Over the years that I’ve been in the business, I’ve come across a lot of people who confuse a critical illness plan with a medical insurance policy. Yes, you are likely to be reminded now of that zealous insurance agent who tried shoving that critical illness plan down your throat when you opted for a life insurance plan. Like most of us, you brushed aside his visions of doom; reasoning that you are too young to worry about stuff like this. I mean, who worries about critical illness at 28, right? Wrong.

According to Cancer Research UK, one in three people are likely to develop cancer during their lifetime. Here’s another fact: It has been reported that smoking, stress, junk food and lack of exercise are creating heart-disease patients in the UAE 15 years earlier than in the West. The truth is that most of us have some sort of medical insurance, in most cases that cover has been provided to us by our employer, under the guidance of the Labour Law. But what happens if you’ve suffered a heart attack?

Here’s a likely scenario: In the event that you suffer a critical illness, the doctor advises you to take a break from work for three months, work half-days for the next three and you are also forbidden to drive. Your employers keep you on the company sponsorship and probably give you some income on a monthly basis, but how long do you think it will be before your boss is forced to cut you loose? After all, he’s got a business to look after.

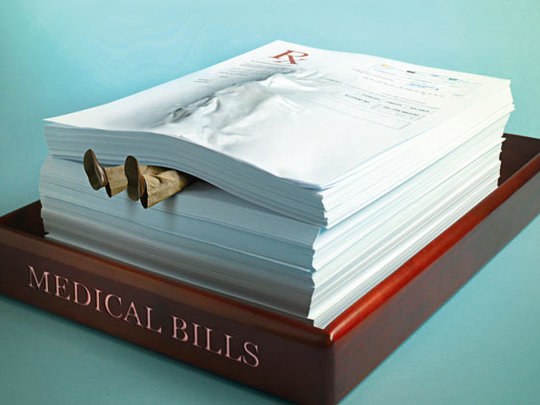

Bereft of a group medical cover, you’re now obliged to pay all your own bills. What could be worse? You have a mortgage to pay off. Are your kids still going to attend that expensive neighbourhood school where all their friends go? Will you still stay in the same place? Are you willing to let go of your life savings and more to deal with the potential loss of income?

Do you now need to constantly monitor your illness, which is now a ‘pre-existing condition’ to any new medical insurance provider? Your doctor needs you to relax and be stress-free during your time off work, but here you are, worried about mounting debts and expenses. And to think that none of this would have been a cause for worry if you had the right critical illness coverage in place.

Suddenly, the zealous insurance guy doesn’t seem so zealous anymore. Critical illness cover was originally sold with the intention of providing financial protection to individuals following the diagnosis or treatment of an illness deemed critical.

Critical illness cover may be purchased by individuals in conjunction with a life insurance or term assurance policy at the time of a residential purchase, known as a ‘bolt-on’ benefit. It can now even be purchased as a standalone contract. The finances received could be used to:

a) Pay for the costs of the care and treatment.

b) Pay for recuperation aids.

c) Replace any lost income due to a decreasing ability to earn and/or fund a change in lifestyle.

This insurance can provide financial protection to the policyholder or their dependents on the repayment of a mortgage if the policyholder contracts a critical illness condition or worse, dies. Some insurers may choose to structure the policy to repay a portion of the outstanding mortgage debt on the contracting of a critical illness, whilst the full outstanding mortgage debt would be repaid on the death of the policyholder.

Alternatively, the full sum assured may be paid on diagnosis of the critical illness, but then no further payment is made on death, effectively making the critical illness payment an ‘accelerated death payment’.

All this morbid talk may not necessarily be stuff you want to hear right now, but it is essential to know. If you haven’t done so already, talk to your advisor about critical illness cover now. If you already have some, consider reviewing it – buy what is affordable today based on your needs. Remember, it is impossible to buy critical illness cover once you’ve been diagnosed with a life-threatening illness, so always think ahead.