Shares in India notched up gains for the third consecutive week, shrugging aside concerns about the impact of slowing growth on corporate earnings, as investor focus shifted to the upcoming annual budget that is likely to have many business-friendly policies needed to bolster the manufacturing sector and creation of jobs.

While opposition lawmakers and some economists are warning of a prolonged slowdown, triggered by the government’s shock decision in early November to invalidate high-value bank notes that comprised 86 per cent of the currency in circulation, market savvy players are betting the pain could ease off by the end of the March quarter.

Growth, the optimists believe, could rebound strongly by the latter half of 2017. Borrowing costs have fallen, and could decline more in the months ahead with inflation dropping well below the central bank’s target. Flooded with customer deposits after New Delhi’s drive to flush out unaccounted cash hoardings, banks would be encouraged to cut interest rates and help jump-start sluggish loan growth.

Big foreign investors are also impressed by Prime Minister Narendra Modi’s ability to take unpopular decisions, such as the demonetisation of Rs1,000 and Rs500 currency notes, which could benefit the real economy in the longer run. There is also greater expectation the government would pursue more reforms.

“You’re going to see a transformation take place before your eyes in India,” Reuters quoted Canadian billionaire investor Prem Watsa as saying, comparing Modi’s reform agenda to Lee Kuan Yew, the builder of modern Singapore.

Watsa, whose investment vehicle Fairfax India is raising $500 million (Dh1.83 billion) to add to its initial $1 billion corpus collected in 2015, was attending a business summit in Gujarat.

“India is the single best country to invest in worldwide for the long term,” he said, adding that all the companies Fairfax India has invested in so far are registering double-digit growth rates. “I see huge opportunities.”

Building confidence

There were other signs of budding confidence after the sell-off in November and December. The Bombay Stock Exchange, Asia’s oldest bourse, said it would launch an initial public offer of shares on January 23.

The sale of up to 15.4 million shares by around 300 shareholders, including Singapore Exchange and a unit of Citigroup, aims to fetch about Rs13.5 billion (Dh729 million) at a price band of Rs800-850 per share. Deutsche Borse, another strategic investor in the BSE, is not selling any stock in the offering that will close on January 25.

Bigger rival, the National Stock Exchange, has filed papers for an IPO that aims to raise as much as Rs100 billion. Central Depository Services (India) Ltd, founded by BSE and owned in part by banks, including State Bank of India and Standard Chartered Bank, is also readying plans for an IPO.

On Friday, budget carrier SpiceJet Ltd said it had reached a deal to buy up to 205 aircraft from Boeing, worth up to $22 billion at list prices, in another sign of companies looking ahead to better times in Asia’s third-largest economy.

Air passenger traffic in India is expanding at double the pace of rival China, bolstered by rising incomes and growing middle class. The purchase, which covers deliveries up to 2024, should enable SpiceJet to better compete with bigger rivals IndiGo, Jet Airways and Air India.

SpiceJet shares have risen 14.5 per cent since end-December, outpacing the top-30 Sensex that has gained 2.3 per cent over the same period.

Earnings watch

Quarterly earnings from export-driven software services companies, Tata Consultancy Services and Infosys, beat market expectations and their outlook appeared better than the sullen mood that marked the sector for much of last year. Analysts at Deutsche Bank are particularly bullish about Tata Consultancy, projecting the stock to reach Rs3,200 over the next 12 months — a more than 40 per cent upside to Friday’s closing of Rs2,252.

“Going forward, the stock performance will depend on the smooth transition of power to the new leadership. Management changes suggests continuity and is less disruptive,” the investment bank said in a note, adding that it believed TCS’s decentralised operating structure will pass the test.

N. Chandrasekaran, who led TCS since 2008, will be moving out to take charge of Tata Sons Ltd, the holding company of the Tata Group, which has annual revenues of more than $100 billion and include Tata Steel Ltd and Tata Motors. TCS Chief Financial Officer Rajesh Gopinathan will take over as CEO of the top information technology company from February 21.

Energy conglomerate Reliance Industries Ltd will unveil its quarterly numbers on Monday, followed by electrical equipment company Havells on Tuesday. Private-sector lenders Axis Bank and Yes Bank are scheduled to release their results on Thursday.

Ride out storm

All said economic growth in the current financial year to end-March is set to slow, hurt by disruptions caused by the shock removal of high-denomination notes. An acute cash shortage, in a country where more than 90 per cent of transactions are done in cash, dealt a severe blow to consumer spending.

The World Bank this week pared the country’s growth to 7 per cent in 2016. Government estimates initially had projected the $2 trillion economy to expand 7.7 per cent in 2016-17, but last week toned down to 7.1 per cent, while many private-sector economists paint a gloomier picture pegging the pace at below 6.5 per cent.

However, the tide should change for the better in the financial year that begins on April 1.

“India is expected to regain its momentum, with growth rising to 7.6 per cent in FY2018 and strengthening to 7.8 per cent in FY2019-20,” the World Bank said in a report. “Various reform initiatives are expected to unlock domestic supply bottlenecks and raise productivity. Infrastructure spending should improve the business climate and attract investment in the near-term.”

It said moderate inflation and a civil service pay hike should support real incomes and consumption, assisted by bumper harvests after favourable monsoon rains. “A benefit of ‘demonetisation’ in the medium term may be liquidity expansion in the banking system, helping to lower lending rates and lift economic activity.”

Consumer price inflation, the main gauge that determines the central bank’s rates policy, eased to a two-year low of 3.41 per cent in December as demand plummeted in the wake of cash crunch.

Rating agency Moody’s said that beyond the short-term negative impact on growth, demonetisation has the potential to raise government revenues and provide some fiscal space to support growth if required. It maintained its positive outlook for India.

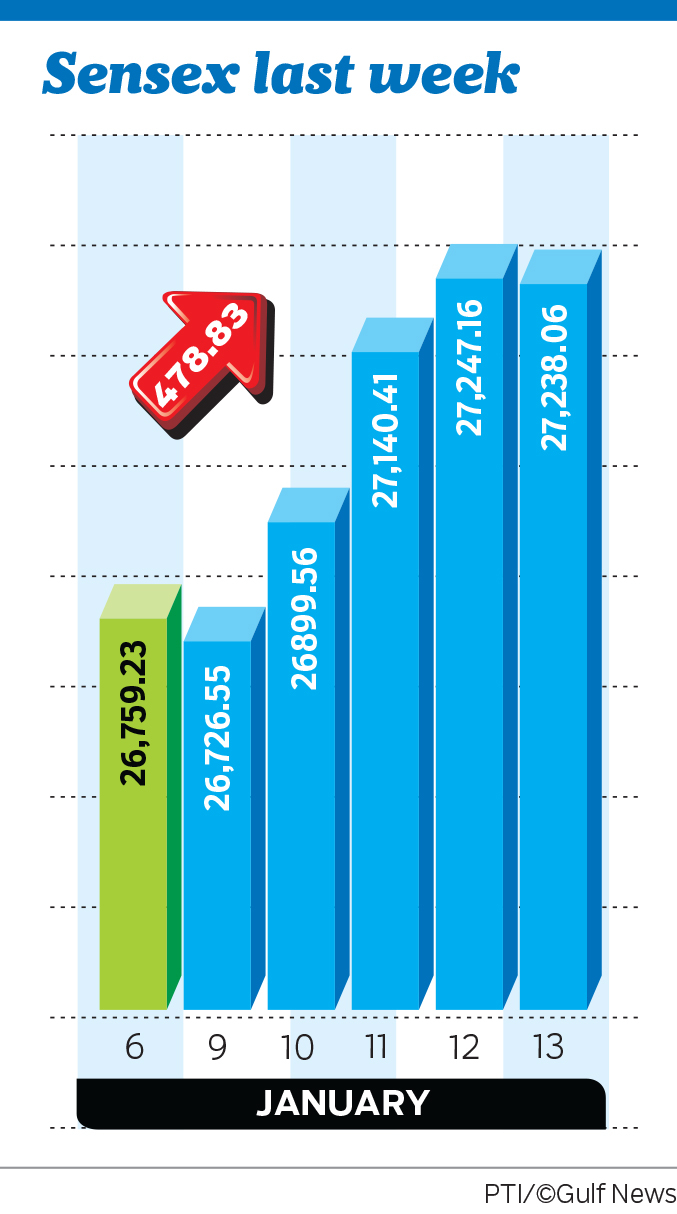

Little surprise the closely tracked Sensex climbed 1.8 per cent over the week to 27,238.06 and the broader 50-share Nifty rose 1.9 per cent to 8,400.35. Metal makers were among the big gainers on the back of improved global prices and China’s decision to slash steel output. Tata Steel firmed 6.4 per cent and Hindalco rose 7.1 per cent.

Shares in Power Grid Corp soared to a record Rs199.80 on Friday and closed at Rs197.20, up 4.5 per cent over the week as the state-run company readied to commission a much delayed project that cost $2.1 billion. Brokerage CLSA retained the stock as its top pick among large-cap utilities and set a 12-month price target of Rs225.

The writer is a journalist based in India.