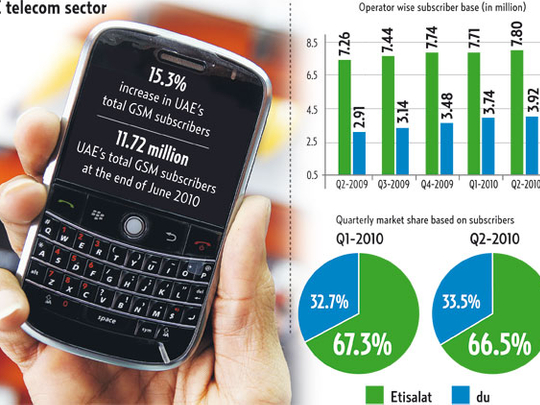

Dubai: The UAE's total GSM subscriber base increased 15.3 per cent year-on-year to 11.72 million at the end of June 2010, more than double the country's population, according to a latest report by Global Investment House.

Telecom subscriber numbers witnessed a quarter-on-quarter growth of 2.4 per cent in subscriber base, added 272,100 new customers during the quarter.

Du

"In Q2-2010, etisalat added 90,000 subscribers while du added 182,100 subscribers achieving a quarter-on-quarter growth of 1.2 per cent and 4.9 per cent, respectively, in total subscriber base," the report said.

Du took the higher share of new subscriber additions in the second quarter of 2010. It accounted for 66.9 per cent of new subscriber additions in Q2-2010. "Du achieved significant mileage in terms of subscribers market share which increased from 28.6 per cent at the end of Q2-2009 to 33.5 per cent at the end of Q2-2010," it said.

Though it is hard to quantify the impact of possible BlackBerry ban on the telecom companies, it is likely to have a negative impact on telecom service providers as many corporations use it as the system of first choice, the report said.

"Keeping in mind the imposition of BlackBerry ban in UAE, we believe the price performance of UAE companies will remain subdued till the issue is sorted out. In the GCC telecom space we remain overweight on Wataniya Telecom and Mobily," Faisal Hassan, researcher at Global Investment House, said "The stock price performance of UAE telecom companies will remain subdued till the BlackBerry issue is sorted out. In many GCC countries competitive environment is becoming stiffer."

Solutions to BlackBerry services have been achieved in Saudi Arabia, while the UAE is expected to follow soon. "The UAE is likely to follow suit. Though the UAE regulator announced the imposition of a ban on BlackBerry services including instant messaging, e-mail, and web browsing starting from October 11, it has kept the door for discussion open.

"With the resolving of the issue in Saudi Arabia, the chances have become brighter for a similar deal in UAE. The issue is important for the country since it will put the federation's reputation of a business-friendly commercial and tourism hub at risk," Hassan wrote.

Etisalat

Etisalat's revenue grew by 2 per cent year-on-year in the first half of 2010 to Dh16 billion while its net profits declined from Dh4.6 billion in the corresponding period of 2009 to Dh3.9 billion in 1H-2010.

In 1H-2010, its operating expenses grew by 29 per cent to Dh9 billion. Operating expenses as a percentage of total revenue grew to 56.1 per cent in the first half of the year from 44.3 per cent in the first half of 2009.

"During 1H-2010, the company made a good amount of savings on its finance costs which witnessed a year-on-year decline of 16.9 per cent to Dh161.1 million. This was mainly achieved in 1Q-2010," the report said.

Its finance income grew from Dh260.8 million in 1H-2009 to Dh456.5 million in 1H-2010.

"We believe that the UAE would still be the main revenue driver for etisalat, however, the key growth area would be data and internet services. But in 1H-2010 we have seen that both revenue and profitability from UAE are under pressure," Hassan said.

"Amongst international operations, we are optimistic about etisalat's operations in Egypt and Saudi Arabia. These markets are the key value drivers in the short to medium term."

On year-on-year basis, the group's total revenue declined by 1 per cent in 2Q-2010 to Dh8.1 billion while net profit declined by a whopping 22 per cent in 2Q-2010 to Dh1.9 billion. In 2H-2010, the company's revenue and profit from UAE witnessed a year-on-year decline of 9.7 per cent and 26.1 per cent to Dh11.8 billion and Dh3.5 billion respectively.

The company's mobile subscribers in the UAE touched 7.80 million at the end of 2Q-2010 which was at 7.71 million at the end of 1Q-2010. Fixed line subscribers reached 1.28 million while internet subscriber base was at 1.39 million at the end of 2Q-2010.

Etisalat is a net cash positive company, which enables it to continue pursuing its expansion strategy and eye strategic acquisitions.