Dubai: Regional telecommunication operators will soon have to change their growth strategy as they deal with increasingly demanding customers, a new study has said.

"Consumers are coming to expect the digital experience — texting, social networking, news and information, high-definition movies anywhere, anytime," said Karim Sabbagh, a partner at Booz & Company and a co-author of the report.

"This trend will affect every aspect of the telecom industry from the high-speed networks consumers will insist on, to the variety of new devices on which they will expect to be able to connect, to the ever-expanding kinds of applications they will be willing to pay for," said Sabbagh. "And the new generation of ‘digital natives', those who know no other world than always-on connectivity, will only grow more demanding."

The study said the regional operators would find growth pockets in new market segments and share of value as "the only meaningful indicator of success".

While companies are growing their subscriber base and revenues, the somewhat closed market allows operators to let innovation take the back seat on the road to expansion.

"Most telecom operators in the region realize that they are falling behind in terms of technology and, with penetration rates rising higher and higher, they need to offer new products and services in order to sustain growth," Sulaiman Abu Al Hosn, telecom analyst at Prime Emirates told Gulf News.

Operators in the UAE are investing heavily in Fibre To The Home (FTTH) that allows fast broadband connectivity and a reliable landline and television signal. The country is due to have a nationwide network ready by the end of 2011.

"They were taking advantage of low competition in the past, but all regional markets are now competitive to a certain extent," Abu Al Hosn said.

While some moves have been made towards advancement, the region in general remains a step behind developed telecom markets.

"There will always be a lag between GCC [Gulf Cooperation Council] and international markets in terms of technology," Abu Al Hosn said, due to innovation transfer time.

Not a very open market, the region has still seen some new players acquire licences and offer greater competition of services.

"There has been a wave of liberalisation in the region's [GCC's] telecom sector over the past few years. But the level of competition in the GCC countries does vary. Some markets are more liberalised and competitive than others," said Matthew Reed, regional senior analyst at Informa Telecoms and Media, the industry research provider.

He cited Bahrain and Saudi Arabia as the most competitive markets in the region.

Additionally, the region has seen some international players test the waters through agreements and partnerships. Vodafone, which has had a presence in Egypt, has also partnered with du in the UAE. Verizon of United States recently acquired a licence in Saudi Arabia.

However, compared to the Indian market that has over 30 mobile operators, the Arab region is tightly regulated.

"Opportunities for international players to move into the GCC are somewhat limited as there are no new licences on offer at present, following that recent wave of liberalisation," Reed said.

Growth

In their emerging markets, Middle East-based operators are focusing on capturing volumes, which typically last for three or four years and then fades away, experts say.

"Operators that adopt the right strategies and invest upfront during such finite periods of opportunity will create long-term sustainable advantage through scale, securing financial performance superior to that of their more reluctant competitors," the report said.

This year, Middle East operators will again be actively seeking growth. "Operators will resume their inorganic growth through acquisitions, but will simultaneously focus on mastering operations in their emerging markets to secure hoped-for growth. Most will be working to find the right balance in their efforts to extract value from their extended footprint," said David Tusa, a principal at Booz & Company and a co-author of the report.

"Broadband is the name of the game," Othman Sultan, chief executive of du has often said.

Broadband demand is exploding globally, in terms of both subscriber uptake and bandwidth requirements. For Middle East operators, the broadband growth story is compelling. Broadband subscriptions in the region were expected to grow by about 44 per cent over the previous year, although penetration remains low, at 2.4 per cent of the region's population.

"Still, the economics of next-generation broadband remain challenging, hindering deployment in both developed and emerging markets as operators struggle to generate returns that can justify the cost of broadband rollout," said Mohammad Murad, a principal at Booz & Company.

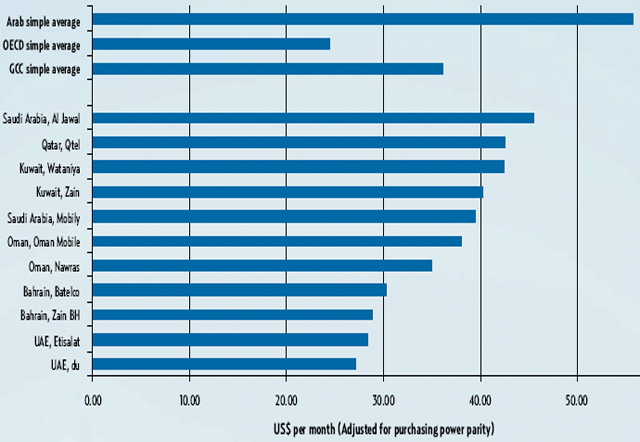

Meanwhile on the mobile front, UAE regulator the Telecommunications Regulatory Authority said the country's mobile prices are lowest in 22 Arab countries, and within the GCC. Mohammad Nasser Al Ganem, the director-general of the TRA said, "Both operators in the UAE are currently offering attractive pricing plans for consumers, especially for mobile voice service, which is an indication of the continued development of healthy competition in the UAE mobile market."

Do you find telecom prices to be higher in the UAE compared to other countries? Which products or services would you like to get from your telecom provider?