Dubai: The UAE's telecommunication industry is seeing a gradual shift from mobile revenues and usage surge to greater development on the internet side.

Mobile revenues are falling, while internet revenues are rising as users move to higher speed broadband internet.

Data released by the Telecommunications Regulatory Authority (TRA) in the first Annual Market Review shows that revenues from mobile phone usage rose by three per cent despite the number of subscribers rising by 14 per cent.

The yearly subscriptions jumped 14 per cent, despite penetration crossing 200 per cent. Meanwhile, the airtime of 20 million minutes for mobile phones generated Dh17,787 million in revenues.

The TRA said that base prices have not fallen, however as both operators, etisalat and du, compete aggressively on the mobile front (the only area of telecom services that can be competed on across the country) special offers and packages are driving down revenue growth.

Du last year saw an increase of 42 per cent in mobile revenues in 2009, over the year before, as it gained the majority of new subscriptions in the country. It currently has over 30 per cent of the mobile market share, that it acquired within three years of operations.

On the other hand, etisalat lost 81,000 subscribers in the second quarter of 2009 and another 30,000 in the first quarter of this year.

Last year saw its mobile revenues dip by two per cent in its contribution to overall income for the operator.

"The business of selling mobile lines is no longer lucrative and very much less attractive than it was 3-4 years ago," said Sulaiman Aboul Hosn, a senior investment analyst in the Research Department of Prime Group, asset management and investment banking.

"This development has led both operators to focus on creating new streams of income," he said.

The primary alternative is value-add services on mobiles such as broadband, mainly generated by iPhone, Blackberry and other smart phones, and the other is triple-play service.

Du already provided the bundle of internet, telephone and television services in the areas that it operated in, while last week etisalat launched eLife that revamps and combines the three services to all houses connected by fibre-to-home network.

Triple-play deal

The launch of the service comes just weeks before TRA's deadline of nationwide network sharing.

This would allow du to expand across the country with its triple-play services, no longer limited to new projects and free zones such as Media City and Internet City in Dubai.

The offer of triple-play under one line — at least in etisalat's case — would ensure that customers do not choose different operators for either of the services, but are ‘bundled' with either du or etisalat.

"Mobile revenues will continue to increase albeit at a very slow rate (low-mid single digits) primarily due to penetration and declining population growth due to the macroeconomic environment," Aboul Hosn said.

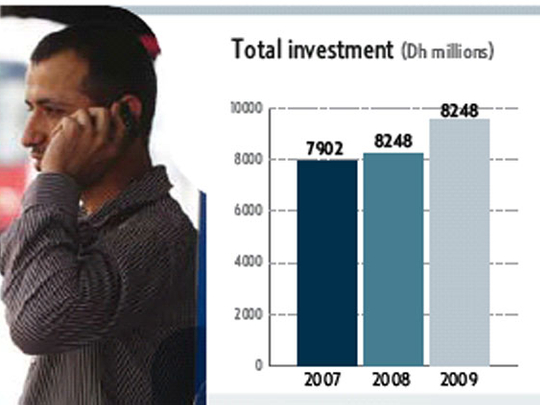

"The new playing field is broadband and this is evidenced by the huge amount of investments being made by both operators in infrastructure," he added.

The number of internet subscribers during 2009 increased by 17 per cent while revenue surged 46 per cent. TRA said this was due to more users selecting broadband and therefore, dispensing more for internet usage.

Internet penetration in the country was 71 per cent in 2009, with total number of broadband subscribers rising by 24 per cent. Penetration of broadband subscribers increased from 11.4 per cent in 2008 to 13.2 per cent last year, the report said. While internet, and specifically, broadband is an obvious growth story, fixed line has opportunities which will likely be explored soon.

With the beginning of network sharing, more competition could bring plenty of offers on fixed line telephony and maybe even drive down the country's notoriously high international calling rates in the absence of special offers.

Fixed lines

The number of fixed lines increased 7.58 per cent to 1.6 million last year, from the year before while revenues increased significantly more at a 21 per cent jump to Dh3.8 million over the same period, the report showed.

A total of five million voice minutes from fixed lines were recorded.

While du's opportunities of gaining new subscribers on fixed lines was limited geographically, it saw a 45 per cent growth in du's fixed line subscriber base from 280,300 to 405,900 lines at year end 2009.

During the second quarter of the year, etisalat lost 19,000 fixed line members, possibly due to a drop in the country's population.

"Fixed line is still a sector… that has a big potential for competition. We know for a fact that prices for fixed business is very high. There is huge opportunity and hopefully this will change," the director-general of TRA Mohammad Al Ganem said at a media event in May.

In the past years, fixed line pricing has not changed much.

He said the reason behind this is that the country's operators currently have a monopoly on geographic locations. If this changes, costs for fixed line calls may fall.