Rasheda Sultana from Bangladesh's Grameenphone thinks that mobile remittances change lives. Presenting her case at the Mobile Financial Services (MFS) Asia Pacific Summit last year, she offered the example of the unbanked who are armed with mobile phones in Kenya, South Africa, India, the Philippines, Mali, Pakistan and of course, Bangladesh.

With financial inclusion being a buzzword, cell phones are the new tools for empowerment. The World Bank's Consultative Group to Assist the Poor estimated in its Financial Access 2010 report that about half the households in the world have no access to a bank account — 2.5 billion people in the developing world are considered financially excluded — while worldwide mobile payment users were said to have surpassed 141.1 million in 2011, a 38.2 per cent increase over 2010. Referring to emerging markets in the Middle East, Asia and Africa, Sultana says in her presentation, "MFS has been around for the last couple of years. The performance so far has not been able to meet expectations."

Banks lead the way

The UAE is home to expats from all these countries who are awaiting developments in this space. At the moment consumers can only remit money to people in other countries by routing this payment through a bank — either by internet transfers or by SMS payments on platforms created by partnerships between banks and money transfer companies.

Although such companies account for a significant chunk of remittance business, a lack of regulations currently prevents them from implementing proprietary programmes.

"We are preparing ourselves with technology and vendors so if ground rules are made, we will be there. So far, it is only happening inland and not cross-border. But we believe that it is the logical next step, since the technology is developing fast," says Gopal Sharma, CEO, Sharaf Exchange.

Exchanges such as Western Union already have money transfer pilots in place. "Currently, consumers in the US, the UK, the UAE, Hong Kong, Singapore and Canada who want to send a mobile money transfer can visit participating Western Union Agent locations and send cash to subscribers of both Globe Telecom/G-Cash and Smart Communications/Smart Money in the Philippines. The beneficiary will receive the remittance in the equivalent peso amount on his/her Globe or Smart mobile phone," Western Union says on its website. The Philippines has also been proclaimed one of the leaders in mobile banking with its Smart Money and GCash initiatives. Their non-bank-based/telco model allows person-to-person transfers, purchase of goods from merchants and bill payment.

UAE Exchange has two services for the Philippines: MasterCard MoneySend and payMAX.

The prepaid partnership

The UAE has already paved the way. The recent launch of the Wage Protection System (WPS) triggered a wave of prepaid cards that provide a perfect partner for mobile money, Charmaine Oak, Practice Lead, Digital Money, at the business consultancy Shift Thought, writes in a 2011 paper on the subject.

"Mobile payments are promoted by government initiatives such as identity cards and mPay. With key segments, expatriates and youth set to benefit from new services, expect to see MFS take off in the UAE," adds Oak.

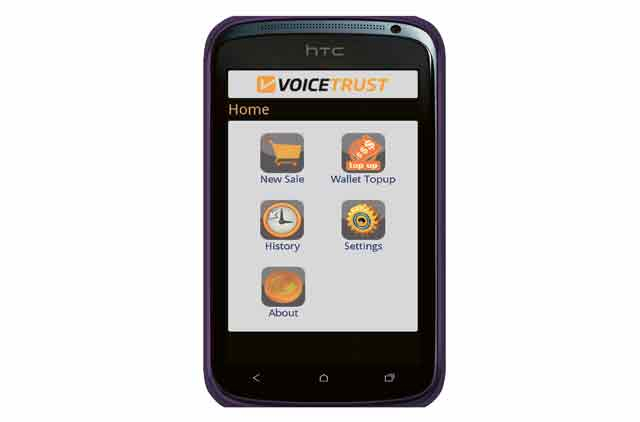

One such product is by VoiceTrust, a global provider of digital payments and voice biometric solutions. "The VoiceTrust m-wallet platform supports financial inclusion in all markets, but especially emerging markets. Earlier this year we launched the VoiceTrust prepaid payroll card, compliant to the WPS. Every month employees will receive their salary on their card," CEO Dr Tariq Habib tells GN Focus.

By the fourth quarter of this year, he says UAE customers should be able to remit funds across borders.

"We are adding the option to cash in the funds to the m-wallet and then remit cross-border. Our role will be that of a platform provider, without holding customers' funds," Dr Habib says.

The technology is already being used in many countries but its wider adoption is limited by the lack of appropriate regulations. Sultana describes this as the lack of proper customisation of the MFS development framework at national or international levels.

Oak says much remains to be done. She offers the example of the payMAX payroll card from Lari Exchange, which allows for the receipt of wages as well as money transfer, according to its website. "Prepaid cards found a perfect partner in mobiles. It becomes possible to properly track the money on your card, making it a mini bank account on your phone. Leading issuers include Emirates NBD, Standard Chartered Bank, Mashreq Bank and National Bank of Abu Dhabi," she says in her paper.

NBAD has won awards for its Arrow service. Enabled by software company Luup, the product allows users to remit money internationally via a text message thanks to a partnership with the transfer provider MoneyGram.

M-wallets are the future

The m-wallet space is set to get really rich. Like others of their type, mobile wallets are as rich as their content. Abu Dhabi Commercial Bank has teamed with Mobibucks, a US-based mobile payments solutions company, to offer Mobi, a product allowing consumers to create a virtual account online, using their mobile number and a secret pin that can be later used to make purchases at participating outlets.

Unfortunately, these outlets are not yet as ubiquitous as those accepting credit cards. In the mobile payment world the more friends you have the better it may be — something companies are striving for before they launch.

Dr Habib says: "We have enriched the VoiceTrust m-wallet platform by building merchant partnerships in the retail and FMCG sectors. Our product development has an innovative roadmap and we have added support for bump, QR and USSD technologies. This means our m-wallet can work in all user scenarios including online and physical point-of-sale."

Money on the go

Internationally, the latest technology lets you transfer money just by bumping two handsets together. For instance, ANZ is promoting its Go Money product where your phone contacts receive money you send them via a website.

Barclays' money transfer app, Pingit, works with current accounts at every bank and building society in the UK. The free service was launched in February, but was initially available only to Barclays customers. Now it is available to everyone over the age of 16 with a UK current account or mobile phone number.

The lack of specific regulations has prompted non-banking companies to work within rules applying to cash transactions.

— S.S.