Mumbai/Hong Kong: Default risk for Indian lenders is dropping the most among Asian peers on confidence the new central bank boss will make progress in clearing bad loans.

The cost of insuring debt of Bank of India, State Bank of India, ICICI Bank Ltd and IDBI Bank Ltd with credit-default swaps declined in the past month after Urjit Patel took over from Raghuram Rajan at the helm of the Reserve Bank of India. The improving outlook for the world’s fastest-growing major economy and progress in overhauling bankruptcy procedures is also reviving investor confidence.

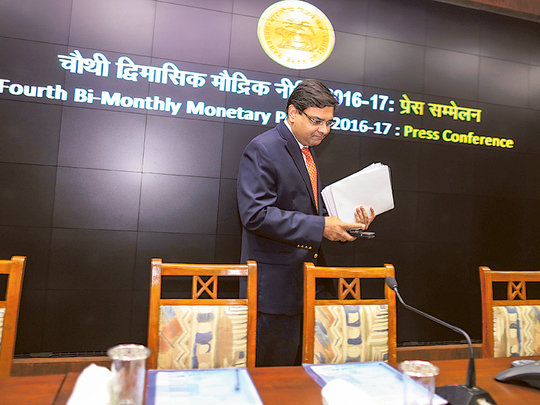

When Rajan started an audit of non-performing loans in October last year, the scale of losses and bleak statements from executives surprised analysts. Patel has signalled he may take a more measured approach to the $120 billion (Dh440.4 billion) bad-debt clean up, which has cut bank profits and eroded capital buffers. He told reporters on October 4 that “firmness but pragmatism” was needed to ensure there was no shortage of credit while clearing NPLs.

“The new regime in the RBI will be more understanding and will definitely be more sympathetic,” Deepak Parekh, chairman of Housing Development Finance Corp, said at a Bloomberg event in Mumbai on October 21. “Don’t forget that the current governor has been on the State Bank of India board for 3 1/2 years. So he has seen the pain that SBI is going through.”

Policy changes

Default swaps of state-owned Bank of India fell the most among banks in Asia over the month to October 26, slipping 11 basis points to 205, while those of SBI declined six to 155 and ICICI’s slid 5 to 170, data compiled by Bloomberg show. That extended second-half drops.

Prime Minister Narendra Modi has burnished India’s appeal through policy changes aimed at boosting growth and improving public finances. Gross domestic product rose 7.1 per cent in April-June from a year earlier, the fastest among Asia’s major economies. Even so, lending has remained depressed, with average fortnightly credit growth slumping to 10 per cent during the past year, compared with an average of 15.7 per cent in previous five years.

“It’s important to have a timeline for banks to clean up their balance sheets, but at the same time there needs to be more flexibility as banks have to bring in fresh capital to write off bad loans,” said Rajesh Mokashi, managing director at CARE Ratings Ltd. “Patel could take a more pragmatic stance. He was part of Rajan’s team and is not out of sync with the bad-loans issue.”

Incentives for banks

In May, India’s parliament passed the Insolvency and Bankruptcy Act, which seeks to accelerate debt workouts. Prime Minister Narendra Modi’s government also plans a Financial Resolution and Deposit Insurance Bill to deal with possible failures by lenders.

Banks need incentives to lend and the bankruptcy code transitions India from a “debtor-in-possession” to a “creditor-in-possession” framework, according to Raja Mukherji, Hong Kong-based head of Asian credit research at Pacific Investment Management Co.

“Banks need to have a framework to work out their existing problem of distressed loans versus selling them at deep discounts,” he said. “In India, it takes four years to resolve a distressed loan that can only generate a 20-25 per cent recovery, versus less than a year in the US with much higher recovery,” he said.