Dubai: There's no time for UAE retailers to catch their breath. If Dubai has not had any significant expansion in new retail capacity since the opening of Mirdif City Centre in mid-2010, it doesn't matter. But Abu Dhabi certainly has, and there's even more to come.

By 2015, Abu Dhabi is set to nearly double its retail space by another 900,000 square metres, based on available estimates.

That is a lot of space for retailers to try and fill up, and there is certainly no lack of interest among them.

According to a recent report by Cushman & Wakefield, Abu Dhabi's current retail capacity is 908,594 square metres.

"In terms of retailer presence, the balance which is now tilted in favour of Dubai will gradually even itself out vis-à-vis locations in Abu Dhabi," said a brand manager with a leading international franchise.

"There will be nothing to choose between the two cities for any retailer."

Readjustments

For retailers long reliant on new store openings as a means of tapping higher growth, all of that additional space in Abu Dhabi cannot come soon enough. As things stand now, retailers already established in Dubai have gone through most of the readjustments in terms of store locations.

It also helped that no major addition in capacity is expected in Dubai over the medium term. Now it's Abu Dhabi's turn.

"With the new retail developments in the city, retailers are spoilt for choice to decide on which location best suits them," said Abraham Koshy, general manager of Rivoli Group.

"For us specifically, it means all of the new ones are in our plans in some way or the other."

"At the broader level, once the new mall supply gets handed over, we expect to see increased demand from international names."

The plans will include Yas Mall, which is set to open sometime next year. It is expected to be another crowd puller among Yas Island's many leisure and entertainment options.

In some quarters, concerns have been voiced about all the new space hitting the market in a short time frame.

Some are concerned that if demand does not keep pace, the retail sector will be left with a glut.

But sceptics are limited in numbers. Hannah Jeffery, who heads the Dubai office of Cushman & Wakefield, certainly is not one of them.

Regional footprint

"As the quality of mall product in Abu Dhabi improves, we expect to see increased demand from retailers who are looking for an opportunity to expand their regional footprint," she said.

"The majority of new retail supply will be located off-island on the outskirts of the city.

"Many of the malls are yet to be completed, therefore the true impact of quality retail space being delivered is yet to be felt."

"There is still significant demand for a better retail offering in the capital, particularly on Abu Dhabi Island. The only prime mall product is Central Market which is still under development."

The existing retail capacity in the city has an over 90 per cent occupancy rate.

Some of them are in need of a major facelift or require changes to remain competitive as the new developments enter the market.

A failure on the part of the older malls to raise their game could have an impact on their long-term prospects.

A similar trend is already being recorded in Dubai. The question is, are the older malls in Abu Dhabi up to the challenge?

"Upgrades may help relieve some of the pressure and impact of the newer malls," said Jeffrey. "However, the focus should not only be on improving the build quality and aesthetics, but also on tenant mix, facilities offered and the branding of the destination."

Improved ambience

"We expect community malls to continue to perform well; however the prime mega-malls will continue to be the main draw for both tourists and the local resident population."

It is possible that the gap between rent in the new spaces and the older malls could widen even further.

"There is definitely a difference, with those recently completed offering an improved shopping ambience and experience," said Jeffrey. "The rental differential will definitely widen as new product is delivered to the market."

Now, that is one serious concern in the making for the existing malls.

And they only have four years to re-invent themselves and remain in strong contention.

Rent - greater space

With the new spaces added by 2015, Abu Dhabi will have an estimated retail stock of 1.81 million square metres. The existing gross leasable area per 1,000 people is set to shoot up to 1,690 square metres from the current 936 square metres, according to data from Cushman & Wakefield.

Rental trends

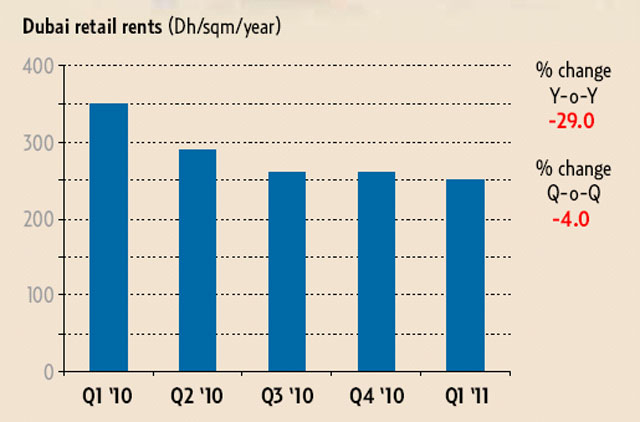

Rentals in Dubai's retail space fell sharply last year, but the latest trends suggest this is now bottoming out. The drop was a marginal 4 per cent in the first quarter of this year. In comparison, retail rents in Abu Dhabi remained stable.