Dubai: A replacement car, higher damage protection as well as upper and lower limits to premiums are some of the key amendments made to the unified auto insurance regulations that have come into effect across the country from January 1.

Instead of the replacement car, which was earlier optional during the duration of accident repair, the consumer will also have an option of demanding a compensation of Dh300 per day for 10 days.

The amendments will also include no additional levy of ambulance or medical evacuation fee, which was introduced in early 2016.

However, all these additional benefits will also mean higher premiums.

We ask industry experts if the amendments will actually translate into more value for money and better quality of service.

Experts in the sector have welcomed the amendments that also specify that the motor insurance shall now be in two parts — one for third party (civil liabilities arising from use of the insured vehicle) and the other for own damage to the insured vehicle.

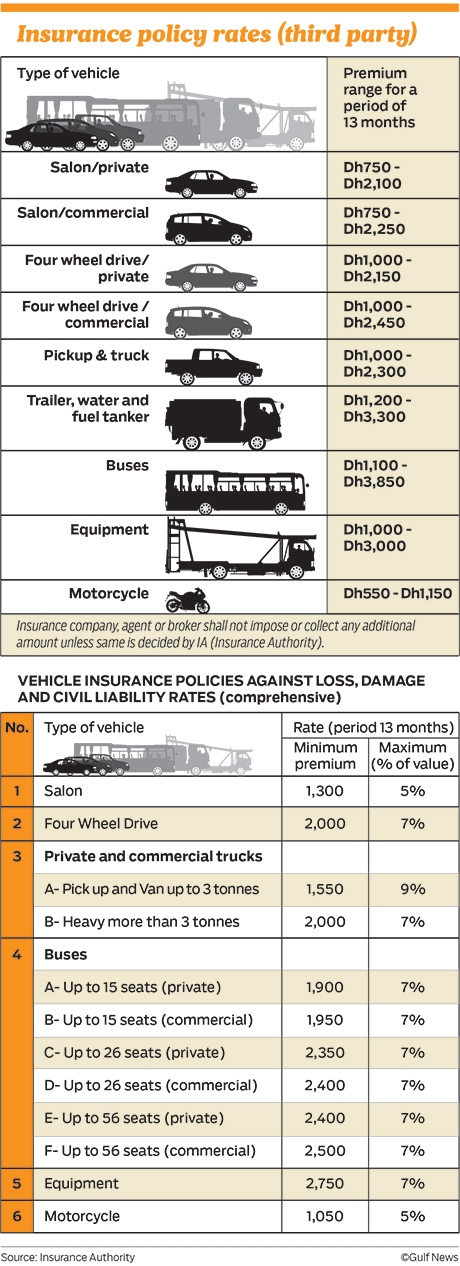

“The Insurance Authority (IA) has now put forward a minimum and maximum premium tariff for third party vehicles in various categories. This is a positive step and, personally, I welcome this. For a very long time, because of irresponsible competition, motor premiums have plummeted to very low levels, resulting in various insurance companies losing money. The intervention of the IA is a welcome step in streamlining this sector,” said Mustafa Vazayil, managing director of Gargash Insurance Services.

According to Sanjay Kalia, CEO of Dana Insurance Brokers, a vehicle is written off if the cost of repair is more than 50 per cent of the insured value of the vehicle.

The amendments will also see an increase in the amount of compensation per accident for material damage from Dh250,000 to Dh2 million.

Interestingly, the law also mandates insurance firms to have vehicles less than a year old repaired at the workshops of authorised dealers.

However, no rules guarantee quality of repair for older vehicles and consumers don’t have the right to choose a workshop of their liking, which is a norm in many Western countries.

“I see that some significant improvements have been made to the insurance policy structure but there is no guarantee that this will translate into better quality service. The law needs to standardise repair practices and ensure quality control, which is missing in the workshops here,” said Gordon Ferguson, general manager of AAA Garage, a leading auto workshop in Dubai.

He called on the authorities to set up an insurance ombudsman in the country, while also making it mandatory on the industry to employ qualified professional assessors and technicians.

Vazayil also agreed that though the higher premiums are likely to improve the insurer’s profitability, it will not necessarily result in improved quality of service.

“The quality of service will still be dependent on the professional management of the insurance company concerned,” said Vazayil, highlighting a need to have an institutionalised grievance redressal system.

“It is important that a grievances redressal system is institutionalised and made formal, preferably through insurance ombudsmen based in each of the emirates, with more centres in larger emirates which have bigger populations,” he added.

Sanjay Kalia also agreed that having an ombudsman will improve quality control, but he added that the amendments to the unified insurance regulations are a step in the right direction.

“I don’t think the quality of repair work is poor in most workshops. I agree that insurance firms are cost-conscious and do mostly opt for the cheapest quotations for repair jobs, but the law mandates that the damaged vehicles should be repaired to the same conditions that they were before the accident. Also, the competition in the market ensures that the job done is up to a minimum standard,” said Kalia, who has been in the insurance industry for more than 30 years.

Kalia added that the new regulations ensure better protection, wider coverage, more transparency and a fixed budget.

“With the new rules, people will have more bases covered like a replacement car, ambulance fee, etc. But, most importantly, they will know in advance what they will pay next year for the insurance and what they will get in return, so there is more transparency and more certainty in the budget,” said Kalia.

However, one key aspect missing from the regulations is the coverage against damage from natural calamities, though there is coverage for loss and any other form of damage.

Factors not included in the new rules:

Choice of garage

Repair guarantee

Calamity coverage

Factors included in the new rules

Premium limits

Replacement car or compensation

Ambulance and medical evacuation

Insured value of vehicle

Is decided on the 15% annual depreciation of the vehicle’s market rate.

According to the new rules, 20% of the insured value will be deducted if the vehicle is written off.