Dubai : If you want Sharia-compliant personal fin-ance, you will ultimately become a sugar trader.

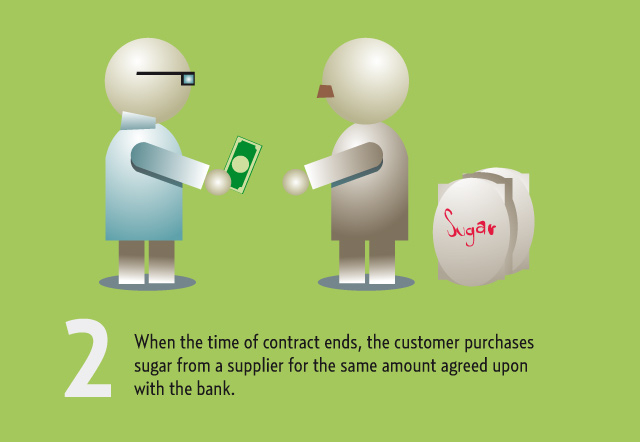

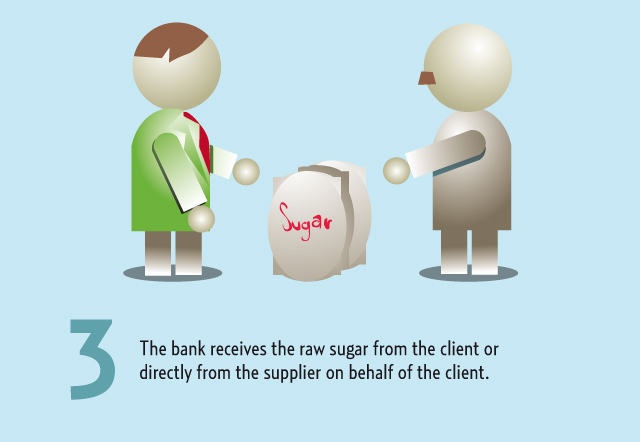

Dubai Islamic Bank (DIB) yesterday launched Al Islami Salam Finance, a product-based on a sale contract in which the bank pays the purchase price upfront of a commodity to the customer on condition of receiving a certain quantity of that commodity at a future date.

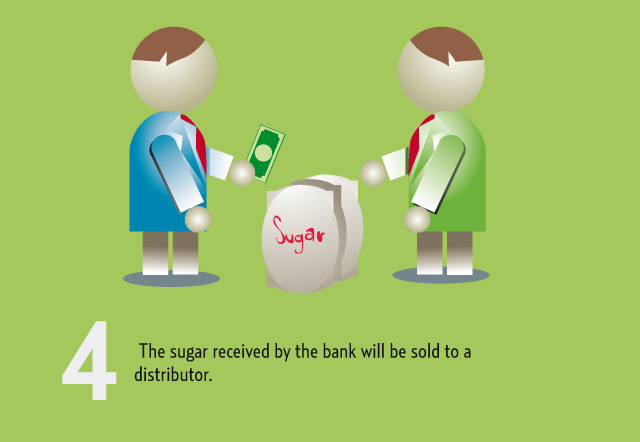

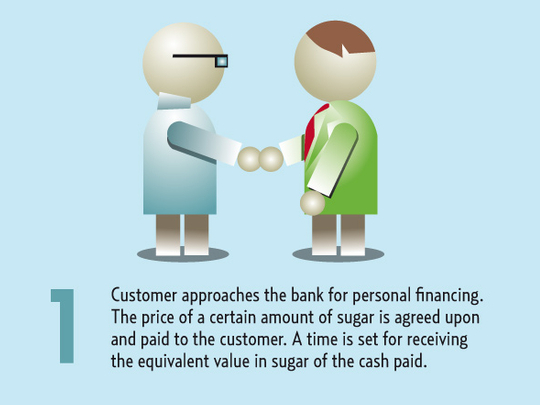

The bank worked with its subsidiary Dar Al Sharia Legal and Financial Consultancy to formulate the product that involves actual trading of a commodity, sugar in this case, which makes it Sharia-compliant. The bank will then sell the sugar to a vendor.

While the customer will not be required to pay a profit to the bank, the company will generate revenues by reselling the sugar. "DIB, through sale of the commodity at a higher price, may earn profit on the commodity," the bank said.

Less volatility

While any commodity may be chosen, sugar presents less volatility.

"The bank, when it was evaluating… and had discussions with many providers, decided that sugar was the safest commodity in terms of volatility in prices," Adnan Chilwan, chief of retail and business banking at DIB said.

He said that the bank had a promise from distributors to purchase the sugar from the bank as and when it takes delivery.

Additionally, at the time of the contract, the customer can contact the supplier and fix the price at which sugar will be purchased at a later date, to avoid exposure to price fluctuations, Chilwani said.

Abdullah Al Hameli, DIB chief executive, said the product would have a positive impact on profits.

He said the bank had set aside Dh1 billion for fin-ancing and it could be increased to Dh2 billion if required. Each customer can receive between Dh25,000 to Dh1 million under the Salam contract.

Hussain Hamed Hassan, head of DIB's Sharia Supervisory Board, said: "Salam facilitates liquidity for people in need of it."

He said two options were permissible under Sharia. "Goods are delivered today and paid later or pay the price today and deliver goods later… what is prohibited [are] futures derivatives," he said.

The product can be loosely compared to futures trading. But while the latter defers the payment as well as the commodity, the former, the Salam contract, only defers the delivery of the goods.

"The bank [will] make sure that its credit criteria and its risk appetite [are] met. It is no different from evaluating the customer from any other type of finance," Chilwani said.

Support for salam

There are many Hadiths supporting Salam.

It was narrated through the son of Abbas, that when "Allah's Apostle [PBUH] came to Madinah and the people used to pay in advance the price of fruits to be delivered within one or two years, the Prophet [PBUH] said: ‘Whoever pays money in advance for dates [to be delivered later] should pay it for known specified weight and measure [of the dates]'."

— N.S.