DUBAI: A Pakistani housewife is facing divorce as her husband of 16 months has refused to share her financial burden.

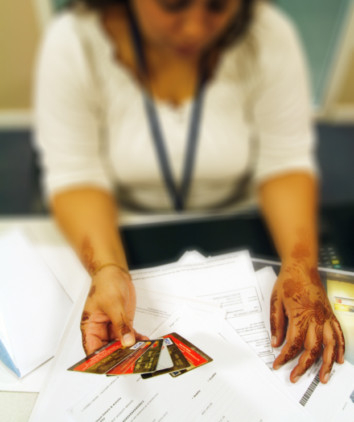

Salma Ali, 25, sits on nearly a half-million-dirham debt — Dh450,000 in personal loans from three banks and Dh30,000 in outstanding credit card bills. There are several cases against her and the loan recovery agents are hunting for her.

If she doesn’t clear her dues by October, she could land in jail. She is jobless and her residence visa has expired. If that was not bad enough, her husband Nawaz Ali has also given her a month’s deadline to find a way out of the debt trap.

rocky relationship

“I had given her an ultimatum to clear all her debts by October. Otherwise I will leave her,” Ali told XPRESS.

“I was new to Dubai when I married her in April last year. I was aware of her loans at the time of the wedding, but had no idea about the UAE legal system. I was always told that her parents would help her out and hence I agreed to marry her. But they are not in a position to help her. My job fetches me a salary of Dh14,000 and I cannot help her either. What do we do? I am fed up with living in fear that she might end up in jail someday.”

Nawaz said he has been postponing his travel plans to meet his ageing parents in Pakistan because of Salma’s financial and legal constraints. “Her problems have taken a toll on my health too. I am fighting Type 1 diabetes. I regret marrying her,” Ali added.

Failed business

Salma said she took personal loans to help her family set up a business in Dubai. “My father owned a driving institute but had to shut it down in 2008. He then tried to launch a car-rental company, which failed after a customer incurred huge fines and ran away. The money I borrowed was to resurrect my father’s business. But today, I stand alone in my financial burden as my family is not in any position to help me.”

She has five brothers and a sister who live with her parents in Dubai. “My elder brother earns around Dh6,000 and takes care of them.”

Salma took the loans on the back of her Dh14,000 per month job with an international events management company in Dubai. But when she was terminated last September because of her declining performance, the banks filed a slew of cases against her. “I wish I were prudent with my finances,” she said, fighting back tears. Salma’s mounting misery has left her begging for help from people.

“I find myself going in circles with my problems. I need a legal consultant to show me the way out. But they ask me to pay them Dh20,000 for just taking up my case. Where am I supposed to get this amount from? All my current cases lead to a jail term.”

Salma, who has lived in Dubai since she was 10 years old, said she’s losing hope. “I am scared of being deported to Pakistan as I have no family there.”

In all her financial woes, Salma has ignored her health. “I have thyroid, polycystic ovarian syndrome (PCOS) and a pending varicose vein operation on my leg.”

Unable to afford to pay for the procedure, she had been putting it off. “I ask God why I have been put through so much misery in this life.”

bitter lesson

But in her despair, Salma is urging people to learn from her experience and not to fall for the lure of easy money.

“Youngsters should apply caution before taking a loan. Money is precious and people should learn to make good use of it. Bank loan agents always tell you the benefits of a loan or a card. It is up to you to take it after careful consideration,” Salma said.

She also warned youngsters not to fall for peer pressure. “If someone has an iPhone, they have to get it too. Little do they realise the consequences of unwarranted spending at such a young age.”

Only time will tell if Salma will get a chance to undo her folly and live a normal life like most other 25-year olds.

(Names have been changed to protect identity)

Box

No loans, no debts

Consolidate your finances and restructure your loan. Some banks offer zero-interest loans for six months to one year. Take advantage of low-interest loans

Don’t ignore your bank. Some banks give discounts on loans

If a bank files a police complaint over non-payment of loans, sort it out immediately

Sell your property or belongings so that you can offer your lender an advance payment. Then pay the rest in instalments

The interest rate on credit cards top 36 per cent per annum. Get a low-interest personal loan to pay off card balances

Don’t let banks intimidate you

Seek help from family/friends (From http://m.gulfnews.com/business/banking/how-to-get-out-of-debt-1.673266)