Gulf family businesses contribute a big share to their countries' economies. As the third generation now moves in, some critical decisions may be necessary to ensure sustainable growth.

It happened once. A family business owner, fed up with his son's lousy performance, went home and invited the son for a talk in the hot tub.

There, he put on a boss hat and sacked the young man. Shortly afterwards, he replaced the hat with another that carried the word "dad" on it, and said:

"Son, I am very sorry to hear that you've lost your job. Is there anything I can do for you?"

The story, though taken from the Western business culture, reflects both the complexity and the uniqueness of family business anywhere in the world.

A family business's strength, longevity and viability stem from the loyalty, hard work and dedication of the members to the enterprise. Such an attitude of family members is the recipe for the enterprise's survival in tough economic times, and for success in good times.

Today, family businesses in the world, including the Gulf region, contribute a big share to their national economies.

In the Gulf region, family businesses hold combined assets estimated billions of dollars and they employ more than half of the workforce in the region. They represent the second largest economic strength after governments. They constitute the majority of non-oil related GDP. Their share in commercial activity is estimated around 90 per cent.

Moreover, some family businesses in the Gulf region have gained international stature and emerged as prominent success stories due to several factors, including "limited external competition, abundant opportunities& more concentrated control within families," a recent study by Booz & Company in Dubai said.

Respect for traditional rules of succession, it added, is also among the unique drivers for family enterprises' success in the Gulf region, which has been a strategic hub for trade between East and West for many centuries,

But at the same time, these family conglomerates face challenges such as the need for investments and diversification of their businesses, besides the current international financial crisis, the Booz & Company study said.

Equally important is the fact that family businesses in the Gulf region witness the transfer to the third generation - a fact that distinguishes such forms of business from similar enterprises in the West.

"The main difference between Gulf family businesses and Western family businesses is related to the age of Gulf businesses," said Ahmad Yousuf, Principal of Booz & Company in Dubai, in an interview with Gulf News

"Gulf businesses are still young, around 50 to 60 years old. They are in the midst of an important and critical generational transition, mainly moving to the third generation. In the West, this happened earlier in the 20th century."

Furthermore, the average size of the family business in the Gulf region differs from the average size of the Western family business - a fact that many business analysts believe adds an "additional layer" of complexity in the Arab family business.

In the Gulf, a typical family business has five or six children on average, whereas the average number of children for a Western family business is one or two.

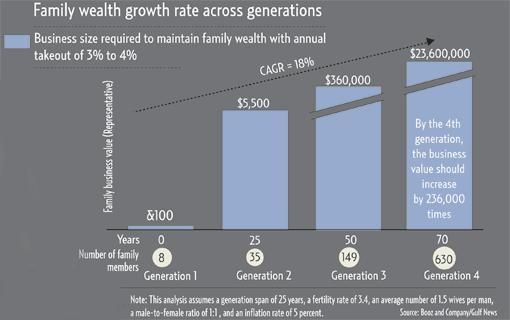

This puts additional strain on the family business to grow to meet the financial expectations and maintain the wealth of the family, Yousuf said.

"Based on our analysis, a family business needs to grow an average around 18 per cent per year to maintain equivalent wealth across generations. This growth is very high and has been achieved by few companies over a sustained period of time, which are 30 to 40 years," he added.

Moreover, the bigger the family is, the bigger are the challenges it faces in employing all its members. All family members desire to work with their siblings in the business, and in the Gulf region, typical family businesses generally are looking to employ their children.

"By the fourth generation, as an example, a Gulf family can have over 100 direct family members that are dependent on the business," Yousuf said. "In this context, family businesses have to encourage some of the family members to explore other employment opportunities, something that is not readily accepted in many families."

However, members in Gulf family businesses expressed different perspectives.

A transfer to the third generation is a plus to the businesses, not a challenge, said Dubai-based Mohammad Al Fardan, head of one of the oldest family businesses in the Gulf region.

"It injects new blood into the enterprises," he said. He himself represents the third generation in his family conglomerate.

Responding to a question on the growing number of family members seeking jobs in their family's business, he replied, "Not necessarily.

"Not all family members work in the business with us.

"Some of the family members are working in other companies& If I decide I need their experience, I'll bring them, depending on their qualifications."

Hanadi Mohammad Al Fahim, also from the third generation in her family business, was asked by her family to head the marketing department of the Abu Dhabi-based business, while her two other cousins were given other departments.

"It was a great opportunity to contribute to the family business what I have learned over the years and to apply the experiences I've garnered," Al Fahim told Gulf News in a statement. Apart from Al Fardan and Al Fahim, other Gulf dynasties include Al Sabah, Al Ganem, Al Khurafi, Al Shamsi, Al Majid, Al Ghurair, Al Fahim, Al Futtaim, Al Qasimi, Al Rajihi, Al Zamel, Bin Mahfouz, Bu Saidi, Bahwan, Zawawi, Al Thani, Kanoo, and Fakhrou.

While both Arab Gulf and Western family businesses resemble in the fact that the family is involved in day-to-day operations, economic researchers and business analysts explain that both sides differ in other areas: the availability of investment opportunities and investments outside the core business. In Western conglomerates, business tends to have a core focus.

In order to survive, grow and sustain success, enterprises need to limit and reconsider their fields of investments, among other measures including developing a long-term strategy, researchers and business analysts said.

"Steps for lasting success begin with a re-evaluation of the existing business portfolio, which may involve the divestment of original businesses that no longer fit into the long-term growth strategy," the Booz & Company study noted.

It said that earliest businesses in the Arab Gulf region are looked at, by many families, as a brand for the group; somehow, an identity to it, and a legacy definition. This explains the "emotional" attachment to the original business. They should focus on the most advantageous use of capital and target fewer businesses to drive superior performance, the analysts said.

"Between 2003 and 2007, family firms that focused on one coherent sector outperformed those that didn't by 5.5 per cent per year," the Booz & Company study said.

"Businesses should take a diversified approach within a sector or industry, and leverage their market presence, brand name, and core competencies," it quoted Joe Saddi, chairman of Booz & Company, as saying.

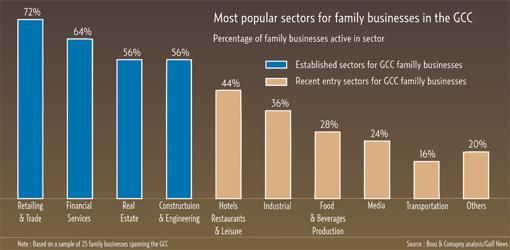

Studies reveal that while retailing and trading constitute the biggest field for family businesses, other fields include financial services, real estate, construction and engineering, hotels and leisure, industrial, food and beverages, media, transportation and others fields including jewellery.

GCC family firms incline to be involved in several sectors, business studies show.

Nearly half of 25 surveyed enterprises (48 per cent) were involved in five or more sectors; 40 per cent were engaged in three or four sectors; and 12 per cent were active in two sectors or fewer, the Booz study noted.

"The restless entrepreneur syndrome is typical of any company that operates within a context of strong economic growth, limited competition, and abundant capital," it added.

"As the environment becomes more competitive and access to credit becomes harder, families have to focus their efforts on the businesses where they have the 'right to win'," Yousuf explained. "They could focus on several but related sectors."

Many GCC family members support the concept of limiting areas of investment and operations. They expressed their belief that business diversification and expansion come with another problem: management. For instance, "if I don't have the experience in certain fields, it will be difficult for me to enter them," Mohammad Al Fardan said. His family business in the UAE includes jewellery and real estate. However, the family invests in other fields, but doesn't participate in running them, he explained.

Profit is what any business seeks at the end, noted Al Fahim, with her business celebrating its golden jubilee this year. Her family business is engaged in several fields ranging from oil and gas to real estate and hospitality.

The enterprise's vision and mission are the important factors in making investment decisions, she said. After all, the betterment of the organisation remains the ultimate goal when any such decision is taken.

In many cases, "emotional attachment" is crucial to businesses, she explained.

"Emotional attachment to the business is still quite essential; when your heart is with your work, you will always ensure that the decisions made are for the welfare of the business as a whole," she said.

"The advantages of a family business are that you will always have a vision to follow because you want to build a solid foundation for your children and ensure the business will continue to thrive when you pass it down to them."

While business analysts strongly recommend that family businesses create clear guidelines for new investments, they equally encouraged businesses to build a talented management team capable of growing the business "independently" from the shareholders.

Family businesses must delegate control to the management team when the need arises.

Moreover, business experts called on family businesses to define a clear line between family and company activities. This, they explained, can be achieved through creating a "family office" in the business to handle family created activities; separating philanthropic activities of individual family members from business, as well as weighting the possibility of creating a separate financing arm that could support family member's own business ventures.