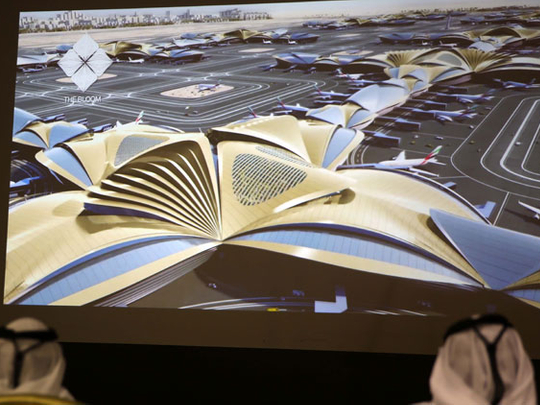

Dubai: The ongoing expansion of Dubai’s Al Maktoum International Airport has been rated as one of the gamechangers that can create tomorrow’s global super-cities, according to a report by the real estate consultancy Knight Frank.

Passenger services started at the second airport in Dubai in 2013 and the target is to ‘increase to 220 million passengers a year’, the report states.

Meanwhile, Dubai International is already the world’s busiest by handling 72 million passengers a year.

“A key word in today’s global cities is connectivity - A four-hour plane ride from Dubai allows access to one-third of the world’s population and an eight-hour ride to two-thirds,” said Khawar Khan, Research Manager at Knight Frank Middle East.

“In addition, over the next decade, Dubai South is planned to be easily accessible by road, rail and sea. All of this will no doubt increase this location’s appeal for businesses.”

Dubai South is the new name for Dubai World Central and has as its development canvas a staggering 56 square miles. The master-developer’s stated aim is to create a city-within-a-city, and - just as central to its plans - make it the ‘Happy City’.

“While the project is part of a long-term strategic masterplan, it also ties in with the World Expo 2020 that will be hosted at Dubai South and is expected to attract 25 million visitors,” said Diaa Noufal, Associate Partner MENA Research at Knight Frank.

Other airports cited by Knight Frank include the Singapore’s Changi, which has a new -- its fourth -- terminal under construction and which will raise the passenger traffic to 82 million a year, while there are plans for a third runway at the Hong Kong International Airport, which will raise the capacity to 102 million passengers a year.

Global Cities

For the other mammoth-scale infrastructure projects, Knight Frank’s ‘Global Cities Report - 2016’ cites the Panama and Suez canal expansions, the Delhi-Mumbai Industrial Corridor and Kenya’s LAPSSET ((Lamu Port and Lamu-South Sudan-Ethiopia Transport Corridor).

Another one that stretches the possibilities of cross-border ambition is China’s ‘Silk Road’, which is ‘using rail to speed up transporting freight to Europe on routes running through Russia, or via Iran and Turkey’ the report notes.

‘By sea it takes cargo six weeks to travel from the inland manufacturing city of Chengdu to Europe, but now a rail freight service reaches Poland in two weeks. To improve connections, a $40 billion Silk Road Fund has been established to finance infrastructure projects abroad.

‘There are also plans to link Kunming in southern China to Singapore via several lines running through Myanmar, Vietnam, Laos and Cambodia. As China diversifies its trade routes, new business hubs will appear, creating opportunities for property investors.’

New cities

Simultaneously, new cities are emerging as economic realities, the majority of them being in Asia. Since 1990, an estimated 470 new cities have been established in Asia, of which 393 were in China and India, according to Knight Frank.

“Expansion for the newer emerging market cities will probably be funded by local investors. International investment is more likely to look at either established centres or the emerging cities that have moved into the global league, like Beijing or Bengaluru,” states James Roberts, Chief Economist at Knight Frank.

“Next year, we expect two major sources of capital to be particularly active, namely North American money into the global market and opportunist domestic money in Europe. The dollar has strengthened on currency markets, while the spread between US real estate and bond yields has narrowed.

“Recent economic indicators suggest that the Eurozone is through the worst, and we expect US capital to look to exploit recovery opportunities. Current evidence suggests a pattern of both direct investment and providing non-bank finance.”