Seasoned travellers say it is easier to pay a taxi cab by mobile phone in Nairobi than in New York. Why? Because Kenya, with its massive population without access to banking services, is the poster child of mobile money services.

In 2007, the world changed when M-Pesa was introduced, where financial transactions just needed two mobile phones with the app to be completed. The system became an overwhelming success, with around 17 million users today, ushering in a brand-new entrepreneurial culture.

M-Pesa has triggered numerous mobile payments systems all over Africa, the Middle East and Asia. According to EY (formerly Ernst & Young), 590 million mobile phone owners globally are already using their phones to bank. The number is expected to top one billion by 2017.

“The trend is most notable in the developing world, where millions of people who lack bank accounts use their mobile phones as electronic wallets,” says Steven Lewis, Lead Analyst, Global Banking & Capital Markets, EY.

Big money

A report released last month by Juniper Research, a UK-based business intelligence firm, has found that the value of global payments via mobile devices will reach nearly $507 billion (about Dh1.8 trillion) this year, a 40 per cent year-on-year rise. The Middle East’s market share is said to be around $30 billion, according to market researcher Gartner.

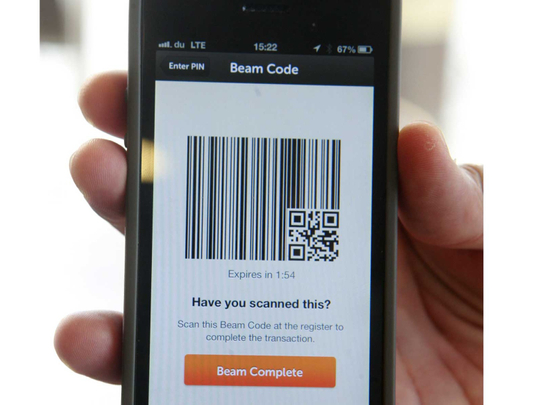

In the UAE, mobile money has quickly caught up with major telecom providers and banks, as well as the Dubai government with its mPay system. Both Etisalat and du have mobile payment solutions in their portfolio — the former launched a mobile money solution, Flous, first with its Egypt subsidiary last year with MasterCard, as well as in Togo, planning to expand it to all its markets.

Meanwhile, Abu Dhabi’s First Gulf Bank entered a partnership with UK-based mobile money firm Monitise this month to offer mobile banking services across the Middle East. The bank says it will increase the variety of mobile money services and build a mobile ecosystem for banking services.

“We are looking forward to delivering best-in-class easy-to-use services to the Middle East’s consumers,” says Fatih Isbecer, CEO, Monitise UAE.

Other mobile payment solutions in the UAE are the Mobi system for low-value purchases, introduced by the Abu Dhabi Commercial Bank and US firm Mobibucks, and the SMS-based payment service by National Bank of Abu Dhabi. T-Pay was introduced by Egyptian IT company Arpu Plus earlier this year in the UAE, Saudi Arabia and Egypt.

Good prospects

Experts see good prospects for mobile money solutions across the GCC with its large expat worker population.

“Expatriates constitute the majority of the population, and for them, mobile money has proved useful both in terms of payment receipts and sending money home,” said Charmaine Oak, Digital Money Analyst for UK-based consultancy Shift Thought, at last year’s Mobile Money Global Conference and Expo in Dubai.

Qatar seems to have taken the lead in introducing mobile money services with a focus on remittances for the huge numbers of expats in the country. Both mobile phone operators, Vodafone Qatar and Ooredoo, are offering these banking options.

Furthermore, Ooredoo announced its commitment to the GSMA Mobile Money Interoperability Programme earlier this month to accelerate the implementation of interoperable mobile money services across Africa and the Middle East. Bharti Airtel, Millicom, MTN Group, Orange, STC Group, Vodafone Group, Zain Group and Etisalat, representing 582 million mobile subscribers across 48 countries, are a part of it as well.