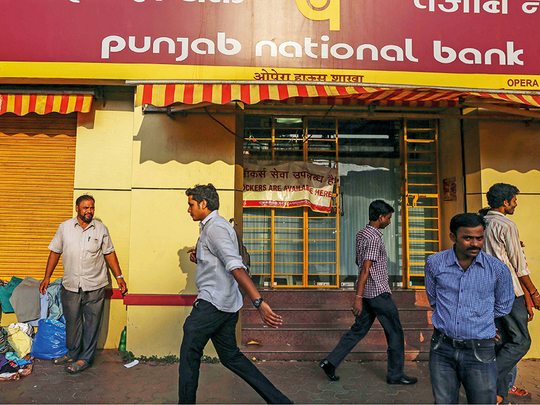

NEW DELHI: Punjab National Bank, India’s second-largest state-run lender, will be able to avoid massive losses after the government forced delinquent borrowers to repay loans or face liquidation proceedings under a new law.

The interest and bids received so far for assets put up for sale by India’s new bankruptcy court indicates that the bank may not have to take “huge haircuts” and cases will be resolved quickly, Sunil Mehta, managing director of the state-run bank, said in an interview over the weekend. He did not give details.

The new insolvency law “will give a good message that if you do not meet your financial commitments you will not be able to retain your assets,” Mehta said.

The government and the Reserve Bank of India are taking unprecedented measures to clean up $207 billion of stressed loans and support lending that’s begun to revive from a 30-year low. India’s central bank has asked commercial lenders to resolve bad loans at 40 of the biggest defaulters within a year. Overdue borrowings have hampered investments and slowed growth in Asia’s third-largest economy.

On its part, the government will infuse 2.11 trillion rupees ($33 billion) into cash strapped banks to rescue them. Under the proposal, it will sell 1.35 trillion rupees of recapitalisation bonds, while banks will raise another 760 billion rupees through resources from the federal budget and the markets.

Punjab National doesn’t need to take part in the recapitalisation program as the lender is “adequately capitalised for 2018-19,” Mehta said. “If I want to go for future business I may require.”

In the first list of 12 cases referred to the National Company Law Tribunal by the central bank, nine are Punjab National’s clients while in the second list, it has lent 65 billion rupees to 20 out of 28 companies.

“None of the cases that RBI had asked lenders to refer to insolvency court have been resolved so far,” Rethish Varma, a Bengaluru-based researcher at MarketSmith India, said by phone. “Until we see some of these large delinquent accounts getting resolved investors will remain sceptical about size of the haircuts.”

Punjab National’s shares, which gained 49 per cent last year, lost 1 per cent to 169.75 rupees in Mumbai.

The country’s soured-debt ratio is the worst among the world’s largest economies, data compiled by the International Monetary Fund show. State-run banks account for almost 90 per cent of all non-performing loans in the South Asian nation, according to Credit Suisse Group AG data.