Dubai

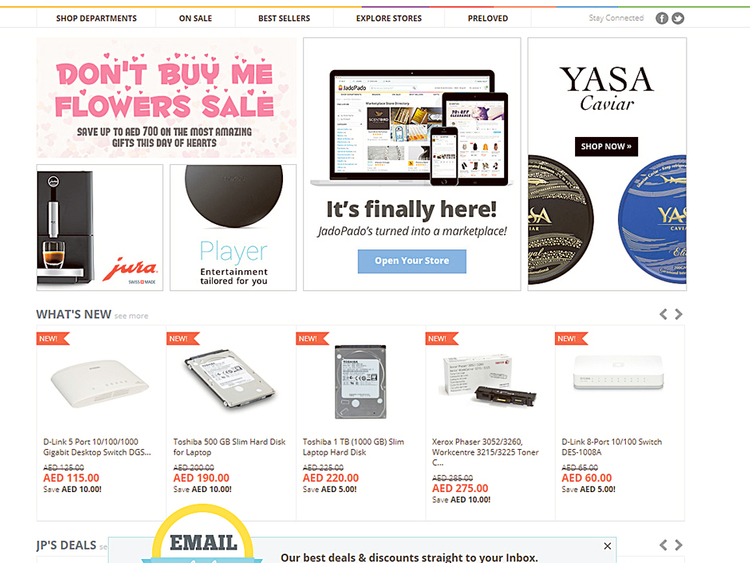

The UAE’s e-retailing portal JadoPado is going the Alibaba way.

JadoPado, in operation for four years now, is transforming its e-commerce site where it sold primarily tech gadgets directly into a ‘virtual marketplace’ where independent sellers across multiple categories can put up their merchandise. Apart from vendors within the UAE and the Gulf, the portal’s promoter is also keeping the virtual doors open for those from the Subcontinent and elsewhere.

Beta testing had taken place over December and January after the decision to go in for the switch was made in February last year. In the new marketplace format, there will be 16 ‘top-level’ categories and 5,500 categories overall. On core electronic products, JadoPado will charge a 4 per cent transaction fee, while on all other categories it will be 8 per cent. Customer deliveries on such concluded transactions vests with the individual vendor.

Another local portal, Tejuri.com has also applied the multi-vendor strategy for its ‘virtual mall’, where retailers take up space to pitch their brands.

“In the last four years, our focus was on developing the customer experience side of things,” said Omar Kassim, Founder of JadoPado.com. “We have been averaging between 280,000-300,000 visitors a month, the majority of them being repeats.

“But we felt there was a big opportunity in terms of the number of categories that could be offered via JadoPado. We talked to many sellers out there, those who had to go through the same struggles as we did in their online ventures and those who did not want to invest the time or spend to do so.

“That was when it was decided there could be value from transitioning the JadoPado portal into a marketplace through a multi-category approach.”

By adding categories such as apparel, fashion accessories and fragrances, the portal will also be stocking up on high-margin inventory and not rely exclusively on the volumes generated through tech gadgets, albeit at single-digit operating margins.

This year, the internet user base is expected to rise to more than 50 per cent of the Middle East’s population, while the two largest e-commerce markets, UAE and Saudi Arabia, should go past the $7 billion (Dh25.71 billion) mark.

According to Kassim, traffic should not be the sole criteria to judge a portal’s success or otherwise, especially those from the local market. “The UAE’s got a sizable floating population, and what we have seen is that the individual transactions more often than not tend to be outsized,” said Kassim. “The basket size tends to be much higher than in other markets, and the reason why traffic cannot always be an indicator.”

Even in the core gadgets and electronic category, JadoPado has been able to win over some of its former competition on to the marketplace. “Some of the small wholesalers see it as a way to get through to the big volume transactions,” Kassim said. “For us they were the low hanging fruit when it came to signing up vendors.”

The portal does not have any specific requirement as regards the licensing of the sellers. But the merchandise will have to pass through rigorous vetting before they can be sold. (JadoPado owns the hardware side of its platform, which meant that the scaling up to a marketplace did not entail substantial costs on that score.)

Kassim also confirmed there were no plans to tap outside funding in the interim. To date, all of its expenditure have been met via own equity.