Dubai: The Gulf region is rapidly expanding its footprint on the global retail map, a new report says.

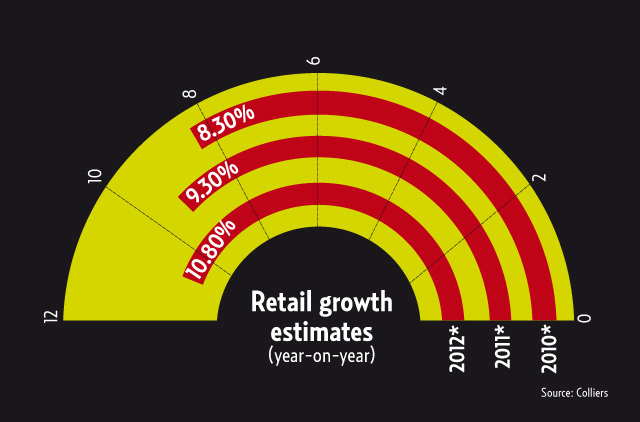

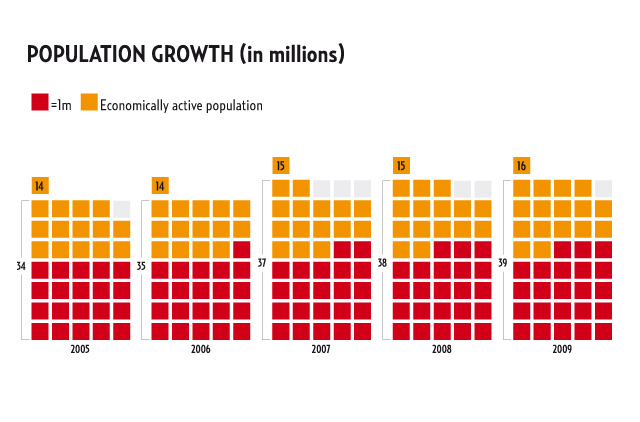

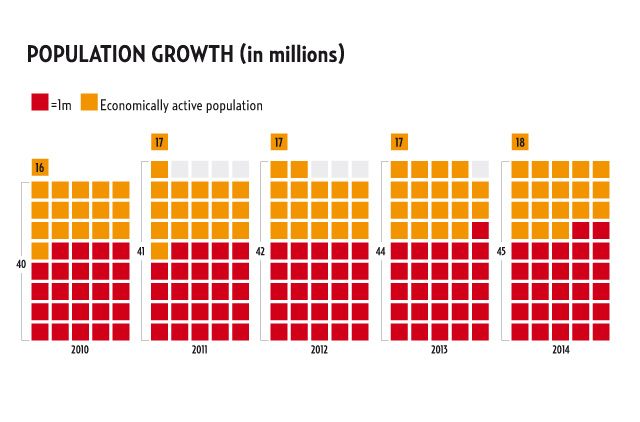

The report by Alphen Capital shows the growth is fuelled by rising disposable incomes, favourable demographic profile, growing middle class, burgeoning expatriate wealth, growing tourism and the development of modern retail infrastructure.

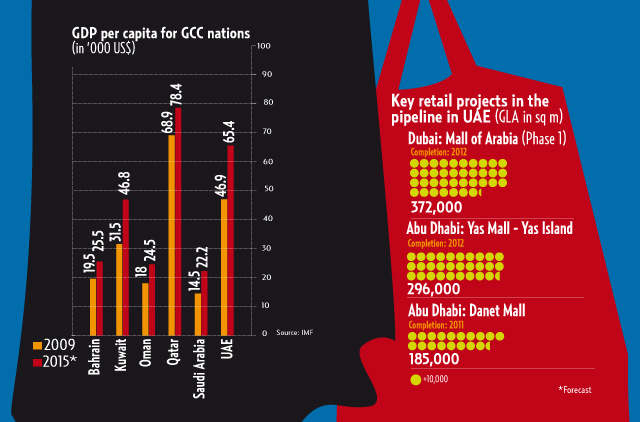

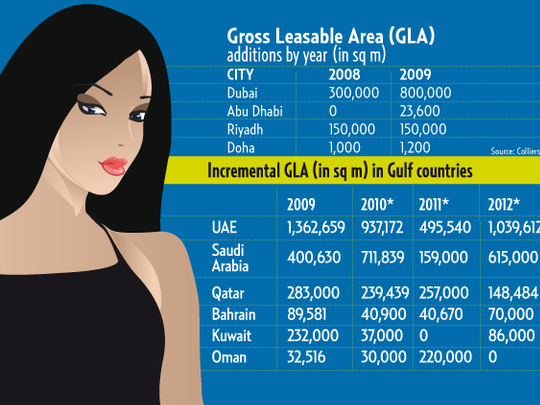

Currently, retail projects of around 6 million square metres of Gross Leasable Area (GLA) are under way, which will increase the region's retail space supply by 2012. Retail is the second-largest non-oil sector in the Gulf.

"The UAE is the largest retail market in the Gulf region, with the highest per capita retail spending, attributed to its higher tourism and expatriate population spends," the report said.

"Dubai, Abu Dhabi and Sharjah are the prime retail markets in the country with significant presence of modern retail outlets. A unique feature of the UAE retail industry is innovation of malls. Retailers promote malls as leisure destinations to increase footfalls. Shopping centres in Dubai have facilities such as indoor ski slopes, rock climbing, aquariums and indoor skydiving."

The majority of the GLA addition is expected in the UAE and Saudi Arabia.

Alpen Capital expects GLA of 937,172 square metres to be added this year, mostly in Dubai while in Abu Dhabi, retail spending per square metre may decline in 2010 under the impact of significant increase in retail space. Around 2.25 million square metres will be added in 2010-12, around 35 per cent of which will be in Abu Dhabi and just over 50 per cent in Dubai.

"I have always maintained that the retail sector is going to be the driving force for the UAE as it shifts towards a more ‘non-oil' based economic growth. The so-called recession might have caused a few hiccups but the industry is looking strong as ever. Many new entrants both local and international, are eyeing the Middle East and UAE markets with serious and long-term intentions, and this can help further strengthen UAE's position as the prime shopping and leisure destination in the region," Yousuf Ali M.A., Managing Director of Emke group, told Gulf News.

Major theme

He said the UAE's retail success is having a ripple effect on neighbouring countries also. "I can see a great deal of activity in Oman, Qatar, Kuwait and Bahrain apart from of course Saudi Arabia. For example we have had five LuLu stores in Oman till last year but now we are opening six more new ones in the next 15 months. Same applies for the Qatari and Kuwaiti markets. In Saudi Arabia we opened our first store last year in Dammam and we will be opening three more in Riyadh and Jeddah this year.

Hypermarkets being our mainstay in retail where we already command a market share of roughly 33 per cent, we intend to take our total store numbers to 100 from the current 78 by the end of 2011," Yousuf Ali said.

Kamal Vachani, director of Al Maya Group, told Gulf News that Dubai has developed shopping as a major theme of its appeal as a tourist destination. Shopping malls in Dubai house facilities such as indoor ski slopes, rock climbing, and aquariums to attract businesses, residents and tourists.

He said no other country in the world has the infrastructure like in Dubai. Customers have become a little selective in spending due to the economic slowdown, but the long-term growth outlook for Dubai is very positive and I am sure Dubai will rebound in a strong way and quickly.

"From a store perspective it is great and plenty for opportunities for growth and it is happening. You have to differentiate yourself to win customers to shopping malls," Tom Miles, director of shopping centres, Al Futtaim Group Real Estate, told Gulf News.

He said the entry of foreign brands will give shoppers better value and deals as competition will intensify. Local players also try to be competitive to win customers. At the end of the day, it is better value for the shoppers.

Dubai's reputation as a leading tourism destination has attracted foreign brands as around 40 per cent of consumers at malls and fashion outlets are tourists. The abundance of custom-designed shopping complexes across the region, along with the proliferation of branded store networks, has created an acute need for professionals to stay in touch with the latest trends.

According to Vachani, everybody has a role and market to play whether it is a foreign or local brand. "We are a commodity-based supermarket. There is a road for everybody. We provide offers and discounts to attract customers. They come and buy not only the discounted products but also other products. This way we win customers. That trend will continue not only for us but also for others. Everyone has different game plan and cater to different societies."

In 2009, the average occupancy of Dubai malls was one of the highest in the Gulf, and this is expected to remain high. In Abu Dhabi, the retail market is undersupplied and, like Dubai, shopping malls enjoy high occupancy rates. The Dubai retail market does not appear to be oversupplied, despite heavy additions to retail space. The short-term imbalance is expected to be corrected once the current employment problems expatriates face are reduced and tourism regains its earlier tempo.

Both Vachani and Miles echoed the feeling that growth in tourism will benefit the retail industry.

"The average spend by tourists is 3 per cent to 4 per cent more than the residents. We witness around 500,000 to 550,000 visitors per week at Dubai Festival City. It is around 20 per cent more than last year," Miles said.

"A little boost in tourism will definitely explode the retail industry, especially in Dubai because Dubai has the best infrastructure in the world," Vachani said.

According to the World Travel and Tourism Council, 60.5 million tourists visited the region in 2009, generating a tourism demand of about $242 billion (Dh890 billion).

The number of international visitors is expected to rise to 78 million in 2014, a growth rate of 5.3 per cent.