Dubai: Several UAE-based Indian expats have been mailed notices from the income tax department in India particularly relating to high value transactions conducted back home, and this has raised concern among non-resident Indians (NRIs) on what the next step should be if they get such notices.

Here’s what you should know when it comes to what needs to be done if you are an NRI and have received such a notice from the Indian income tax department, as it is vital to know how to respond to them given that there was some confusion around doing them last year as well.

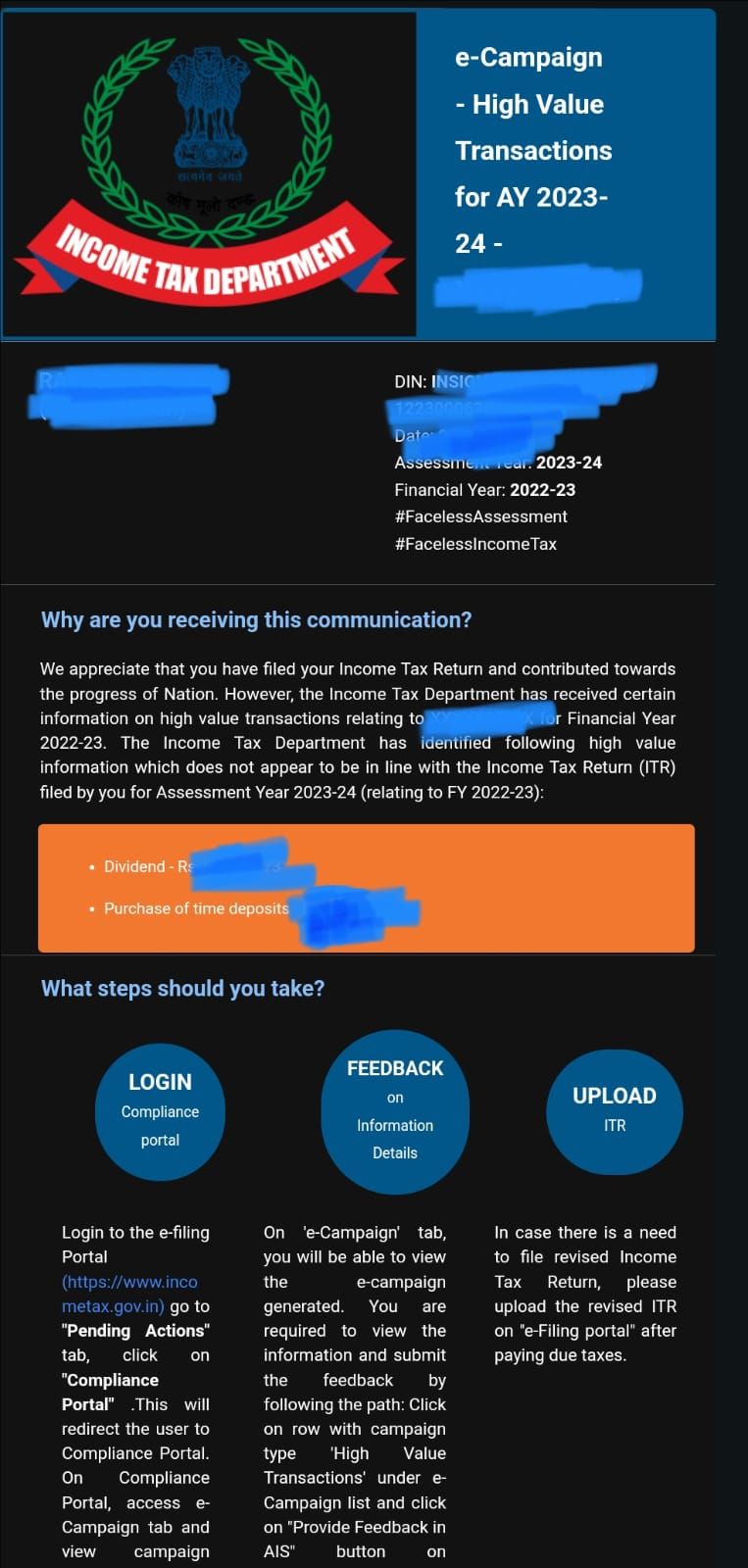

In emailed notifications, titled ‘High Value Transactions for 2023-24’, certain high-value NRI transactions made in India over financial year 2022-23, are highlighted as not included in the filed income tax return (ITR). These notices are sent to NRIs to provide feedback on it or file a revised ITR.

What do such notices mean for NRIs?

Tax experts are evaluating how these advisories may be the result of ‘Rule 12AB’, which was introduced last year and mandates filing of returns for taxpayers whose tax in a year exceeds Rs25,000 (Dh300) or aggregate deposits in savings accounts in a year exceed Rs5 million (Dh60,214).

As a non-resident Indian (NRI), if the Indian Income Tax (I-T) Department has sent you an advisory to confirm high-value transactions in 2022-23, or for non¬-filing of ITRs, this indicates the level of data the Indian government has of NRIs.

The level of data the Indian government has of NRIs includes details of NRI bank accounts like FCNR, NRO, NRE, FDs at these accounts, dividend income, capital gains etc., and people receiving such emails from the IT department are required to respond and confirm or deny the transaction.

An NRE (Non-Resident External) account is a bank account opened in India in the name of an NRI, to park his foreign earnings. But an NRE account is valid only if he or she is still residing abroad. On the other hand, an NRI can also make use of an NRO (Non-Resident Ordinary) account, which is a bank account opened in India in the name of an NRI, to manage the income earned by him or her in India.

Why else are such notices being sent?

Multiple FCNR deposits may be made during a particular year alongside other NRE or NRO deposits, which makes it difficult to segregate between them and match precise amounts that have been reported to CBDT by the reporting banks.

Also, these tax notices may also come as a result of depositing funds out of savings from earnings outside of India, or even conducting high-value property purchases in India. However, if the funds are identified and are out of earnings not chargeable to tax, the provided reason can be justified.

Furthermore, when filing your ITR, making duplicate entries in Form 26, investing under a joint account, not converting bank accounts into non-resident accounts, getting income in the form of taxable dividends, could be additional instances to get such tax notices.

Next steps after getting such notices?

For example, banks may deduct tax at 10 per cent, assuming these account holders are Indian residents, but the deduction for an NRI is supposed to be 20 per cent. This can lead to a situation where ITR needs to be filed as dividends do not have minimum exemption limit.

Receiving such tax notices could also result in having to possibly file a detailed ‘reassessment’ later on, if the IT department has reasons to believe so. For NRIs having no source of income in India, the remedy is to file an online response on the IT portal.

The portal, however, only offers drop down options affirming select information and does not provide any space to write explanations. NRIs required to confirm the deposits placed with different banks.

This ‘reassessment’ is done by including the income which has escaped his or her earlier assessment. However, this may also be the first tax assessment where the NRI has not filed the tax return at all before, in which case it will technically be referred to as ‘assessment’.

How tax ‘reassessment’ notices are phrased

NRIs who receive notices under ‘Section 148, Section 148A’ sections of Income Tax norms, here’s what is mentioned verbatim in both cases:

1. “In this case, the undersigned has certain information in his possession which is available in ITBA system (Income Tax Business Application software available for Income Tax Authorities) and also on Insight Portal. The said information has been identified and flagged by the Directorate of Income Tax (Systems), CBDT in accordance with the risk management strategy formulated by the Board as per the provisions clause (i) of Explanation 1 to Section 148 of the Income Tax Act, 1961.”

2. “In view of the above facts and circumstances, I consider it is a fit case to issue notice u/s 148 of the Act as income has escaped assessment. Hence notice under Section 148 of the Income-tax Act, 1961 is being issued in the case of the assessee for A.Y. along with this order u/s 148A(d) the Income-tax Act, 1961 with due approval of the competent authority as per the provisions u/s 149(1)(a) and 151(i) of the Income-tax Act, 1961.”

On the other hand, Section 148 of the Income Tax Act, 1961, enables the Indian Income Tax Department to issue a notice for reassessment if they believe that the income of the taxpayer has escaped assessment or has been ‘under-assessed’, i.e. the assessment of a tax at a lower value than the correct one.

Key takeaways: If you’re an NRI who got such tax notices, what to know, what to do

If you are an NRI who has received a notice, here's what you need to know regarding what the notice contains, and what your next steps should be:

• When the notice is received, the tax department lists the details of the transactions. For example, the time of deposits, purchase or sale of property, mutual funds, FCNR (Foreign Currency Non-Resident Account) deposit etc.

• Sometimes the amount shown in the table is repeated twice or clients are not able to find the details as the actual amount and reported amount is completely different. In such cases, it is extremely important for a person receiving the notice to take a proper guidance from tax experts before proceeding with any income tax-related submission.

• Reason for the notice: The notice will specify the reason for the notice. This could be due to the Income Tax Department's belief that there has been an under-assessment or absence of income in the previous assessment year.

• Time limit to respond: The notice will provide a time limit within which you need to respond. For instance, the time limit for responding to a tax ‘reassessment’ notice issued under Section 148A is 60 days from the date of receipt of the notice, and for a notice issued under Section 148, the time limit is 30 days from the date of receipt of the notice. While there is no uniform time limit for such a notice as it is more of an intimation, each notice will specify a time limit unique to your tax filing.

• Response to the notice: You can respond to the notice in various ways, such as filing a return of income, furnishing the required information, or filing a written submission challenging the notice. It is advisable to consult a tax expert before responding to the notice to ensure compliance with the relevant provisions of the Income Tax Act, 1961.

• Appeal against the assessment: If you are not satisfied with the assessment made by the Income Tax Department, you can file an appeal with the Commissioner of Income Tax (Appeals) within 30 days of the receipt of the assessment order.

• Consequences of non-response: If you do not respond to the notice within the stipulated time limit, the Income Tax Department can initiate proceedings under Section 144 of the Income Tax Act, 1961, which allows the government tax department to make an assessment to the best of its judgment, based on the available information, and pass an adverse order, after which NRIs will have to go through a painful process of appeal.

Bottom line?

In conclusion, receiving a tax notice can be a daunting experience for any NRI. But it is essential to understand the reason for the notice and respond within the stipulated time limit, either by filing a return of income, furnishing the required information, or filing a written submission challenging the notice.