Dubai: While the geo-political unrest in the Middle East and North Africa took a toll on the tourism business in most of the region's countries, the UAE emerged unscathed.

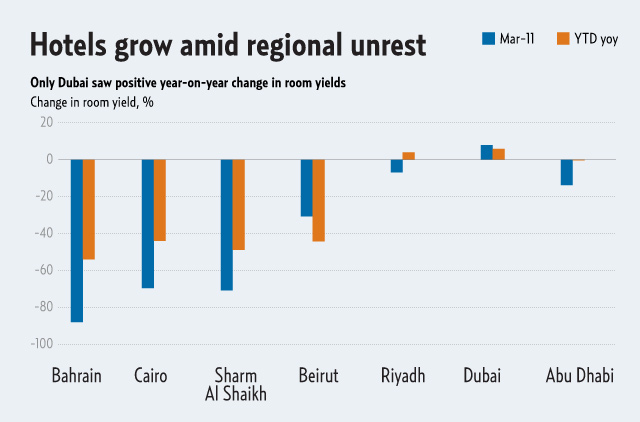

This is established by the numbers released yesterday by Citi Investment Research and Analysis (a division of Citigroup Global Markets) which reveal that Dubai was the only tourism destination in the region in March that saw an increase — of 7.9 per cent — in revenues per available room (RevPAR), quoting the Ernst & Young (E&Y) data from its Middle East Hotel Benchmark Survey for March 2011.

The emirate also recorded a 4.4 per cent increase in room rates as well a 2.8 per cent increase in occupancy as per the E&Y numbers.

The RevPAR represent a more complete measure of overall hotel performance as they incorporate not just occupancy rates but average nightly rate per room.

In the tourism report titled Middle East Macro View, Citi said that Abu Dhabi, meanwhile, saw a 17.3 per cent drop in average room rates, meaning that despite a three per cent increase in occupancy, overall revenues were down in the UAE capital's hotels in March by 13.7 per cent.

"We believe Dubai and Abu Dhabi will continue to lead the growth in the tourism sector, aided by possible ongoing political uncertainty elsewhere in the region," the report stated. It added that while the GCC countries that were unaffected by the turmoil — UAE, Qatar, Saudi Arabia and Kuwait — variously showed some measure of growth in tourism, Dubai and Abu Dhabi were by far the "best performers".

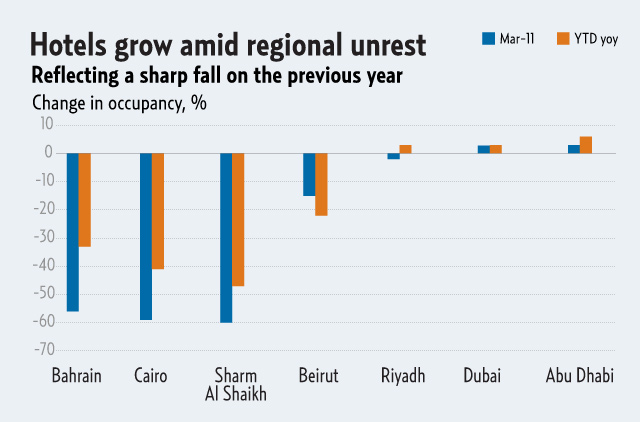

Further, revenues in countries affected by the turmoil were "impacted significantly", as occupancy and average room rates fell in tandem, as per the Citi report. Sourcing E&Y data, it revealed that hotel revenues in Bahrain, Cairo and Sharm Al Shaikh were down 90 per cent, 70 per cent and 70 per cent respectively in March, representing a major blow to the tourism industries in those countries. Amman hotels saw a loss of revenue of 22 per cent, while Beirut hotels suffered a 30 per cent loss in revenues compared with March 2010.

Recovery pace

The recovery of Dubai's tourism industry is gathering pace, aided by the unrest elsewhere in the Middle East, the Citi report pointed out, adding that the tourism industry started exhibiting signs of recovery well before the unrest.

E&Y's hotel occupancy raw data (non-seasonally adjusted) for Dubai on a six-month moving average basis, indicates a highly cyclical market movement, given the drop-off in tourism activity during the hot summer period in the region. The seasonally adjusted data (using Citi's calculations), however, showed a steady recovery in occupancy rates since early-mid 2009.

"In our view, this is entirely consistent with the global economic recovery and parallel resurgence of global tourism that took hold around the same time. The recent turmoil, in other words, has accelerated an already ongoing process," according to the report.

Worst affected

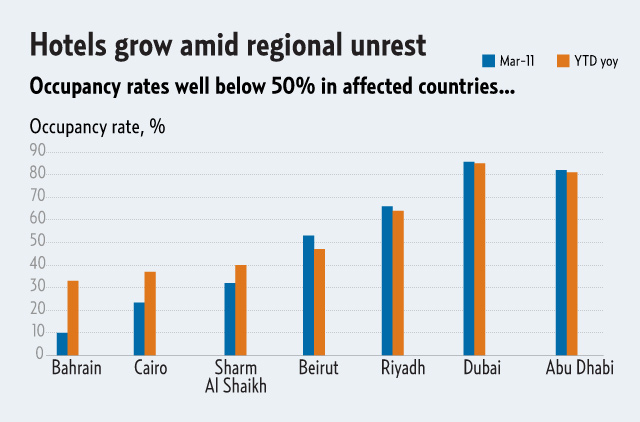

According to the E&Y data, as quoted by Citi report, occupancy rates in hotels in Bahrain for the month of March 2011 stood at just 10 per cent, while in Cairo and Sharm Al Shaikh the figures were 23 per cent and 32 per cent respectively, "representing a fall of between 50 per cent and 60 per cent for these destinations compared with March 2010".

However, year to date (YTD) numbers emerged slightly better as they incorporated the month of January — most of which was free of unrest, as per the report. "But the data overwhelmingly suggest a collapse in tourism in these two countries as violent protests and political instability gripped them throughout February and March," it said.

The report further highlights that some countries less affected by unrest fared better, although occupancy rates in all — barring Dubai and Abu Dhabi — were down in March with Kuwait, Qatar and Saudi Arabia enjoying modest increased occupancy as well only when taken on a YTD basis.

In Jordan, Amman hotel occupancy fell by 6 per cent YTD, as per the data. "This is in part due to the demonstrations experienced there during the period, but also reflects a decrease in package tourism," stated the report. In Lebanon, Beirut hotels saw a fall in occupancy of 22 per cent YTD on last year.

Meanwhile, the GCC countries which did not experience any serious unrest appear to be enjoying "modest growth in occupancy", led by Dubai and Abu Dhabi, with March occupancy rates in the emirates resting at 86 per cent and 82 per cent respectively — "far higher than any regional peers", the report highlighted, representing an increase of three per cent over last March for each of the emirates.

As for others, on a YTD basis, Riyadh and Kuwait hotels each saw a three per cent increase in occupancy levels followed by just one per cent occupancy in Doha hotels, whereas, Muscat hotels witnessed a fall of one per cent in occupancy.

Mixed tourism

According to Citi estimates, the outlook for tourism in the Middle East looks "mixed". The report stated that great political uncertainties expected to surround Egypt, Jordan and Lebanon in the coming months, could "negatively impact" tourism prospects in the medium term. "On the other hand, the GCC countries [barring Bahrain] are likely to continue to experience strong tourism growth, led by Dubai and Abu Dhabi," the report stated.