Dubai: As the penetration rate in the UAE mobile phone sector stagnates above a mind-boggling 200 per cent, telecommunications service providers such as du and etisalat have no choice but to seek alternative means to keep the revenue coming.

While Emirates Telecommunications Corporation, or etisalat, has clearly pegged its future growth on an aggressive expansion plan that has already seen it enter multiple markets in the Middle East, Africa and South Asia, its competitor in the UAE, Emirates Integrated Telecommunications Company, or du, is looking at other options.

According to du chief executive Osman Sultan, his company will remain in line with its charter and not seek pastures abroad for the next two years.

Infrastructure-sharing

It will instead focus on the benefits afforded by the UAE Telecommunications Regulatory Authority opening up infrastructure-sharing and ramping up fixed-line subscribers and revenues.

"When our shareholders ask us, with justification, what plans we have for five years down the line, in 2013, 2014, we believe we have two clear tracks for growth," Sultan told Gulf News in a phone interview.

"One is continuing our acquisition of mobile phone subscribers until we achieve parity with other players. Two is fixed-line growth, including the market for VoIP [Voice over Internet Protocol], broadband internet and pay TV.

"The clear strategy is to be more attractive than our competitor. We not only want a larger slice of the UAE telecoms pie, but we also want more subscribers who get me higher revenue per user," Sultan said.

Du has increased its average revenue per user as of June 30 to Dh111, up from Dh108 in the first quarter and Dh104 during the second quarter of 2009.

Revenues for du's fixed-line business, including fixed telephony, TV and broadband, amounted to Dh290 million, a 20 per cent on-year increase over Dh242 million in the second quarter of 2009 and a 10 per cent on-quarter increase from Dh265 million, reflecting approximately 499,900 lines.

Earnings

Earnings before interest, tax, depreciation and amortisation, or Ebitda, increased by 87 per cent on-year and 24 per cent on-quarter to Dh454 million in the second quarter of this year.

Ebitda margins also improved to 27 per cent, up from 23 per cent in the first quarter of the year and 18 per cent in the second quarter of 2009.

Sultan said du's capital expenditure programme remains on track, and is expected to exceed Dh2.2 billion this year, with Dh341 million accounted for during the second quarter. The investments continue to be focused on building infrastructure, he said.

Du completed a Dh1 billion rights issue in the second quarter, which was oversubscribed.

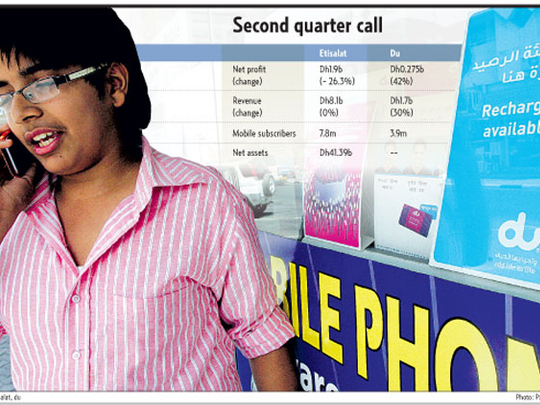

Etisalat, on the other hand, said in July that it recorded net revenues of Dh8.1 billion in the second quarter, same as in the comparable period last year. Net profit was down 21 per cent to Dh1.9 billion compared to Dh2.4 billion in the same period last year.

It saw a two per cent growth in revenues to Dh16 billion for the half-year ended June 30, compared to Dh15.7 billion in the same period of 2009. Net profit eased to Dh3.9 billion compared to Dh4.6 billion in the second quarter of 2009.

Etisalat has 7.8 million mobile subscribers in the UAE, 1.28 million fixed-line subscribers and 1.39 million internet users at the end of the first half.

Commenting on these results, Mohammad Omran, Chairman of Etisalat, said: "The international markets have seen a great deal of fluctuation, but in spite of this we have been able to deal with this situation through a practical strategy which is based on maximising positives and reducing the negative impact as much as possible."

He added that "despite the unique circumstances that the global economy finds itself, we have received strong contributions from our international subsidiaries well in advance of the business plan. This encourages us to continue our international expansion worldwide."

Acquisitions

Simon Simonian, senior vice-president of research at Shuaa Capital, said: "Since the acquisition of a 45 per cent stake in Etisalat DB Telecom India for $900 million in 2008, etisalat has adopted a more disciplined strategy. They initially planned a full commercial roll-out in fourth-quarter 2009. However when they saw the cut-throat competition in the Indian market, they shifted to a more cautious wait-and-see approach.

"As a result, they only did a soft launch in five circles out of 15 in March 2010, with the remaining 10 circles launched in June to comply with minimum regulatory requirements yet minimising start-up losses."

Etisalat participated in the 3G spectrum auction in India in April. But it pulled out when it saw the exorbitant prices other operators were willing to pay. Etisalat is now in discussion with Reliance Communications and other Indian operators.

"It would make sense for Etisalat to merge with an established player and retain a stake in the combined entity," Simonian said.

Du has no plans to venture into markets outside the UAE as a service provider. "Going abroad brings no value to my shareholders," Sultan said. "The players in other markets are already very strong. Acquisitions, as we have been seeing, will be at very high prices. And greenfield projects are next to impossible in highly competitive markets," he said.

Simonian agrees. "Sultan is looking at ways to differentiate his company from the competition. That's why he is looking at content verticals. This is good news. It creates customer stickiness and it is not capital intensive," Simonian said.

Customer is king

In this battle for subscribers, eyeballs and revenues, the customer is increasingly looking like being crowned king.

"In the UAE, the good news is that the telecommunications sector remains a duopoly. This is a win-win situation, in my view," Simon Simonian, senior vice-president at Shuaa Capital, told Gulf News in a phone interview.

"The mobile segment is approaching maturity. We need a resumption of population growth to extend the companies' growth cycle."

"However, more competition on a national scale means prices will go down for the consumers, while investors continue to benefit from the competition being capped at two operators."