Dubai: Call it the soul food catharsis. UAE's residents may have clamped down a lot on their non-essential spending during the dark days of the downturn, but certainly not on their dining out expeditions.

In fact, there has been a noticeable spike in the pattern, with figures recorded by the TGI survey finding that 74 per cent of the country's population "had a meal in a regular restaurant" in 2009, up by an appreciable margin on the 64 per cent recorded in 2005. And keep in mind that consumer spending had taken an appreciable dip on nearly every other count during 2009.

The TGI survey does add the caveat that per capita spending per visit to a restaurant may have come down during the recession. But in terms of frequency of visits, while nearly 10 per cent dined out more than once a week, as many as 30 per cent said they did so two or three times a month.

Taken together, they reveal why the local F&B (Food and Beverage) sector has been nothing less than recession-proof. And why restaurateurs are drooling over their future prospects.

"Restaurateurs who have a genuine offer with a product that's original and which tastes great and at a price that's fair are doing well," said Tapan Vaidya of Bahrain-headquartered Jawad Business Group, which is putting the finishing touches to the first outlet in the region bearing the famed British chef Jamie Oliver's signature.

"I believe people in Dubai want food prepared using original, fresh and healthy ingredients, which also must taste great. Restaurateurs who understand the business and keep their focus customer-centric will do well ultimately."

Expansion

As will a good location for the outlet. For this, the restaurateurs, existing and future ones, have to the thank the recent real estate boom in the city, which led an expansion of residential and commercial locations into what is known as New Dubai. So have the opening of leisure destinations such as the Dubai Mall, Mall of the Emirates and Mirdif City Centre, not to mention the options provided by many of the recently opened hotels.

The leading local business houses have not been slow to read the trends and capitalise on them. If getting famed global retail brands was what they were intent on in the 1990s and the early half of the last decade, the intention now is what they can serve up by way of an international dining experience to local palates.

But that's not the same as saying that any imported dining concept will work here. The local F&B scene is littered with the detritus of those that have not worked, or were pushed over the edge by the impact of the downturn. As far as Vaidya is concerned, such a shakeup was just what was needed.

"The somewhat unchecked growth in the restaurant scene in Dubai during the last decade and a half unfortunately needed a correction, which is what happened in the shadow of global recession," Vaidya added.

Unless the restaurant has a business house to back it to the hilt or the deep pockets of its own, the going can get prickly. Being in high-profile locations also come with a higher rental bill, though that burden has eased somewhat.

Steady flow

"But not to the extent that it can compensate for a restaurant not being able to maintain a steady flow of diners day in and day out and not confined to the weekends," said a restaurateur who operates an independent outlet in what is one of the most coveted locations in the city.

"Last year, we failed to turn a profit and unless we see more tourists coming in to add to the resident diner numbers, the going can become tricky for me. It's touch and go."

While some business houses are enticed by the kind of profile operating a restaurant franchise can provide, the traditionally lower yields in the sector are giving them something to chew on.

According to a director with a leading business group which is heavily into retail, "An entry into F&B should be an ideal extension for us and it's proposal that's been on the table for the last two years. But the rest of the board has not signed off on it because of the kind of margins it entails. And the proposal has been placed in cold storage."

Vaidya can identify with the sentiment — "That yields in the F&B space are not high is very true — however everyone does not know that it is so. To a layman, the cost of a dish appears always a third of the price he pays from the menu, little realising there are other costs too, including facility, labour, utility, investment, etc."

That should be food for thought for any wanna-be restaurateur out there wanting to give it a try. The kind of returns he is looking for will take a lot of simmering.

Health factor

Obviously, the health consciousness message is not permeating into the UAE residents' food habits.

According to a TGI survey conducted by Parc, fast food consumption, including takeaways, shot up to 86 per cent in 2009 from 77 per cent in 2005.

But the campaigns are starting to show some results, albeit marginally. "Half of the adult population agrees that they look for the nutritional contents in the food," said Shaharyar Umar, a spokeperson at Parc, which conducted the TGI survey.

Expense

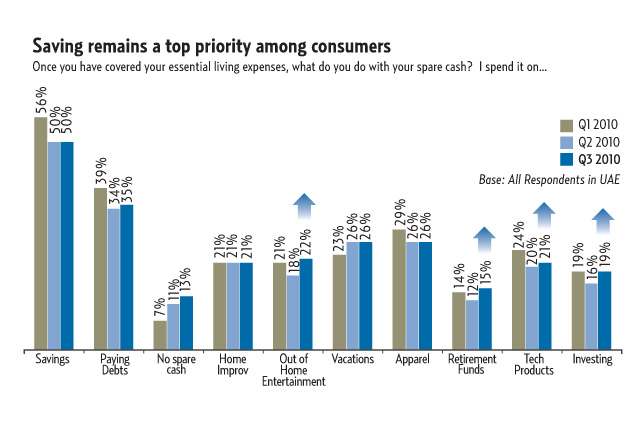

According to The Nielsen Company, UAE's residents have been much more discrete when it comes to their out of home entertainment options during 2010. In fact, exercising tight control over these expenses is what many were doing to stay within budgets.

"However, once the essential living expenses are taken care of, around 20 per cent of the consumers claim they spend the remaining amount on-out-of home entertainment," said Sevil Ermin, managing director for the UAE, The Nielsen Company. "The increasing number of discount deals and promotions and coupon offerings on dining could also potentially increase the appeal of eating outside by providing the means through which UAE consumers can remain within budget while not having to relinquish one of the main expat privileges and an indulgence that has become a staple of their UAE lifestyle."