Back to basics

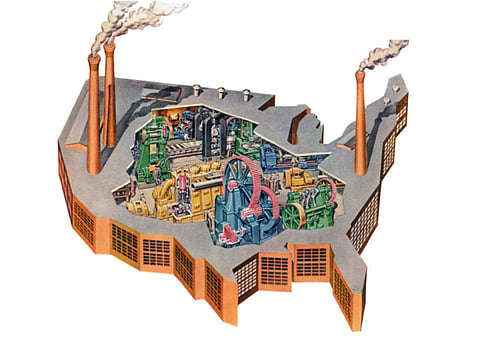

The outlook for US economic growth is optimistic, but also an oxymoron of sorts. GN Focus outlines the strengths and continuing uncertainties

There is no doubt that 2013 represents a milestone in the arc of the US’ economic growth. The first day of the year set the tone as the country veered itself away from the fiscal cliff of simultaneous increase in tax rates and decrease in government spending.

Only a few days later, US President Barack Obama took hold of the reins and appealed to the nation’s manufacturing industry to “bring jobs back”. “I’m calling on those businesses that haven’t brought jobs back to take this opportunity to get the American people back to work,” he said. “That’s how we’ll rebuild an economy where hard work pays off and responsibility is rewarded — and a nation where those values live on.”

Now, half way into the year, the US economy has continued to show great resilience despite the tax increases and spending cuts. Not surprisingly, positive predictions have begun showing up on the radar.

The International Monetary Fund and the Organisation for Economic Cooperation and Development both predicted a 2-3 per cent GDP growth for 2013. In the last week of May, Moody’s upgraded its outlook on the US banking system to stable — a far cry from the negative it had been saddled with since the 2008 financial crisis. The rating firm said it expected the US GDP growth to be in the 1.5-2.5 per cent range in 2013-14, as unemployment slipped downward toward 7 per cent (at the time of its report, it stood at 7.5 per cent).

Less than a month later, ratings agency Standard and Poor’s (S&P) upgraded its outlook for the US economy from negative to stable. S&P said the strengthening US economy and the dollar’s status as the world’s key reserve currency contributed to its decision to reverse 2011’s unprecedented downgrade. The rating agency, which assigned AA+ long-term and A-1+ short-term ratings, said in its report, “We believe that the US monetary authorities have both the strong ability and willingness to support sustainable economic growth, and to attenuate major economic or financial shocks.”

S&P also praised the Federal Reserve’s “timely and effective actions to lessen the impact of major shocks since the Great Recession”.

Moderate growth

Later last month, the Federal Open Market Committee (FOMC) held a two-day meeting and, based on its review of recent economic and financial developments, said it sees the American economy continuing to grow at a moderate pace, notwithstanding the strong headwinds created by current federal fiscal policies.

Facts presented by the FOMC — the principal organ of the US’ national monetary policy — are indicative of growth. The US labour market has continued to improve steadily, with gains in private payroll employment averaging 200,000 jobs per month over the past six months. Job gains, along with the strengthening housing market, have in turn contributed to increases in consumer confidence and supported household spending. The unemployment rate remains elevated at 7.6 per cent, as do rates of underemployment and long-term unemployment. Overall, the downside risks to the outlook for the economy and the labour market have diminished considerably since the fall.

Bernanke’s remarks about the Fed’s programme of quantitative easing (QE) reducing over this year — and probably ending in 2014 — were analysed widely. The fact that stocks fell and bond yields rose following his speech is evidence that international markets do not take his reassurances at face value. The markets also overreacted, as they are apt to do. But Bernanke draws attention to the challenges of a return to normalcy in existing financial conditions — because that is what the tapering of QE and the distant prospect of higher short-term interest rates represent.

The editors of Bloomberg commented on his speech and reactions thereof: “The danger is that the adjustment will be so abrupt that it causes collateral damage, or that asset prices might fluctuate wildly as the market finds equilibrium. It has long been argued that there would be less volatility if policymakers made their intentions clearer, but at the moment this doesn’t look so plausible.”

Christopher Matthews wrote in Time magazine: “One of the more conspicuous ironies of the stock market in recent years is that it tends to go down when the Federal Reserve is forecasting an improved economy. That’s because faster economic growth makes it more likely that the Fed will provide less stimulus, in the form of low interest rates, than it otherwise would.”

In its second quarterly report of 2013, the UCLA Anderson Forecast says “despite the US’ improvement in both GDP and key economic sectors, the overall growth falls short of the rates required for the national economy to truly recover from the most recent recession”.

The UCLA Anderson Forecast is one of the most cited economic outlooks for the nation and was credited as the first major US economic forecasting group to declare the recession of 2001.

Fundamental problems

Leamer says this tepid growth continues to obscure the nation’s most fundamental problems: too much government spending funded with too much borrowing, too little savings to cover late-in-life health-care issues, and too many workers lacking the skills to compete in the modern economy.

In effect, Leamer’s essay, Great Recovery: Wherefore Are Thou, describes the great paradox of the American economy: Growth in GDP is positive but not exceptional. Jobs are improving but not rapidly enough, and the jobs being created are not necessarily jobs that will ensure workers a secure future.

This oxymoron of an economy is also explained in Manufacturers Alliance for Productivity and Innovation’s (MAPI) quarterly economic forecast of June. “The good news is that the US has enjoyed more than three years of uninterrupted economic growth and falling unemployment since the recession ended. The bad news is that this has been the weakest rebound since Second World War. Economic growth has averaged less than 2.25 per cent since the recovery began and is estimated to have slowed to less than 1 per cent in the most recent quarter. Unemployment is still way above where it should be at this point.”

MAPI has raised its employment growth outlook for 2014 though — from 289,000 to 352,000 additional manufacturing positions. Chief Economist Daniel Meckstroth explains, “Consumer deleveraging is close to an end and households have the capacity to use more credit; housing prices are rising and with that change comes a virtuous cycle of increasing wealth, consumption and income that feeds back into more housing activity; pent-up demand is releasing postponed spending for consumer durable goods; and the job market is repairing itself.”

The US economy continues to battle headwinds that do not show any signs of abating anytime soon, including a fast ageing population, meaningless government austerity, rampant income inequality, and almost five million long-term unemployed workers. More market volatility is expected when the Federal Reserve policymakers meet next. But despite the small notes of concern, the overall outlook is overwhelmingly positive.

The nonpartisan Congressional Budget Office sees a relatively fast growth of 3.4 per cent next year, and 3.6 per cent between 2015 and 2018. But the best summary of the situation was encapsulated in a recent opinion piece by Nelson D. Shcwartz in the New York Times. The title of the essay simply said: Even pessimists feel optimistic about the American economy.