Highlights

The cloud accounting software tops competitors in terms of depth, capabilities and customisation

We are not sure if you are familiar with Zoho Books, but if you are running a business in the UAE, you definitely should be. The cloud-accounting platform assembles the lion's share of financial tools needed by businesses, especially after the introduction of VAT. For a basic package starting at just Dh29 per month, Zoho Books offers automated workflows, bank reconciliation, custom VAT-compliant invoices, expense tracking and recurring transactions. Its usability, flexibility, superior depth in bookkeeping, support options and an excellent mobile version, make it the right choice for small businesses in the UAE.

VATever it takes

Apart from the software itself, we were impressed by the extent to which Zoho has gone to help UAE-based businesses understand and adjust for VAT. There is an entire section online on Zoho.ae dedicated to explaining the nuts and bolts of VAT, how it affects supply, reverse charges and excise tax, its impact on free zone companies and real estate, along with guides to smoothen the transition to the VAT system. Zoho has also put up VAT FAQs, infographics, webinars and YouTube videos. Moreover, you can test the VAT features of Zoho Books by signing up for a fully functional, 14-day trial that does not ask for your credit card details.

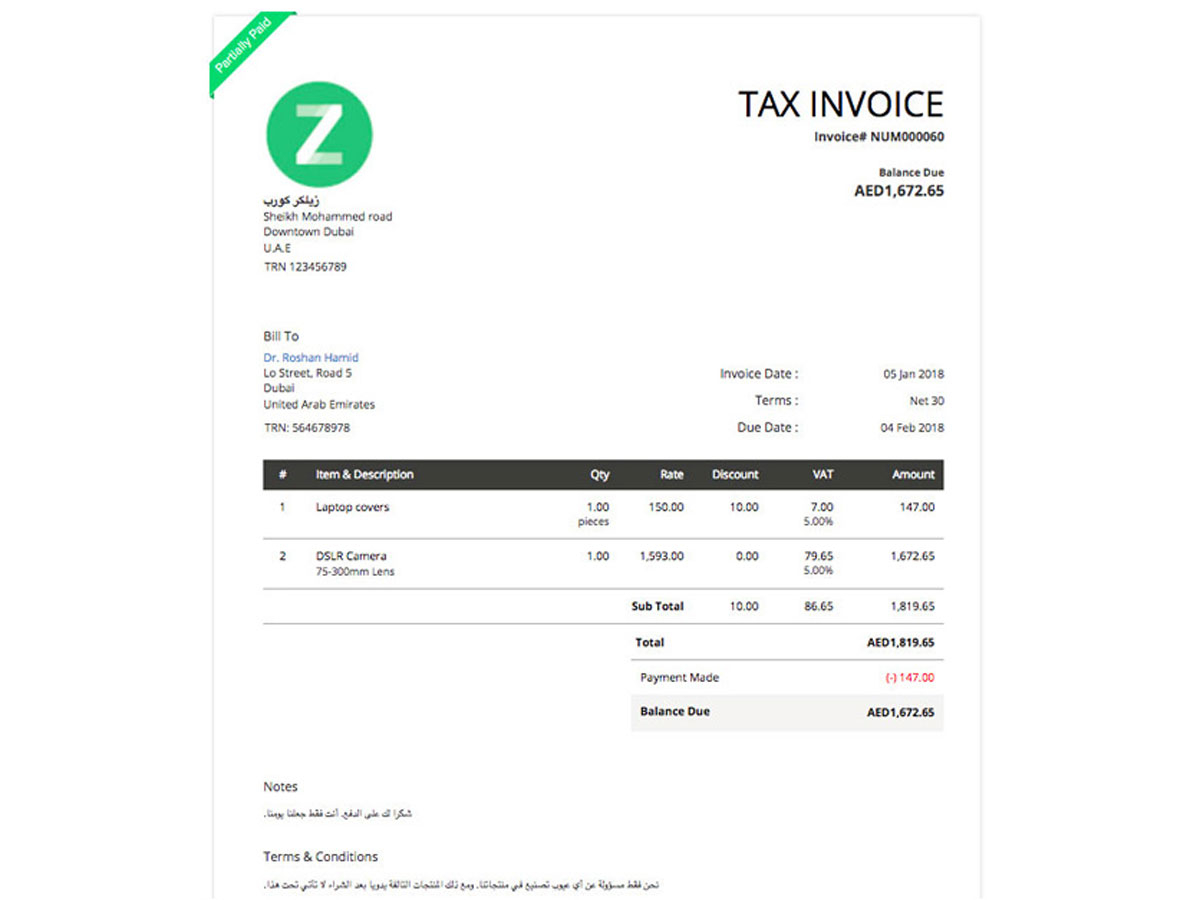

Ready for VAT

Registering for Zoho Books is as easy as filling up a few boxes — or you can use your Google, Facebook, LinkedIn, Microsoft or Twitter accounts to further speed up the process. The VAT integration pops up during the setup itself, by asking for your VAT Registration Number and whether you do business with other GCC and non-GCC countries — this info is also used to handle reverse charges. The VAT integration carries over to details on your vendors and customers. You can specify the VAT Treatment for each — whether they are VAT registered or not, GCC VAT registered or not, or are outside GCC. This data is automatically applied to every transaction you make, or invoice you send. It even comes in handy while filing VAT returns. The company is working on further automating your tax filing by feeding the data into the Federal Tax Authority’s system.

Comprehensive, yet clutter-free

Software developers have to execute the fine balancing act of cramming their products with features that a diverse range of businesses might need, without turning the interface into a complicated mess. Zoho Books has solved this challenge rather elegantly — during the initial set-up, users can turn off features they don’t need. The laundry list of available modules includes estimates, retainer invoices, time sheet, price list, sales orders, delivery challans, purchase orders and inventory management. And if your business collects online payments, you can hook Zoho Books into leading payment gateways.

Navigation that makes sense

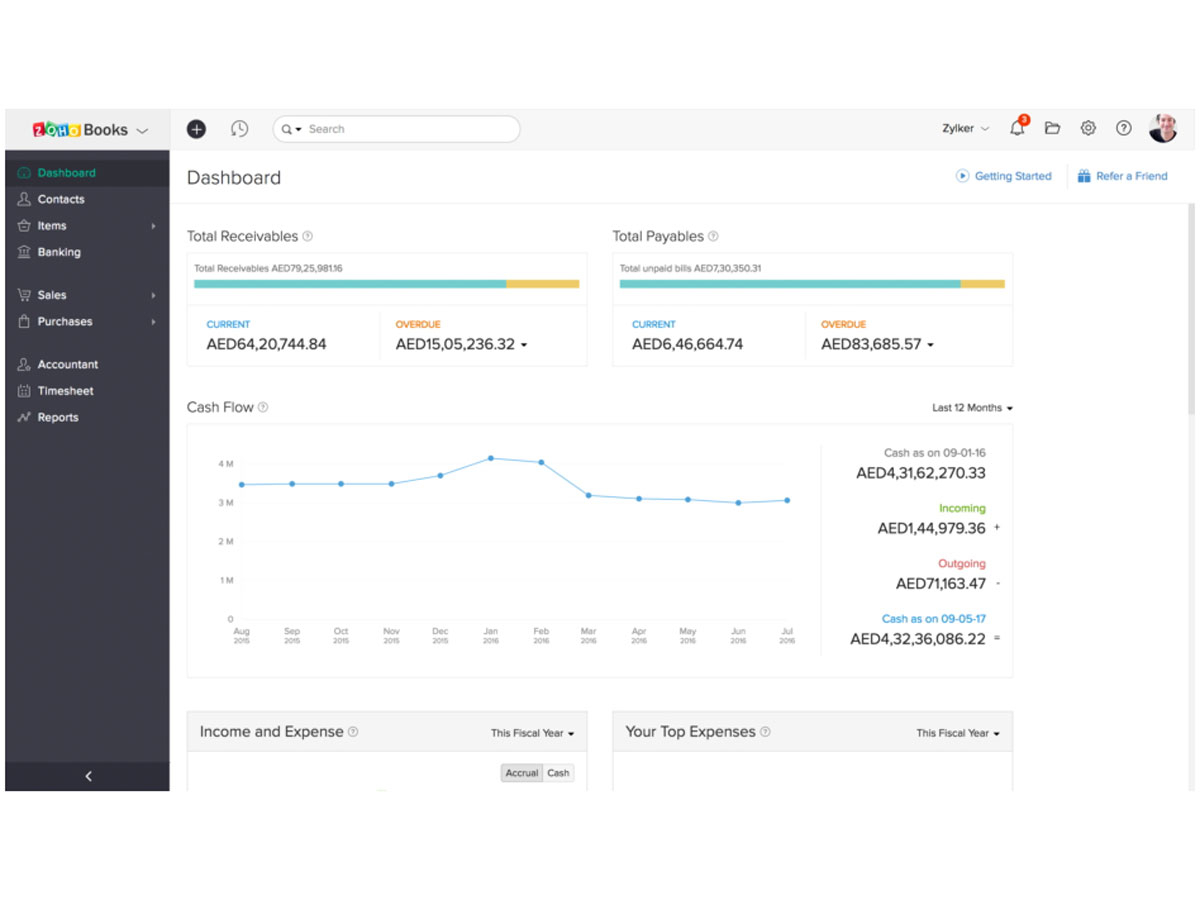

Zoho Books uses a simple, two-column interface that will be familiar to any online user — a narrow left column lists the software’s main sections, while the wider right column displays the ‘content’ of each section. Subsections are tucked away as lists that can be expanded or collapsed.

The horizontal strip running across the top includes a range of icons that provide access to user profile, settings, help and support and notifications. With Zoho Books, the equivalent of a website’s ‘homepage’ would be the Dashboard. It delivers a bird’s eye view on the current health of your business — with graphs for total receivables, total payables, income and expense, top expense, ongoing projects, and bank and credit card updates. Overall, the interface turned out to be so intuitive, we could skip a task we usually dread — poring over the user manual.

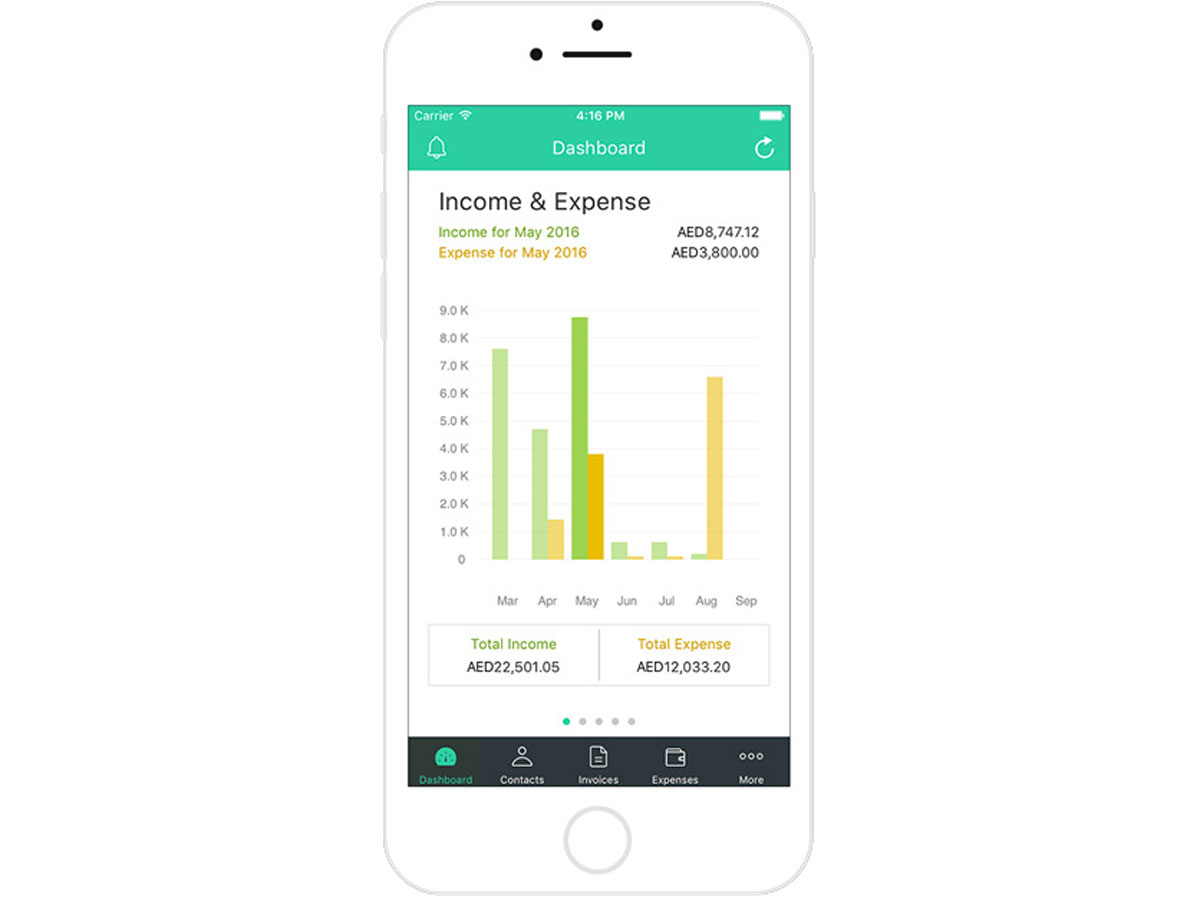

Take your accounts anywhere

Apart from a web interface that works fluidly, Zoho has invested in building apps for Apple iPhone and iPad, and Android devices phones. Apart from giving you an overview of your finances, the mobile apps can be used for generating and sending estimates and invoices, recording expenses, paying bills, slicing and dicing financial data for insights, keeping tabs on billable time and even inviting your accountant “to review your numbers” — presumably, app-enabled accountants too don’t go to sleep.

As Taher Alami, Founder of Dubai-based Abweb, a leading digital agency, explains, “Zoho Books makes it easy to create an estimate from my smartphone right after a meeting or a call. It is simple to set up, fully customisable, and has a user-friendly interface. Now all I have to do is focus on my core business for better productivity.”

Although it might sound like a gimmick, we like it that Zoho has covered Apple Watch users — you can view outstanding invoices, send payment reminders or track time spent on projects, right from your watch.

Secure in the cloud

Nearly 30 million users access Zoho’s services, and it takes data security very seriously. This includes physical security at the data centres — 7x24x365 surveillance, biometric and two-factor authentication, bullet resistant walls and hosting at multiple, undisclosed locations. Network security is handled via 256-bit SSL encryption of data, regular virus scanning, a stripped-down OS that minimises vulnerabilities, intrusion detection and prevention systems, and regular audits.

Power users

Larger organisations will appreciate the flexibility of Zoho Books that allows for role-based access and compartmentalisation of sensitive information — this includes setting up special access for accountants. Besides, you can leverage versioning and rollback, auto-scan and extraction of data from receipts, converting scanned documents into transactions, and setting folder-level user permissions.

Prashant Ganti, Head of Product Management - Global Compliance, Accounting and Payroll Solutions, points out that one of the biggest strengths of Zoho Books is the ease with which it can be customised. It leverages an online scripting language called Deluge (Data Enriched Language for the Universal Grid Environment). In other words, if a business wishes to tweak the workflow or add new features into the accounting backend, a competent developer could easily get this done.

---------------------------------------------------------------------

Start your 14-day free trial of Zoho Books at zoho.ae/books or call toll free 800 0444 0824.