Dubai: As summer discounts reach a fever pitch, banks and financial institutions have joined in the craze, enticing customers to apply for loans with less paperwork and quick approval.

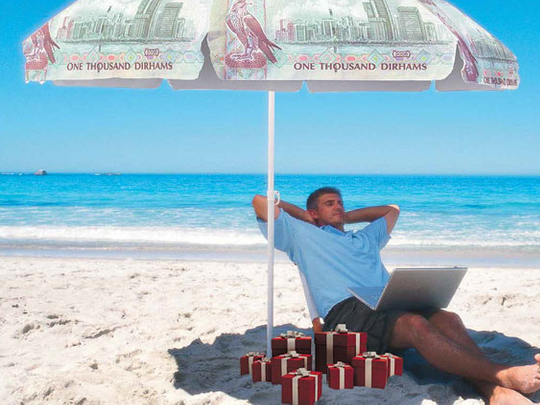

Whatever you intend to do in the next few weeks: bring the whole family to a ski resort, get married or remodel your apartment, lenders are ready to offer cash assistance as much as Dh2.5 million which can be had within one day and with annual interest rates ranging between 6.49 per cent and 6.99 per cent.

The special loans, valid only this summer, also come with a bundle of freebies such as hotel stays, free-for-life credit cards, insurance and installment deferment option and free bank accounts that don't require a minimum balance, among others.

At HSBC, for example, borrowers can get a booklet of vouchers that can be used at a wide selection of premium hotels in the Middle East and North Africa, Asia and Europe.

"Customers usually take loans for weddings, vacations, education or to renovate their homes in the summer. Whatever be the use, they can now enjoy a discounted holiday after redoing their home or extend their honeymoon stay after the wedding, using these vouchers. They can opt for a weekend getaway, a short break nearby or an extended holiday at an exotic location," says Raman Muralidharan, regional head of customer value management, retail banking and wealth management at HSBC.

Mashreq for its part is enticing customers to get cash in their accounts in only 24 hours. Borrowers have the option to get a job loss insurance, up to 60 days payment holiday and free overdraft facility for the first year. The offer is open to UAE nationals, who can borrow up to Dh2.5 million, and expatriates, who can get as much as half a million dirhams.

It wasn't too long ago when financial institutions tightened their credit rules, making it difficult for many borrowers to find emergency cash assistance. Judging from the offers, it appears that banks have achieved a better financial position and are now actively looking at how best to utilize liquidity to reap better returns.

Some lenders, however, brush aside speculations that brisk lending is back, citing that they have not changed their loan practices in the first place. "We have always encouraged responsible lending and we have not slackened on that front," a spokesperson from Mashreq says.

Muralidharan notes that while they offer preferential rates and exclusive benefits, among others, they continue to "place utmost importance on maintaining sound credit policies".

"The bank's credit risk management techniques are continually monitored and altered to ensure we keep up with the changing market – a customer's credit profile will always be a key part when we assess a credit application," he adds.

Experts say many financial institutions are still in a tight situation due to stricter Central Bank regulations, so it is normal to see them aggressively marketing their products. The country's Central Bank last year prohibited banks from cold calling customers to sell their loans and services, and imposed a mandatory 20 per cent down payment on car loans.

"The banks are facing difficult trading conditions under new orders from central bank. For example, they may only phone existing customers of the bank and deposits of (20 per cent) are required for new car loans. They are becoming more assertive with marketing for personal loans, which require no deposit and charge higher rates of interest" says Steve Gregory, managing partner at Holborn Assets.

While banks may have eased their lending requirements, they don't easily extend loans to just about any customer strapped for cash. "I believe they still thoroughly investigate who they lend to, and the terms of those loans," observes James Thomas, regional director of Acuma Wealth Management.

"I believe that the loosening of the lending policies has been caused by banks now being in a stronger financial position, and now looking at where they can deploy capital to achieve the best returns."