Slumping oil prices may have taken a bit of the sheen off the UAE’s economic performance this year but the outlook remains positive in the medium term, according to analysts and economists.

The country’s vast foreign assets, its relatively diverse economy compared with other Gulf states and the government’s timely fiscal belt-tightening will buffer the economy as it adjusts to lower oil prices, while in the medium term higher government spending and the finalisation of Iran’s nuclear deal will boost economic activity.

“We expect real GDP growth to have been about 3.1 per cent in 2015 and near that level in 2016,” says Steven Hess, Senior Vice-President at Moody’s Investors Service. “This is not as high as in 2013 and 2014, but still a reasonable rate of growth on a global scale.”

Shifting priorities

The economy of the UAE grew at a rate of 4.6 per cent in 2014, according to the IMF.

Oil traded at about $42 (Dh154) a barrel in November, down from $106 in June 2014. The country’s oil and gas sector contributed 34.3 per cent of GDP at current prices in 2014, according to the National Bureau of Statistics. As a result of lower oil prices, the UAE will run a fiscal budget deficit this year for the first time since 2009, the IMF predicts. The country, which is the third-largest OPEC producer, has taken a number of steps to offset falling oil prices. First, the government has said it plans to increase volume of production.

“The oil sector will have a positive effect on real GDP growth in the coming few years,” explains Hess.

However, change is expected. “Next year will see improvement in prices,” Matar Al Nyadi, Undersecretary of the UAE’s Energy Ministry, told an industry conference in Bahrain last month. “In 2016 we could witness some correction in the market.”

The government also announced in July it was removing fuel and electricity subsidies. These have cost UAE state-owned energy firms about $1 billion per year over the past 10 years, Energy Minister Suhail Al Mazrouei said in February.

The government has also indicated it is preparing legislation to introduce a federal value-added tax (VAT) and a corporate tax.

As well as cutting subsidies and introducing plans for VAT, the government has also scaled back on public spending, which grew at a rate of 15 per cent per year on average from 2005 to 2014, according to a recent Institute of International Finance report.

“This is forecast to drop to a rate of 3 per cent in 2015 and 2016, following recent measures to reduce subsidies on electricity and water and to prioritise investment projects,” the report said.

Oil accounted for about 65 per cent of government revenues in 2014 and for about 30 per cent of total goods exported. The government plans to reduce reliance on oil by up to 10 per cent in the next 15 to 20 years, the UAE’s Minister of Economy Sultan Bin Saeed Al Mansouri said in October when he delivered the annual budget.

“These ratios are the lowest among GCC countries and bode well for the country’s diversification agenda,” says Dima Jardaneh, Senior Economist at investment bank EFG-Hermes. “The UAE [has] a higher degree of fiscal flexibility to respond to lower oil revenues.”

However, she adds that the UAE “needs to move up the value chain” in terms of the quality of the goods it exports and must continue to expand the services it offers international markets in order to deepen the underpinnings of diversification.

“Nonetheless, it is undoubtedly the frontrunner among its neighbours,” Jardaneh says.

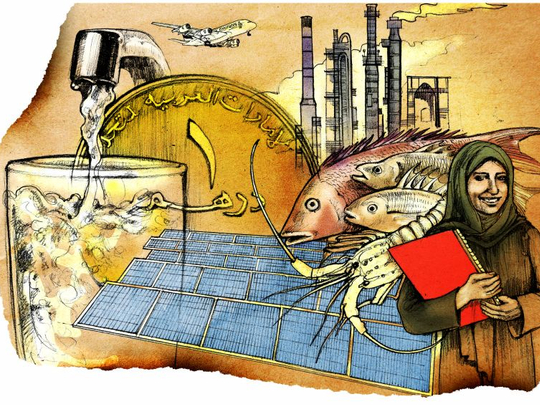

Diversification

While Abu Dhabi remains mainly dependent on oil and the resource is still the most important source of exports and government revenues, the UAE as a whole has a burgeoning services sector that includes tourism, financial services, real estate and logistics, and which accounts for more than half of GDP.

Dubai’s economy is expected to get a lift from hosting the World Expo in 2020. The emirate in 2013 also announced its intention to double visitors to 20 million per year by 2020 as it triples revenues generated by tourism.

“Construction activity related to Expo 2020 and tourism should provide a boost to economic growth, particularly in Dubai,” explains Hess.

“Government spending on infrastructure and the construction of new hotels are likely to cause an acceleration of economic growth in the later years of this decade.”

Iran impact

With its economic and political stability, the UAE has benefited from its safe-haven status over the past few years and increased private capital inflows from the Middle East and North Africa.

Trade and investment may also be spurred by the lifting of sanctions on Iran.

“These benefits could begin as early as the first half of 2016, conditional on the International Atomic Energy Agency verifying that Iran has shrunk its nuclear programme, is cooperating with regard to past weaponisation studies, and facilitating access to nuclear sites,” Trevor Cullinan of Standard and Poor’s wrote in a recent research note.

The UAE non-oil export trade with Iran was worth $11.5 billion in 2014, according to the National Bureau of Statistics. However, UAE-Iran non-oil export trade dropped to 11 per cent of all non-oil export trade in 2014 from 16 per cent in 2011 due to sanctions.

“We expect this ratio to significantly increase by the end of 2016,” Alp Eke, director and senior economist in the Economic Department at the National Bank of Abu Dhabi recently told Gulf News.

Eke also expects Iranians to tap into other sectors, including the property market. In Dubai, Iranians currently own about 2.6 per cent of the real estate market in terms of value, according to the Real Estate Regulatory Authority. This is expected to jump.

“Iran is estimated to have around $100 billion in net foreign assets, more than half [of which] are frozen,” Eke says. “As Iran gradually acquires assets, it will look for investment opportunities in the region. The UAE stock exchange, real estate market and bilateral trade will most definitely benefit significantly.”

The big picture

The UAE government approved a federal budget of Dh48.56 billion for 2016, down from Dh49.1 billion this year. Though the federal budget accounts for only 14 per cent of fiscal spending, this is the first federal cut after seven years of increases. The IMF predicts Saudi Arabia will have a budget deficit of 21.6 per cent of GDP in 2015 and the Kingdom has sought advice on how to make spending cuts, with a deficit of 19.4 per cent expected next year.

Elsewhere in the Gulf, Saudi Arabia’s budget surplus peaked at 12 per cent in 2012. Kuwait has posted a surplus for 16 years, hitting 34.7 per cent in 2012. Its parliament approved a budget of 19.17 billion dinars (Dh238 billion) this year, including a 7-billion dinar deficit.