Dubai: A court has ruled that the global crunch doesn't qualify as an "unexpected circumstantial factor" that would allow a corporate entity to dodge a resettlement agreement. The court made the observation after a corporation tried to renege on a payment of Dh11 million to an investment company in a property deal.

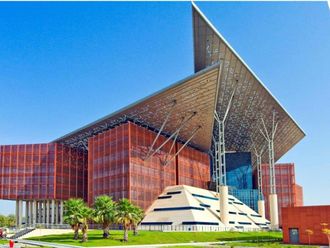

"The global financial crunch and its outcome across all countries is not deemed as a ‘general exceptional accident' that cannot be expected… crises should be constantly expected to hit any time and any country worldwide," said a judgment, by Dubai Civil Court, ordering the corporation to pay Dh11 million to the investment company as part of a resettlement agreement regarding a 21st floor flat in the Dubai Pearl Project.

Compensation sought

Representing the investment company, Dr Habib Al Mulla and Co Advocates and Legal Consultants lodged a civil lawsuit against the Jebel Ali Free Zone-based corporation asking it to honour outstanding payments of Dh11 million [as part of a mutually agreed resettlement agreement signed in September 2008] plus an additional Dh5 million in compensation for damages incurred.

Lawyer Gassan Daye, of Al Mulla Advocates, mentioned in the lawsuit: "The litigating parties agreed, as per the 2008 resettlement agreement, to finalise the sale and purchase deals between them concerning the 21st floor in Dubai Pearl Project. The defendant agreed to pay Dh25 million to the claimant. They paid Dh14 million in 2008 and the balance, which was due last year, remained unpaid. Despite our legal notice, the defendants did not commit to the agreement and settle the outstanding payment."

Prior to the judgment, the Civil Court assigned a financial expert to look into the case. The expert reported that the corporation had breached the resettlement agreement and recommended that it should pay Dh11 million. The court-assigned expert also reported that the investment company had failed to corroborate its Dh5 million worth of damage claims.

Meanwhile, the corporation lodged a counter-lawsuit with its lawyer arguing: "We ask for the annulment of the resettlement agreement and dismissal of the civil lawsuit. And/or we ask the court to reevaluate the outstanding payment to a convenient one, as per article 249 of the Civil Transactions Law, following the crash and downturn in real estate industry and the depreciation in the flat's value. Article 249 stipulates that a judge has the discretion to reevaluate inconvenient payments in case the market is hit by any unexpected general exceptional accident."

Presiding Judge Ziyad Mustafa Basheer said in his judgment: "Since the litigating parties inked the resettlement agreement, the court ruled out any general exceptional accident. And the jury doesn't consider the global crunch or its upshots as such. The court dismissed the counter-lawsuit and decides that the 2008 agreement still stands."

Presiding Judge Basheer ordered the corporation to pay Dh11 million plus five per cent legal interest. The primary judgment is still subject to appeal. Court records have shown that the resettlement agreement was signed between the litigating parties after the investment company bought the flat from the corporation and resold it to it.