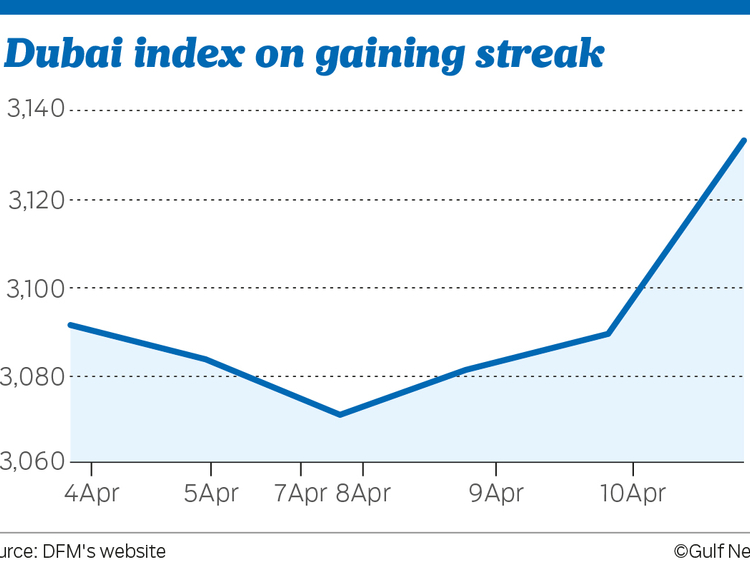

Dubai: Dubai index rose Wednesday, extending gains for a third session on continued bargain buying even as the Abu Dhabi index witnessed profit-taking after gains, which was triggered by a boost in banking shares.

The Dubai Financial Market General Index closed 1.4 per cent higher to 3,132.97, after gaining 0.5 per cent in the previous two sessions.

Emaar Properties closed more than 4 per cent higher to Dh5.93. Dubai Islamic Bank closed at Dh5.50, up 0.36 per cent while Gulf Finance House closed 0.75 per cent higher to Dh1.34. DP World closed 0.48 per cent lower to $22.89 and Dubai Investments closed at Dh2.11, up 1.93 per cent. Total traded value stood at Dh210 million.

The Abu Dhabi Securities Exchange general index closed 0.47 per cent lower to 4,689.74 despite gains in banking stocks. Abu Dhabi Commercial Bank closed 2.74 per cent higher to Dh7.12, while Union National Bank closed 2.43 per cent higher to Dh3.80.

“Abu Dhabi banks are still showing great resilience and heading upwards as all market data indicates a strong performance for the sector despite the short term implications of Basel3 and IFRS 9,” Menacorp said in a note.

First Abu Dhabi Bank closed 0.79 per cent lower to Dh12.55 while etisalat closed 0.3 per cent lower to Dh17.30.

Elsewhere in the Gulf, Saudi Arabia’s Tadawul index closed 1.87 per cent lower to 7,802.74. Dar Al Arkan Real Estate Development Co closed 0.08 per cent lower to 12.82 Saudi riyals, while Alinma Bank closed 4.29 per cent lower to 20.52 riyals. Saudi Kayan Petrochemical Co closed 4.27 per cent lower to 13.66 riyals.

In other markets, Qatar exchange index closed over the keenly watched 9,000 mark. The index closed 0.09 per cent higher to 9,015.15. Meanwhile the Kuwait Stock Exchange index closed at 6,633.44, up 0.45 per cent. The Egyptian Exchange EGX 30 Price Index closed 1.39 per cent higher to 17,943.96 while the Bahrain all share index closed 0.07 per cent higher to 1,288.82.

Looking ahead

Egyptian markets, which gained 18 per cent in the first quarter, look strong amid decreasing political risks and a revival in tourism among other factors. “Given the strong pipeline of opportunities we have identified in Egypt over the last 18 months, we have been building a sizeable overweight on this country over time. Given the strong performance of Egypt in the first quarter, a large part of our alpha came from this market,” Al Mal Capital said in a note. Egyptian equities have gained 19.47 per cent so far in the year.