The Indian property market has slowed down in the past few years due to multiple factors, including growing interest rates and a sluggish economy, prompting developers to look more fiercely beyond Indian shores to tap the non-resident Indian (NRI) market.

“The year-on-year indices of the past financial year have not been upbeat and the construction sector has certainly been impacted,” says Bhawna Dhawan, Deputy General Manager — Sales and Marketing of Brahma City, one of the exhibitors at the Indian Property Show (IPS), which will run from tomorrow until Saturday at the Dubai World Trade Centre.

The Gurgaon-based realtor will exhibit its plots and luxury villas that will be built on a 150-acre community development at the Golf Course Extension Road.

Traditionally, she says, NRI investors rely on friends, relatives and acquaintances to identify property for investment. “Today, the whole process has become globalised with so many reputed real estate developers having tie-ups with world-class construction companies and offering their properties at seminars and expos in different parts of the world,” says Dhawan.

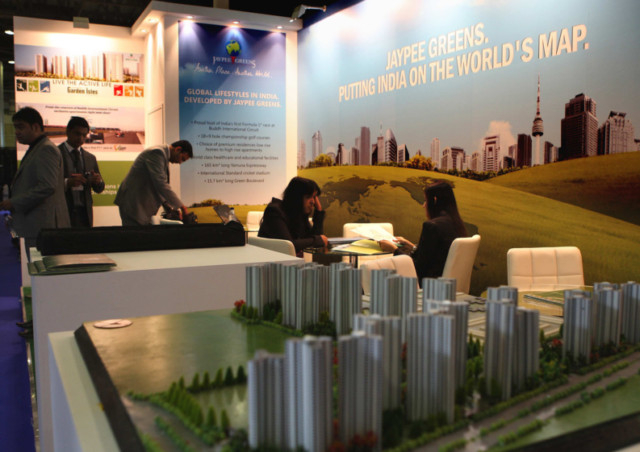

The organiser says exhibitor participation is more than 20 per cent higher than the previous edition. “The exhibition is poised to be the largest ever,” says Sunil Jaiswal, CEO of Sumansa Exhibitions. “We will have more than 140 exhibitors taking more than 220 exhibition stalls. The total floor space is 6,400 sq m. We also expect more than 17,000 visitors.”

Adds Sanjeev Birari, Head of Sales — International at Mantri Developers, one of the show’s pioneering exhibitors: “I think people look forward to this event because there are good developers coming from different cities from all over India.”

Mantri will be showcasing Mantri Courtyard, a row-house development recently launched in Bangalore, Mantri Lithos in North Bangalore and Mantri Euphoria, a villa project in Hyderabad.

Jaiswal says more and more developers are focusing on NRI investors each year, with the UAE being one of the most lucrative markets. “NRI investors also keep a close eye on the real estate market in their home towns and when they find an opportunity, they invest without hesitation,” he adds.

The potential of the NRI market, however, still remains to be fully realised as NRIs only account for a relatively small percentage of property sales in India.

“The share of NRI sales is only around 8-15 per cent because there have been no focused activities to tap the NRI market,” says Birari, adding that the depreciation of the Indian rupee and the dip in domestic demand have forced developers to increasingly seek out potential NRI buyers.

Exciting offers

With the increasing interest in the NRI market, Indian developers are now more aggressive in participating in international expos and events such as the IPS to promote their projects. On the other hand, these events give NRIs access to new projects and great offers.

This year, a number of leading developers, including India Bulls, Propshell Group, Unique Builders, Kanakia Spaces, Omkar Realtors, Brigade Group, Lavasa, Ozone Group, Siddha Group and Bombay Realty, are taking part in the exhibition. Many of them are offering special deals and spot discounts to lure prospective buyers.

“There are exciting things happening this year, including a property to be given away through our Home Shanti Home campaign,” says Jaiswal. “Any visitor who comes to the show will have a chance to win a property in India in a raffle draw.”

Mantri Developers is offering various payment schemes at the show such as a pre-equated monthly instalment (EMI), wherein a buyer can pay the monthly interest only on the disbursed loan amount, and extended pre-EMI. The company is also providing spot booking discounts and free tickets for prospective buyers to visit project sites in India.

Since the rupee touched bottom against the dollar, Indian developers have seen at least a 30 per cent surge in property deals routed through NRI investors. “Typically, NRIs looking at investing in Indian property find periods of depreciation of the rupee a good time to invest, principally because of the higher capacity to acquire quality real estate. It is a good time to remit funds to India for investment,” says Dhawan.

With India’s federal elections due next year, industry experts believe the current situation of policy paralysis will change and the market will improve once a new government takes charge. “The Indian property market has been stagnant for the past year and this is certainly a good market for buyers. After the forthcoming elections and with a stable government coming into power, prices are expected to rise again,” says Kamal Khetan, Chairman and Managing Director of Sunteck Realty, which is also participating in the IPS.

Hot destinations

But with so many developers coming up with a wide range of projects across India, how does one decide where to invest? In a poll conducted by Sumansa Exhibitions on more than 17,500 NRIs in the UAE, it was revealed that Mumbai is the top destination for property investment (with 33.7 per cent of the votes), despite high property costs and low supply.

The IT city of Bangalore grabbed the second spot with 22.6 per cent, up 5 percentage points, followed by Pune (17.5 per cent) and Chennai (16 per cent). Delhi was fifth with only 8.6 per cent interested in investing in the capital city.

“While Navi Mumbai, Cochin and Gurgaon still remain popular, Hyderabad and Coimbatore lose out to Ahmedabad and Goa as hot destination cities for property purchase,” according to the survey report.

Dhawan says Delhi, Gurgaon, Mumbai and Bangalore are the undisputed top cities when it comes to big-ticket property investment. “These big cities offer sizeable returns to investors owing to the increased supply of new working talent and consequent supply of real estate space,” she says. “These cities also offer premium residential developments of superior quality, design and luxury facilities.”

Dhawan says Hyderabad, Pune and Chennai have become new real estate propositions because leading IT companies have been expanding their campuses in these cities.

NRI woes

“The industry has come a long way. Many developers have now started to deliver quality projects and, as a result, you are seeing projects designed by the likes of Armani and others,” says Jaiswal.

As for delays, he says they cannot be avoided. “It’s a given that a sizable project will be delayed by an average of six months. It’s not only in India, it happens worldwide.”

Industry experts also say it’s important for an NRI investor to undertake a credibility check on the developer. “A good developer with strong financials and track record will ensure that the project gets completed on time,” says Khetan. “As far as overpricing is concerned, we believe that developers are providing attractive offers on closures and are being practical in their approach, given the market sentiment.”

Dubai factor

Indians are still among the biggest investors in the UAE property market. With Dubai winning the right to host the World Expo 2020, analysts say the property market will see a huge demand from NRI investors as well, but caution against comparing the two markets.

“Indian property investors love Dubai due to fast appreciation, higher rental returns, no tax on rental income and capital gains,” says Jaiswal. “India is the home country of NRIs and it’s more than just an investment destination.”

Though Dubai has its own appeal, Dhawan says a recent survey by Sumansa Exhibitions reveals that NRIs having great affinity with India still believe property in their home country will achieve a higher return on investment than property they own elsewhere. She adds strict visa rules and other regulatory obstacles in Dubai may drive NRI investors to explore opportunities in India.