An accountant in Dubai withdraws Dh600,000 from the bank, hides the cash underneath the car's floor mat and walks into a restaurant to have a Dh12 breakfast. By the time he finishes his meal, someone else has already smashed the car window and fled with the thick wad of cash.

Stories like this apparently do not discourage many residents in the UAE who still prefer to shop or do business with cold, hard cash. In this age of paperless transactions, it may be surprising to see how many people are not comfortable paying their barber, plumber, laundry shop, garage or local grocery store with plastic.

It may very well be that consumers are left without a choice, considering that there is a lack of investment in cashless payment facilities in the country. For one, if a UAE resident walks into a public office, there's an 80 per cent chance that his plastic card will be rejected.

Even for small businesses, where cash flow is critical and capitalisation is very low, cash is still very much the norm. The issue is also a matter of personal choice. Some people refuse to use credit cards because they want to avoid creating a huge pile of excessive debt.

However, there are positive indications the UAE is catching up with the rest of the cashless world. Some electronic payment systems are now being put in place, while more merchants are investing in card facilities. Web-based transactions and demand for online services are also on the upswing, while there have been attempts in the public sector to promote cashless payments.

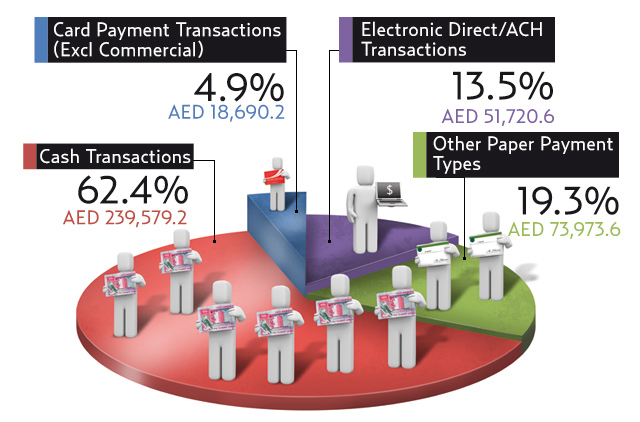

According to global market research company Euromonitor International, the majority of consumers in the UAE are still using cash. In 2009, 62.4 per cent of total consumer payments were made in cash, compared to 4.9 per cent for card transactions (excluding commercial). Other "paper payment" mode of transactions represented 19.3 per cent.

"Spending in the Middle East is predominantly cash-driven with less than 20 per cent card spend. The reason why the Middle East has been a cash-driven society is due to the low levels of investment in the payment systems infrastructure over the last decade," Hussain Doughan, Euromonitor's senior regional consultant for Middle East and North Africa, told Gulf News.

However, Doughan said the payment landscape is changing, especially in the UAE, where point of sale terminals grew by 56 per cent in 2009, higher than the 30 per cent growth posted in Egypt.

Euromonitor also expects strong card circulation growth in the Middle East over the next five years at 13 per cent compound annual growth rate, outpacing regions such as western Europe and Asia Pacific.

"The cash is king culture is still very evident in the UAE, however, this is changing as more and more people realise the benefits of electronic payments," said Kamran Seddiqi, Visa general manager for the Middle East.

R. Sivaram, cards business head for Emirates NBD, agreed, saying that consumers have become increasingly aware of the convenience and security that plastic money offers in place of carrying cash.

"Also, banks have been investing in both educating and rewarding customers, and this combined with economic activity between 2006 and 2008 has helped the strong growth in cards usage," he said.

"There is no doubt that the UAE is predominantly a cash-driven society. However, there is a shift towards the use of plastic as the consumer becomes more aware and educated, and sees the real benefits and advantage of using credit and debit cards," added Mustafa Ramzi, HSBC's head of cards, UAE.

Ramzi said the growth in their cards business across the region, particularly in the two largest markets — the UAE and Saudi Arabia, is proof consumers are moving away from cash.

"Research has shown us that our customers of cards tend to be the ones who have a global lifestyle and constantly want to get more out of life. Travel rewards and benefits are an integral part of what they see as a true value-add from a credit card," Ramzi said.