Dubai: Bangladeshi consumer electronics brand Walton has entered the Gulf through a franchise agreement with a Dubai-based company. Separately, a Qatar-based company acquired the rights to Walton's business on the peninsula.

Walton employs 12,000 workers in Bangladesh's largest household consumer goods manufacturing plant.

It distributes 4,500 types and models of goods ranging from mobile handsets, microwave ovens, DVD players, LCD and LED televisions to motorcycles and sells them through a network of 4,986 outlets, sales centres and dealers across the country.

It manufactures 1.4 million refrigerators and freezers, 300,000 airconditioners, 1 million television sets and 300,000 motorcycles.

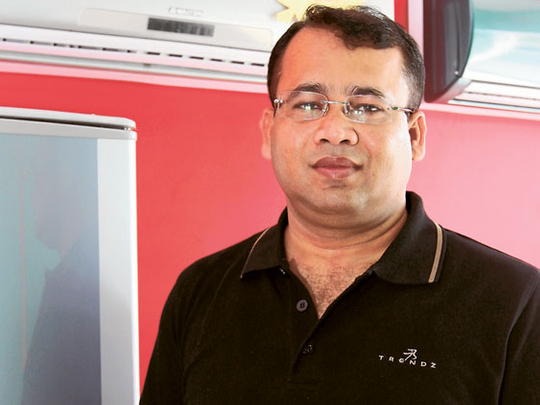

"We started three months ago and our first consignment has been sold out before schedule," Mahmoud Mamun, Managing Partner of Mohd Moqbul Trading LLC - franchisee of the Walton brand, told Gulf News.

"We are currently finalising distributorship and sub-franchisee arrangements in all seven emirates and Al Ain within the UAE and Oman before entering the Saudi market.

This is in addition to five containers re-exported to Afghanistan. The company, which stocks goods in an Ajman warehouse, is looking for another in Jebel Ali.

"During the first year of operation, we plan to import and sell more than 120 40-foot containers worth Dh10 million.

‘Made in Bangladesh'

Walton has an end-to-end manufacturing plant that produces components in 200 factories and then manufactures brown and white goods from those in the production line, promoting the ‘Made in Bangladesh' label.

In 2009, Walton bought a mobile handset manufacturing plant in South Korea that once manufactured Nokia and other mobile cellphone brands. Following the acquisition, it has shifted the plant to Bangladesh where it produces millions of handsets every year.

"For the UAE market we have brought a few models to suit the needs of our customers," Mamun says. "Our cheapest handset that sells for Dh100, offers dual sim, radio, camera, internet, social media, video recording among other features — that you don't get for Dh100."

The number of mobile subscriptions in Bangladesh increased 50 per cent to 86.57 million in January, according to the Bangladesh Telecommunication Regulatory Commission. Bangladesh's population is an estimated 160 million.

However, of the country's 28.37 million users, 26.9 million are mobile internet users — reflecting the popularity of mobile-internet usage. Walton's handsets are going to help meet the domestic demand first, analysts say.

"The Bangladesh consumer durables market is on a growth curve. Consumption of durables such as televisions, refrigerators and mobile phone handsets are on the rise," according to a chemicals and materials analyst at Frost & Sullivan.

"However, the Bangladesh consumer durables industry is yet to see growth similar to that of other developing countries like India and China, indicating the high potential of the market.

"The Bangladesh consumer durables market was an estimated 13.30 billion taka in 2011 and is expected to grow at a year on year rate of 15 per cent over the next two to three years."

The semi-urban and rural population of Bangladesh has a preference for home-grown brands. Local brands such as Walton and MyOne are growing rapidly by specifically targeting this section of the population.

For example, while multinationals import and price 10 cubic-foot refrigerators at 30,000 to 33,000 taka, brands such as Walton price similar refrigerators at 20,000 to 22,000 taka so as to specifically target the lower socio-economic classes of Bangladesh society.

Quality

Local brands are growing in popularity due to the perceived quality and comparatively lower prices of these brands. Further, the availability and awareness of these brands is also rapidly growing, closing the gap in brand equity between multinational and local brands.

"The key growth areas of the Bangladesh consumer durables industry has been the rural and semi-urban consumption of fast moving consumer goods and consumer durables.

"A higher percentage of the rural population is consuming consumer durables when compared to their urban counterparts," he said.