling abroad, it is often not a bad idea to use a credit card rather than continually withdrawing cash from ATMs. Not only is it safer, but banks also compete for the best exchange rates with each other, so credit cards customers often get a better rate than cash customers."

Andy Barnett, a professor of economics at the American University of Sharjah, believes the fee is rational.

He said: "The card issuer correctly assumes that those using their card in an international context are less sensitive to fees. That is, despite the fee, most will use their card when travelling abroad. In short, this is about price elasticity of demand, not rationality."

Barnett only uses his credit internationally in case of an emergency. "If consumers boycotted international use because of this fee, market pressure would force card providers to reduce or eliminate the fee," he added.

Alternatives to credit cards

Debit cards

The funds are immediately withdrawn directly from the cardholder's bank account or the remaining balance on card.

Automated teller machine (ATM)

Withdraw cash from an ATM located in your hotel, the airport or a bank. Avoid multiple withdrawals; plan ahead for the day.

Prepaid credit cards

The cardholder has to add funds to the card's balance, similar to a prepaid mobile phone.

Traveller's cheque

A cheque of a specific amount, which allows the issuer to settle an amount or exchange for a similar amount from a bank.

Overdrafts

When the withdrawn amount is larger than the available balance, the account shows a negative balance, or overdraft. A prior agreement with the bank allows this overdraft, with a certain interest rate.

Do you think banks are justified in charging overseas transaction fees? Why? Have you suffered due to bank overcharges when travelling?