Dubai: Dubai property developer Nakheel on Wednesday announced a Dh4.8 billion asset-backed sukuk to its trade creditors to be listed on Nasdaq Dubai on Thursday. This completes the last leg of a complex debt restructuring deal with its creditors.

Nakheel Chairman Ali Rashid Lootah told a media gathering that the first tranche of the sukuk will be for approximately Dh3.8 billion with a profit rate of 10 per cent.

"It has been a tough 18 months — a period in which we have managed to successfully restructure our debts and the company," he said.

"This is the end of an era and the start of a brighter Nakheel.

"The completion of our financial restructuring signifies the financial markets' and investors' confidence in dynamic leadership and the vision of the Rulers of Dubai and the UAE.

"It is the most significant milestone in our history, and allows us to move forward and focus on the delivery of our master-planned communities, while continuing to find solutions for investors in our long-term projects," he said.

The company offered trade creditors repayment of 40 per cent cash and the remaining 60 per cent in the form of an Islamic bond, or sukuk as part of its restructuring programme.

He said the company has not sold any assets. The sukuk is also not guaranteed by the banks, but assets. "The sukuk is backed by assets including real estate projects," Lootah said.

Nakheel developed some of Dubai's iconic projects including the Palm Jumeirah and the World Islands — that recreates the globe in the form of 300 man-made islands and in the shape of the seven continents — 70 per cent of which are sold to investors.

Upbeat news

Property analysts were upbeat on the news, saying this could help restore investor confidence in the market.

"Since Nakheel is now a fully government entity, with some more clarity, these developments will give positive vibes in the property markets and the financial community," property analyst Tarek Ramadan, of Richville Property Brokerage, told Gulf News.

"The issuance of the new sukuk will help Nakheel to close a chapter of the past and move ahead with some of the unfinished projects that will release more residential units."

Nakheel which once had a portfolio with a book value of $100 billion (Dh367 billion), earlier signed a debt restructuring agreement with 90 per cent of its trade creditors. The other 10 per cent have yet to agree to its terms.

"We have already signed debt restructuring deal with 90 per cent of the trade creditors. The Dh1 billion has been kept as a cushion for those who are yet to sign the deal," Lootah said. Nakheel has restructured a total of $16.06 billion in debt, including $8.71 billion owed to Dubai Government that has been converted into equity. The remaining amount is owed to trade creditors and banks.

Nakheel, which was part of Dubai World, shared the conglomerate's $59 billion debts in 2008.

Total liability

"At that time, we had a total liability of $16 billion, part of which was paid by the Dubai Government in the form of cash investment - from where we paid our creditors about Dh8.6 billion and the rest was in the form of equity," Sanjay Manchanda, Nakheel's acting CEO and Chief Financial Officer, said.

Lootah said the company's long term liabilities stood at around Dh10 billion, following the initial cash injection and debt restructuring.

"Our liability on the long-term projects was approximately Dh10 billion and we managed so far to accommodate people for a value of Dh6 billion. We will be able to repay the rest in five years as per the agreement," he said.

The Dh4.8 billion sukuk is part of the deal.

Manchanda said that with the new sukuk the company might not require any more debt issuance.

"I do not foresee the need for further debt issuance. Hopefully this is the last one," he said.

Lootah said the company's cash flow remains positive. "Our collection is very good. We will require less funding, going forward," he said.

Following the restructuring, the company has been fully acquired by the Government of Dubai from Dubai World. "The transfer of ownership has been completed and as of yesterday [Tuesday], we have been separated from Dubai World," Lootah said.

Developer to issue contracts soon

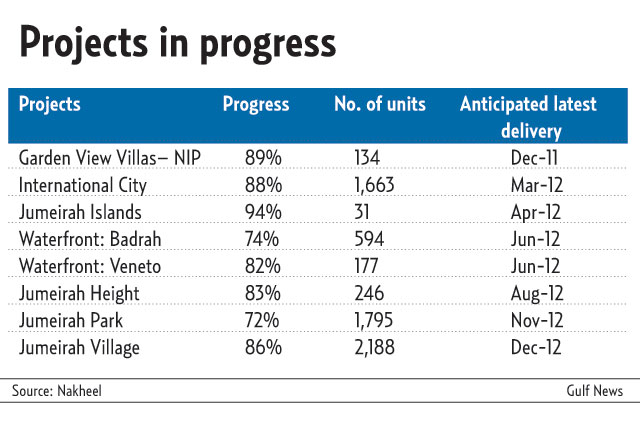

Nakheel, developers of the iconic Palm Jumeirah, is returning to business, as it plans to deliver 7,982 homes in nine developments across Dubai in the 12 months ending December 2012. The developments include Jumeirah Islands, Al Furjan as well as Badrah and Veneto in the Waterfront project.

Nakheel will soon issue construction contract for the development of villas and an extension of its retail facility — Dragon Mart, a top official said. "We will soon issue construction contracts for new villas on the Palm Jumeirah as demand for properties is coming back," Ali Rashid Lootah, chairman of Nakeel, told a press conference - its first in three years.

"The prices are coming back and we see a slight increase in demand and prices of villas on the Palm Jumeirah. Ever since we have announced the extension of the Dragon Mart, we have been receiving calls for booking."

Lootah said his company has an inventory of 20,000 residential units, 70 per cent of which are occupied. "This was 40 per cent a year ago. So the demand is picking up," he said. "We will put them for sale when there is a need."

He said Nakheel is going to start a cruise tourism division to cater to the growing needs of the market by selling short cruise trips to inbound tourists.