Dubai: UAE's telecom sector is expected to witness limited growth in subscriber numbers this year due to the declining population, one of the key drivers of growth in the last few years, experts said.

"The impact of declining population will be felt more by du than etisalat as the former caters more to the lower segment while etisalat has mixed subscriber base," Saeed Irfan, research manger, telecommunications group, Middle East, Turkey, Africa, said.

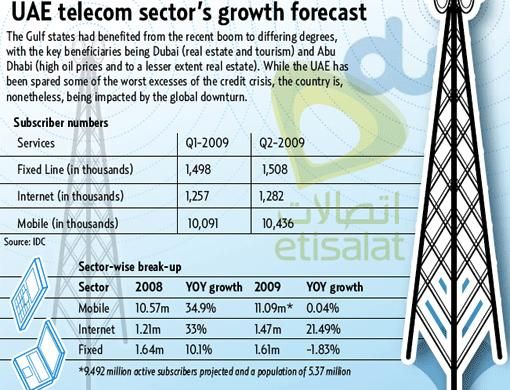

"Mobile subscribers are expected to rise by 3.41 per cent in second quarter of this year to 10.44 million from 1.9 million while internet subscribers are expected to rise 0.2 per cent to 1.28 million from 1.26 million and fixed line sector is expected to register a mere 0.07 per cent rise to 1.51 million from 1.49 million," he said.

"Population easing from the second quarter onwards could result in lower revenues in the second quarter. We do not expect to see it impacting subscriber numbers until the third quarter due to the TRA's 90-day active rule for mobile subscribers," Irfan Ellam, vice-president, equity research, Al Mal Capital, said.

Ellam projects UAE's population easing by 4.2 per cent in 2009 and by a further 1.2 per cent in 2010 and growth resuming in 2011 by three per cent.

The industry is poised to record Dh29.62 billion in revenues, an increase of 6.85 per cent compared to Dh27.72 billion in 2008.

He said etisalat's total revenues are expected to increase by 9.7 per cent to Dh28.64 billion while du's revenues are expected to rise by 24.05 per cent to Dh4.90 billion in 2009.

Al Mal Capital does not expect the falling population to impact the growth of internet subscribers, although it will rise slower than in 2008.

Ellam said sharing of network infrastructure between etisalat and du would benefit du as it will not have to build additional infrastructure, thus reducing capex spend, depreciation expense and leverage.

etisalat would, however, be saddled with maintaining and enhancing existing infrastructure.

"If ownership of infrastructure is transferred to a third party, who would earn an economic return by charging a usage fee, both du and etisalat will effectively become MVNOs [mobile virtual network operators]."

"We would favour the second option as being more equitable. Both options also open up the possibility of allowing a third operator to enter the market. We would, however, not expect a third operator to be licensed until the current economic situation has passed," Ellam said.