Dubai: Middle East sovereign investor confidence is stable and they continue to pursue long-term investment goals through strategic asset allocation, despite sustained low oil prices and continued market volatility, according to Invesco’s Global Sovereign Asset Management.

The study, an in-depth report on the complex investment behaviour of sovereign wealth funds and central banks covers 77 individual sovereign investors and reserve managers across the globe representing 66 per cent of sovereign assets and 25 per cent of foreign reserves — totalling $8.96 trillion of assets.

This year’s study shows Middle Easter sovereign investors are confident that they are well positioned to work within in the challenging economic environment and continue to invest in global markets across various asset classes. The study showed that there is a strong preference for the US above other geographical regions and an increased appetite for real estate investment to drive allocations towards alternatives.

While the challenging macro-economic environment, driven by the sustained low oil price, has impacted on global sovereign investment performance, with average annual portfolio returns having fallen, Middle East sovereign investors remain better prepared in terms of investment capability and governance. On average new funding accounted for 3 per cent of assets, while the average sovereign investor withdrew or cancelled only 7 per cent of assets, as sovereigns cope with funding challenges.

“Many sovereign investors are now comfortable operating in an environment with limited new funding. Some have ceded assets to governments without cancelling long-term investments, while others have not been called upon at all for withdrawals over the last 12 months. Many of these institutions appear confident in their funding outlook and are increasing the importance of their investment objectives relative to their short-term liquidity needs,” said Alex Millar, Head of Invesco EMEA sovereigns & Middle East and Africa institutional sales.

Time horizons for investing are also lengthening as Middle East sovereign investors manage these challenges, rising from 7.1 to 7.7 years over the past four years amid continued interest in the diversification benefits and illiquidity premiums offered via alternatives.

The study indicates that overall Middle East sovereign investor confidence remains stable - and has done since 2013 - with Invesco’s Sovereign Confidence Index highlighting that overall confidence has remained steady at 7.2 in 2014, to 7.3 in 2016.

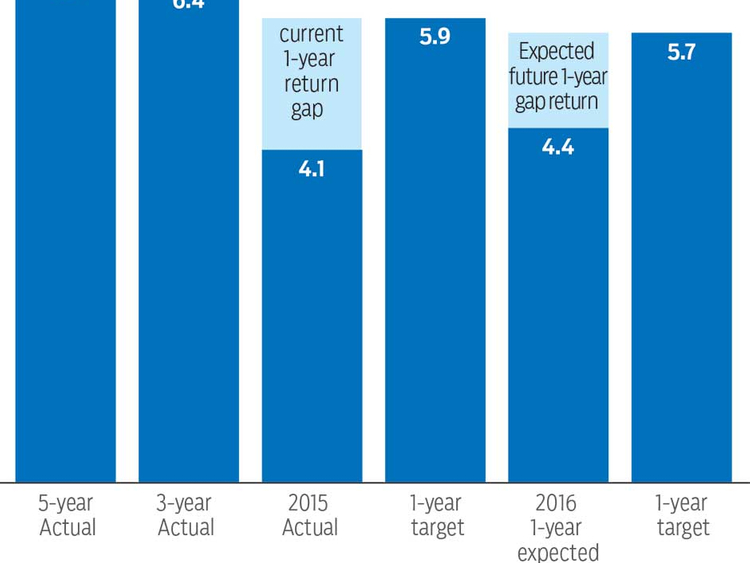

Tracking confidence based on returns and aggregate capabilities (looking at investment expertise, people and talent, governance and third parties), the index shows that global liability & development sovereigns report increased confidence consistently across both categories. While lower returns have impacted global investment & liquidity sovereigns, who have seen confidence based on performance drop from 8.4 in 2014 to 7.7 this year, confidence in aggregate capability has gone up from 7.4 to 7.8 over the same period.

Real estate preference

Middle East sovereign investors have focused on increasing allocations to infrastructure and private equity over the last two years; however attitudes have changed in 2016, and for the first time fewer sovereign investors expect to increase allocations to these asset classes. While allocations to infrastructure and private equity have increased over the last three years, total allocations remain low. From 2013 to 2015, Middle East sovereign investors’ average total portfolio assets to infrastructure increased from 0.3 per cent to 2.5 per cent, whilst private equity rose from 5.2 per cent to 5.5 per cent of the Middle East average sovereign portfolio.

Conversely, their allocations to real estate have risen significantly, from 5.9 per cent in 2013 to 9.8 per cent in 2015. Global sovereign investors expect to increase global and local allocations into real estate more than any other asset class in order to meet diversification and absolute return objectives.

Sovereign investors globally attribute this largely to real estate investments carrying fewer execution challenges than private equity and infrastructure, where sovereigns have encountered difficulties in deploying their assets.