TOKYO

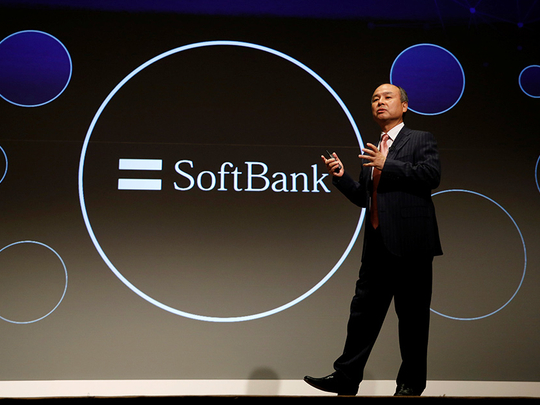

SoftBank Group Corp’s CEO Masayoshi Son said on Wednesday the Japanese firm should benefit from President Donald Trump’s promised deregulation of the American economy and that he is keeping his options open about US telecoms unit Sprint.

SoftBank, a telecommunications and technology behemoth that holds a 29.9 per cent stake in Chinese e-commerce giant Alibaba, was among the first major foreign corporations to promise US investments and jobs after the November presidential election.

Billionaire Son pledged a $50 billion investment and 50,000 new jobs in the United States after meeting Trump in early December.

“President Trump has promised to ease various regulations and that should make it easier to do business,” Son said at a press briefing in Tokyo following the release of SoftBank’s quarterly results.

Son didn’t specify what deregulation promised by Trump would benefit his company.

His investment pledge in December had revived speculation that telecoms firm Sprint, 83 per cent owned by SoftBank, might rekindle merger talks with T-Mobile US Inc that had died under pressure from US regulators.

Asked at Wednesday’s briefing about a renewed merger bid with T-mobile, Son said: “Three years ago, I was so eager to buy T-Mobile. But now, I have many options. Sprint can be profitable on its own. Keeping Sprint separate is also an option.” Some of Son’s $50 billion US investment commitment could come from a giant tech fund backed by Saudi Arabia that SoftBank announced in October. As the telecoms services markets mature, Son wants to transform SoftBank into a company with cutting-edge tech investments, or what he calls the “Berkshire Hathaway of the tech industry”.

SoftBank expects to invest over the next five years at least $25 billion in the $100 billion tech fund, which would be one of the world’s largest private equity investors and a potential kingpin in the technology industry.

“We are preparing to launch a fund that would be far larger than all venture capitals combined,” Son said on Wednesday, adding it will own 20 per cent to 40 per cent of the companies it invests as top shareholder. Son declined to give details about the fund’s operations because of a “quiet period” ahead of the launch.

Apple Inc has revealed plans to invest $1 billion in the fund. Foxconn of Taiwan, Oracle founder Larry Ellison’s family office and chipmaker Qualcomm

are said to be intending to invest in the fund.

Asked about Trump’s travel ban, Son said he wanted to refrain from making comments about “political matters”.

SoftBank’s October-December operating profit soared 71 per cent to 295.7 billion yen ($2.63 billion), beating a Thomson Reuters Starmine SmartEstimate of 246.30 billion yen.

SmartEstimates give greater weight to recent forecasts by top-rated analysts.

Sprint trimmed its quarterly loss as the No. 4 US wireless carrier added more subscribers than Wall Street expected.

This was the first full quarter since SoftBank completed a $32 billion acquisition of Britain’s most valuable technology company ARM, but SoftBank’s earnings are still highly dependent on Sprint and the performance of the domestic telecommunications business.